McKinsey

DUBAI

EnergiesNet.com 07 12 2023

Energy is at the core of COP. To limit warming to 1.5°C we need to smoothly ramp down the energy system of today, while scaling up the energy system of tomorrow. The global energy system contributes more than three quarters of global emissions, and decarbonization of our energy systems could account for up to 74 percent of GHG mitigation required to reach net zero, per the Global Stocktake.

Today marked Energy Day and Indigenous Peoples Day.

Here, we recap some of the main announcements on energy so far. We also share a deep dive on methane, the “super pollutant” that has been a major focus at COP28.

The Global Decarbonization Accelerator (GDA) sets out a set of actions aimed at decarbonizing the existing energy system and building the energy system of the future.

- 3x renewables and 2x the rate of energy efficiency: 118 governments committed to tripling renewables and doubling the rate of energy efficiency improvements by 2030. Achieving net-zero emissions from the energy sector by 2050 rests on the world’s ability to triple renewable-energy capacity by 2030. McKinsey partner Andreas Schlosser led a panel on accelerating global renewables expansion with business leaders and policy makers on the COP28 main stage in the Green Zone.

- Hydrogen: There were other initiatives included in the GDA, such as the UAE Hydrogen Declaration of Intent, with 39 countries endorsing a global hydrogen certification standard. Hydrogen is a versatile energy carrier that could help decarbonize hard-to-abate sectors. Based on announced projects, hydrogen supply could increase by almost 40 times by 2030. This declaration could help unlock industry growth by addressing industry challenges flagged by the Hydrogen Council.

- Cooling: The Global Cooling Pledge, signed by over 60 countries, is aimed at reducing emissions from cooling by 68 percent by 2050. Cooling equipment represents 20 percent of electricity consumption in buildings. Getting on track for net zero by 2050 requires more efficient coolers, new designs, and behavior changes like setting thermostats slightly higher.

- Oil and gas decarbonization: The O&G Decarbonization Charter was signed by 50 companies accounting for more than 40 percent of global oil and gas production. The signatories committed to net-zero operations by 2050 across Scope 1 and 2 emissions (that is, focused on emissions from production, not from use), near-zero methane in upstream operations by 2030, zero routine flaring by 2030, and increased transparency in emissions reporting.

Methane: Why is it important and what is being done about it?

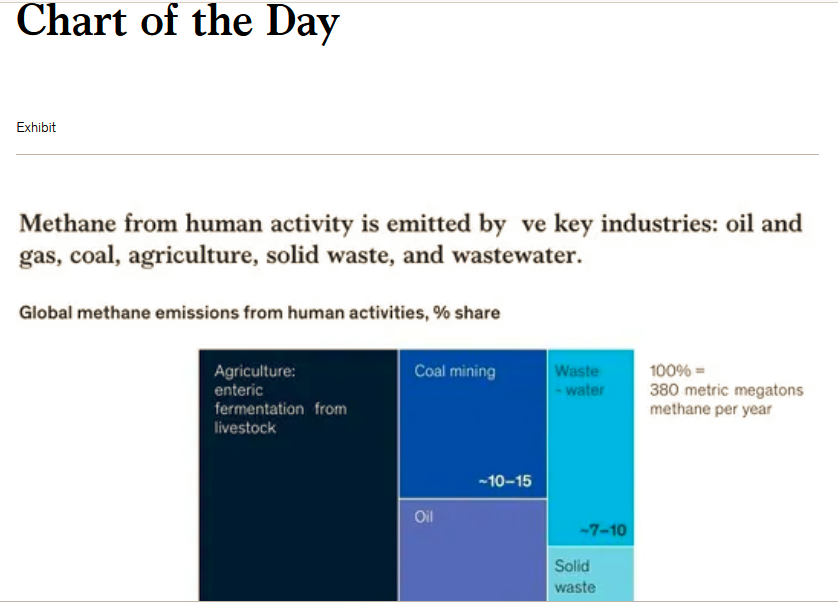

Methane is responsible for around 30 percent of the global warming that has occurred since the Industrial Revolution. Following current trajectories, total methane emissions from human activities could rise by up to 13 percent between 2020 and 2030. In scenarios that limit warming to 1.5°C, they need to fall by 30 percent to 60 percent over this timeframe. The Global Methane Pledge aims to reduce global methane emissions by at least 30 percent from 2020 levels by 2030—and has more than 150 signatories.

Multiple challenges slow action. First, methane emissions are highly dispersed across and within industries. Second, monitoring and reporting of emissions need to be upgraded. Finally, further technological innovation is needed to generate solutions at scale.

- Oil and gas: Methane from the O&G industry contributes around a quarter of all human-caused methane emissions, and the O&G Decarbonization Charter announced at COP28 includes a commitment to reach near-zero methane emissions by 2030. Several supporting initiatives aim to ensure that the signatories to the Charter achieve their methane reduction commitments. The World Bank declared its intent to launch at least 15 country methane programs in the next 18 months, abating up to 10 million MT in methane. New working groups will address debt financing for abatement projects and help NOCs in emerging economies execute end-to-end methane abatement projects. These initiatives have the potential to address the more than $75 billion required to achieve near-zero methane emissions by 2030.

- Oil and gas: The US federal government announced new regulations which aim to reduce methane emissions by 80 percent. This is in line with the O&G Decarbonization Charter announced above.

- Agriculture: A $200 million Enteric Fermentation R&D Accelerator was launched to accelerate methane mitigation in livestock production. Enteric fermentation is responsible for 25-30 percent of methane emissions. The accelerator is the largest-ever global livestock methane mitigation research fund.

- Waste: The Lowering Organic Waste Methane (LOW-Methane) was launched with the ambition to reduce waste sector methane emissions by at least 1 million metric tons annually well before 2030, in part by working to unlock over $10 billion in public and private investment.

