| Welcome to Energy Daily, our guide to the energy and commodities markets powering the global economy. Today, OPEC Reporter Grant Smith looks at the biggest headwinds for the oil market. Click here to read about the 3,000-mile US road that’s finally EV-ready. To get this newsletter sent straight to your inbox, you can sign up here. Since the start of the year, oil watchers have widely predicted that prices would end 2023 on a high note. That forecast is looking more and more precarious. After surging to a six-month high above $88 a barrel in London two weeks ago, the rally has fizzled out. On Wednesday, international benchmark Brent was trading below $83. In theory, inventories should be depleting at the fastest clip in two years as China’s post-pandemic rebound and output cuts by OPEC+ tighten the market. But as analysts at Julius Baer Group Ltd. said this week: “The oil market is just about adequately supplied, and the much-awaited tightening is still pending.” Debate has swayed in recent weeks on whether the market’s foil was supply or demand. The answer now appears to be both. Consumption is under pressure as China, the world’s biggest oil importer, contends with crises ranging from youth unemployment to turmoil in its property and shadow banking sectors. A top executive suggests the nation’s fuel use may have maxed out for the year. |

On the supply side of the ledger, a recovery in Iranian output is going from strength to strength. Tehran has revived production to a five-year high as it engages in nuclear diplomacy with the US to remove sanctions. One tanker tracker estimates that exports have swollen to more than 2 million barrels a day.

Still, there are plenty of reasons why forecasters such as JPMorgan Chase & Co. and UBS Group AG might be right to double down on predictions that crude will surge to $90 a barrel.

Global demand is setting new records, and physical cargo markets from the Middle East to the North Sea are showing signs of resilience. Storms are threatening to wreak their annual havoc on oil infrastructure across the US Gulf Coast, and Saudi Arabia has said it could reduce output further if the market continues to sag.

Nonetheless, with headwinds growing on both the supply and demand sides, the obstacles to another oil rally have intensified.

–Grant Smith, Bloomberg News

Chart of the day

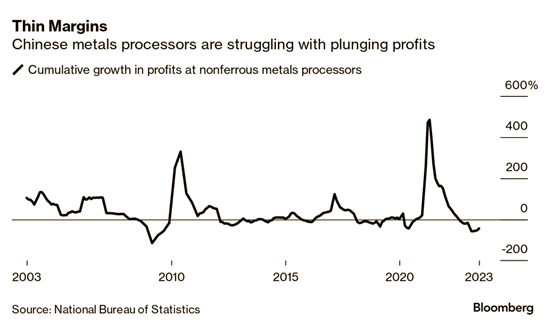

China’s stuttering economy is now the biggest threat to global commodities demand. Base metals prices have retreated from their January high as the economy loses steam, crushing margins at smelters and fabricators. Inventories of copper and aluminum, the most widely used base metals, have dropped, with stockpiles of the former near critical levels.

_____________________________

Today’s top stories

Russian drones struck Ukrainian grain infrastructure near the Danube River, the latest in a raft of attacks on the waterway that’s vital for getting Ukraine’s exports out to markets now that its Black Sea ports are shut.

Turkey and Iraq failed to reach a breakthrough in talks to restart a crucial oil pipeline whose shutdown has cut off nearly half-a-million barrels of crude from global markets.

A Morgan Stanley unit was fined £5.4 million ($6.8 million) for failing to retain messages sent by traders over WhatsApp in the first-ever penalty of its type issued under the UK energy regulator’s powers. Separately, former JPMorgan gold traders were sentenced to prison for spoofing and fraud.

China vowed to take “necessary steps” to safeguard food safety and the marine environment after Japan set a date to begin flushing treated nuclear wastewater from the Fukushima site into the Pacific Ocean.

Russia’s invasion of Ukraine is forcing the US and Europe to search for alternative sources of enriched uranium to power their reactors. The centerpiece of a transatlantic project to rejuvenate production of the fuel lies in New Mexico’s desert.

| Best of the rest |

- Decarbonizing the economy is expected to double UK electricity consumption by 2050. While supply issues remain, grid constraints are becoming pinch points on the demand side, this article in the Financial Times argues.

- A patch of the Pacific Ocean floor that’s slightly larger than the European Union may soon become the first site for deep-sea mining. It could boost output of minerals critical for clean energy but destroy oceans in the process, the Scientific American says.

States in the US are making a generational push to ramp up renewable energy, with New York lining up $48 billion of projects over the next two decades. Politico says the spending spree will show up in higher bills for consumers.

bloomberg.com 08 23 2023