Charles Newbery, Platts S&P Global

BUENOS AIRES

EnergiesNet.com 11 21 2024

Argentina’s natural gas industry expects to start exporting supplies to Brazil as soon as December following the signing of a memorandum of understanding for the trade by both countries, experts said Nov. 19.

«I think that the exports are going to start this summer,» Daniel Ridelener, CEO of gas transporter Transportadora de Gas del Norte (TGN), said at the Forbes Energy Summit in Buenos Aires.

The supplies, at least initially, will be sold under interruptible contracts, starting at as low as 1 million cu m/d in the summer months of December, January and February, he said.

«The importance of this volume is not going to be economic but symbolic, that we have started exporting to Brazil again,» Ridelener said.

The exports by pipeline, he added, could increase to 12 million to 15 million cu m/d to supply industrial consumers under steady contracts in the next three to four years.

But there is even more potential for supplying Brazil’s thermal power generators, a market of a steady 10 million cu m/d with peaks of 70 million cu m/d that is better to supply with LNG, given the sharp fluctuations in demand.

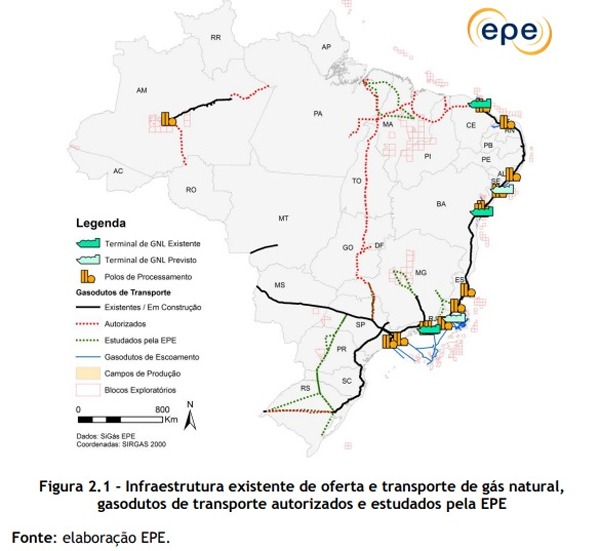

Brazil gets most of its power from hydro, but when dry spells hit every three to four years it must turn to the global LNG market to make up for the shortfall via nine regasification terminals, Gabriela Aguilar, general manager of US-based floating LNG terminal supplier Excelerate Energy in Argentina and Brazil, said at the event.

Improving fortunes

The forecast for export growth comes after Argentinian Economy Minister Luis Caputo, the country’s chief energy architect, signed the MOU on Nov. 18 with Brazil’s Minister of Mines and Energy, Alexandre Silveira, on the sidelines of the G20 summit in Rio de Janeiro. The deal calls for gradually increasing the exports to 30 million cu m/d by 2030, beginning at 2 million cu m/d in 2025.

Argentina was once a regular gas supplier to Brazil, but it had to stop exporting in the early 2000s as its production dwindled so much that it had to turn to Bolivia for supplies, as well as the global LNG market.

Those sagging fortunes began to turn around this decade as production recovered, led by the development of Vaca Muerta, one of the world’s biggest shale plays with an estimated 300 Tcf of resources, way more than the country’s 2 Tcf/year of consumption.

The Patagonia play is now leading a rise in gas production, taking it to nearly 150 million cu m/d in September from a most recent low of 114.2 million cu m/d in early 2021. This is reviving expectations that Argentina can once again become a regional gas supplier – it exported 20 million cu m/d in the late 1990s and early 2000s – over existing cross-border pipelines built in the 1990s, with some 5 million cu m/d going to Chile over the past few years.

The biggest market in the region is Brazil, which has relied on Bolivia for supplies for several decades. But with production and reserves in decline there, Brazil is looking to diversify its suppliers, Julio Glinternick Bitelli, Brazil’s ambassador to Argentina, said at the seminar.

«Brazil is going to need more and more gas» to feed its growing industrial and power capacity, he said.

This has led the Brazilian government to make it a priority to find multiple sources of gas, the ambassador said. One source could be Brazil’s offshore subsalt fields, but the prices are not yet «economically attractive,» he added.

By comparison, Vaca Muerta appears to be an option that is «more practical, economic and strategic,» Glinternick Bitelli said.

Moving the supplies

The next step is to determine the routes for moving the supplies by pipeline to Brazil, with various options on the table.

These include using Bolivia’s spare capacity to move the supplies from Argentina to Brazil for a transit fee, as well as a more recent option to build a new pipeline connecting the countries via Paraguay, or extending a pipeline in Uruguay to reach Brazil in the south before extending northward to São Paulo, Glinternick Bitelli said.

Argentina has started to build more takeaway capacity for Vaca Muerta with a 40 million cu m/d pipeline to the center of the country, where there are connections to move the supplies north. The first 11 million cu m/d of capacity has been built on the line, recently re-dubbed the Perito Moreno, and it is expected to reach 16 million cu m/d next year. At the same time, TGN has completed a project to make its pipeline to the northwest of the country bidirectional so that supplies can flow from Vaca Muerta to the north, not just south from Bolivia and northern Argentina gas fields as has been done for many decades.

This bidirectional capacity is 19 million cu m/d, but as more sales opportunities surface, such as supplying the mining sector in northern Argentina and Chile, as well as to industrial consumers in Brazil, this can be expanded by other 10 million cu m/d, Ridelener said.

A key for building more pipeline capacity in Argentina and Brazil is to enter into fixed-term — or take-or-pay contracts — with buyers, as that will guarantee the future cash flow for financing the projects, he added.

LNG exports

The next step to increase deliveries to Brazil will be to build LNG export capacity in Argentina.

The most advanced project for this is one led by BP-backed Pan American Energy, Argentina’s fourth-largest gas producer. Pan American has teamed up with Norway-based Golar LNG to install a floating terminal to start exporting some 12 million cu m/d of LNG in 2027. Argentina’s state-run YPF, meanwhile, is pushing forward on a $30 billion project to export up to 120 million cu m/d of LNG from 2031, though likely starting sooner at a smaller scale.

While the facilities will supply the global market, the closeness to Brazil makes it a prime market for deliveries.

Adding to that attraction is the expectation of growth in demand, as Brazil plans next year to hold an auction for building new thermal power capacity that most likely will be supplied by LNG, Excelerate’s Aguilar said.

The bidders for this capacity will have to show that they have long-term LNG supply contracts, she said.

spglobal.com 11 18 2024