- Monitoring and reporting: The US-China-UAE methane and non-CO2 gases summit issued a call to action for parties of the Paris Agreement to issue NDCs covering GHGs. New funding worth $450 million from Sequoia Climate Foundation in partnership with Global Methane Hub and other Philanthropies will help countries incorporate non- CO2 GHGs into their NDCs. Over $1 billion in funding was announced to support methane and other non-CO2 greenhouse gas reduction across sectors in developing countries. The Global Methane Hub and its partners announced multiple initiatives, including: the Data for Methane Action Campaign to improve satellite data for addressing methane leaks, supported by around $100 million; and a partnership with climate philanthropies to help countries address non-CO2 GHGs.

Phasing down coal

Coal accounts for about 40 percent of global emissions from fossil fuel. All 1.5°C scenarios require coal demand to decline rapidly by 2030. The phase-down of unabated coal was agreed at COP26.

- Nine new countries committed to the more ambitious goal of phasing out unabated coal by joining the Powering Past Coal Alliance. The new members include the US, which has the world’s third-biggest capacity of operating coal plants, and the Czech Republic, which secures more than half its electricity from coal, versus the EU average of 16 percent. The alliance issued a statement on the need for COP28 to set a strategy on coal phase-out and called on financial institutions to commit to ending funding for unabated coal plants while installing guardrails to protect coal-dependent communities during the transition.

- New financing mechanisms are emerging to help countries deliver on coal pledges. The Coal to Clean Credit Initiative (CCCI) proposed a new coal “transition credit” to incentivize transition away from coal plants to clean energy in emerging and developing economies. A pilot transaction was announced to retire a coal plant in the Philippines with finance from transition credits generated by replacing coal-powered capacity with solar and wind. During the event at the Blue Zone main stage, McKinsey’s Vishal Argarwal talked about the opportunity in the retirement of coal plants. There is potential to expand this approach to other fuels such as The Africa Carbon Markets Initiative’s effort to decommission diesel generators.

Renewed attention on nuclear

22 countries have called for tripling nuclear energy capacity globally by 2050. Nuclear energy currently contributes about 10 percent of global energy generation, and can be a fundamental lever to provide the base-load that helps the energy sector transition away from fossil fuels faster, helping to bring stability to an increasingly renewables-based system.

Net zero utilities

The Utilities for Net Zero Alliance (UNEZA) was announced. This is an initiative led by TAQA and backed by more than 25 leading global utilities, including E.ON, RWE, Iberdrola, EDF, Tenaga, and other entities such as the UN High-Level Champions and IRENA. Investment in grid infrastructure needs to double to an average of $630 million per year on a net-zero pathway. This alliance aims to accelerate this transition.

McKinsey at COP28: Insights from our events

How can we accelerate the energy transition? Over several sessions, McKinsey’s Humayun Tai and Fransje van der Marel covered critical transition enablers with leaders from across the energy and industrial sectors.

- Scaling innovation: Existing technologies like carbon capture and heat pumps need to scale—and be complemented by disruptive new solutions such as high-temperature electric heating.

- Closing the investment gap: Some countries and regions have mobilized funding to support industry, including public funding such as the United States’ IRA and Japan’s green transformation plan. But investment gaps remain, particularly in the Asia Pacific region, which faces a $1.1 trillion invest gap through 2030, compared to a $240 billion gap in Europe.

- Intensifying collaboration: Ex-Shell CEO Ben van Beurden said global impact requires “global alliances—not just at the country level, but also sector level.” He added that differing opinions across industries on the path to transition have been a barrier to meaningful progress.

- Approaching the solution holistically: Jim Coulter, executive chairman and a founding partner at TPG Capital, stated, “decarbonization is hard because it’s a system problem. There are 80 different sub sectors [of industries]. We have to go after all of it.”

- Identifying untapped potential: Rebecca Kujawa, CEO and president of NextEra Energy, called out permitting and supply-diversified global supply chains as “real opportunities” for continued progress in the sector.

- Building on optimism: Panelists overwhelmingly expressed optimism about the state of renewables and confidence that policy would continue to lift the overall landscape. One panelist pointed to the fact that demand is no longer an issue.

How can we ensure energy reliability and affordability through the transition? Leaders from across the energy system joined McKinsey’s Micah Smith to discuss the role of the oil and gas sector in ensuring the net-zero transition achieves four interdependent objectives: emissions reduction, affordability, reliability, and industrial competitiveness.

- Revamping how the world produces and uses energy. The world will need to run two energy systems in parallel, smoothly ramping down the old, fossil fuels-based one while scaling up the new. Doing so well can help reduce emissions to net zero while ensuring reliable and affordable access to energy.

- Scaling the new energy system as quickly as possible. Solutions discussed included expanding alternative energy sources, changing end-use sectors, and improving energy efficiency.

- Reducing fossil fuel emissions, including methane. While fossil fuels are still in use, the industry should work to deliver products with the lowest energy intensity possible. Key levers to reduce emissions include carbon capture, use and storage; reduced flaring and venting; and electrification of operations.

- Advancing innovation. The fossil fuel industry has an opportunity to drive technological innovation, R&D and industry-wide collaboration.

Key questions for leaders:

- Does my organization have a concrete plan to reduce Scope 1 & 2 emissions? For the oil and gas sector, how do I drive systematic emission reductions across my value chain?

- It is time to act on methane emissions. Do I know the extent of my organization’s methane emissions? How can we credibly report on these emissions, and do we have a plan to reduce them?

- How can I partner across the energy and industrial system to enable the transition?

- What are the new set of financing opportunities that I can leverage to accelerate investment in the new system and avoid stranded cost for existing assets?

mckinsey.com 12 05 2023