The OPEC+ group of oil producers celebrated their fifth birthday in early December. It’s been a turbulent time — more so than they could have imagined when they first came together to face the threat posed by the U.S. shale boom back in 2016 — and the future doesn’t look much easier.

On the verge of collapse in 2020, OPEC+ was saved by the Covid-19 pandemic and the need for a coordinated response to oil-supply management in the face of an unprecedented slump in demand. They have risen to that challenge with remarkable cohesion. Their next one will be continuing to stick together as the world’s need for oil tests their production limits.

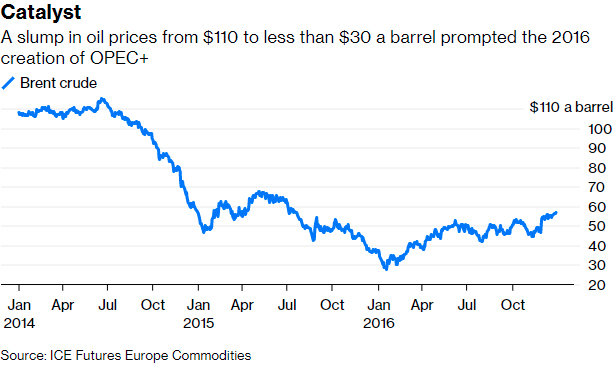

Faced with a slump in oil prices, which had fallen from $110 a barrel in mid-2014 to less than $30 by early 2016, and soaring oil stockpiles, the 13 members of the Organization of Petroleum Exporting Countries agreed in November 2016 to cut production by 1.2 million barrels a day and called on non-member countries to support them with additional reductions.

A group of 11 countries — including the three biggest former-Soviet producers, Russia, Kazakhstan and Azerbaijan — agreed to reduce their collective output by almost 560,000 barrels a day from the start of 2017.

That initial production cut was meant to last until the end of June. But it was extended, not once, but twice. Then, at the end of 2018, it was made even deeper, and subsequently extended yet again. By March 2020, what had initially been a six-month program of output restraint had run for more than three years.

And then suddenly it all blew apart.

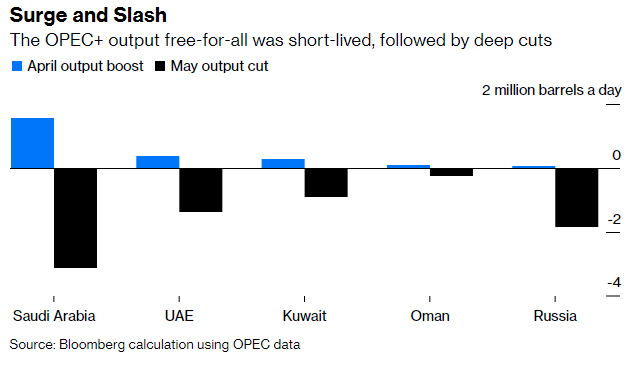

As the Covid-19 pandemic began to bite into demand, Saudi Arabia demanded that Russia share in a proposed supply reduction of a further 1.5 million barrels a day. Russia demurred. OPEC+, as the wider group had become known, fell apart.

The producers didn’t quietly go their separate ways. Instead they launched the bitterest of post-break-up fights — opening the spigots and flooding the market with crude, just as lockdowns and international travel restrictions were slashing demand. Prices plummeted again. That was enough to get them around a (virtual) table in April 2020 to agree to the deepest-ever voluntary output cuts. Their performance since then has defied expectations, certainly mine and probably even their own.

Note: A new long-term plan, introduced in July 2021, introduced the tapering. The original plan had cuts of 5.76 million barrels a day until April 2022

The group has shown a great deal of flexibility in attempting to adjust their supply to evolving demand as the pandemic has ebbed and surged over the past two years — even if they haven’t always got it right. They delayed early plans to ease output cuts, while Saudi Arabia made additional reductions on its own when demand was slow to pick up. More recently, they introduced a program of easing supply back onto the market as the recovery gained pace.

Even more surprising than the flexibility has been the degree to which producers stuck to what they said they would do. Sure, there have been those that haven’t, but imperfect compliance has been helped by unilateral Saudi cuts, maintenance outages in countries such as Kazakhstan, and falling production capacity in countries including Angola and Malaysia. More importantly, expectations that the deal would fall apart as demand picked up have been confounded.

The outlook for 2022 remains just as uncertain as this year’s has been. The pandemic is still with us. The emergence of another new variant in November has sent oil prices tumbling again, as countries seek to contain its spread.

In the immediate future, the producer group faces the return of oversupply and a growing need to cut output once again. At the same time, it faces pressure from consuming countries, worried by soaring inflation, to keep the taps open.

But assuming demand continues to recover, it won’t be long until the main concern is the group’s ability to pump all the oil the world needs, even as we attempt to transition away from fossil fuels. Russia’s second-largest oil producer, Lukoil PJSC, says its spare capacity will be used up by April if OPEC+ keeps adding 400,000 barrels a day each month.Opinion. Data. More Data.Get the most important Bloomberg Opinion pieces in one email.EmailSign UpBloomberg may send me offers and promotions.By submitting my information, I agree to the Privacy Policy and Terms of Service.

Saudi Energy Minister Prince Abdulaziz bin Salman warned that the world faces a 30 million-barrel a day supply shortfall by the end of the decade. He was right to do so. With several OPEC+ members already unable to meet their output targets and others — including Russia — rapidly approaching capacity, it may not be long before the group is struggling to add the production as it needs to balance the market.

The next five years may be no smoother for the oil producer group than its first five have been.

Julian Lee is an oil strategist for Bloomberg First Word. Previously he worked as a senior analyst at the Centre for Global Energy Studies.

Bloomberg News 12/27/2021