By Kaieteur News

GEORGETOWN

Petroleumworld 10 06 2021

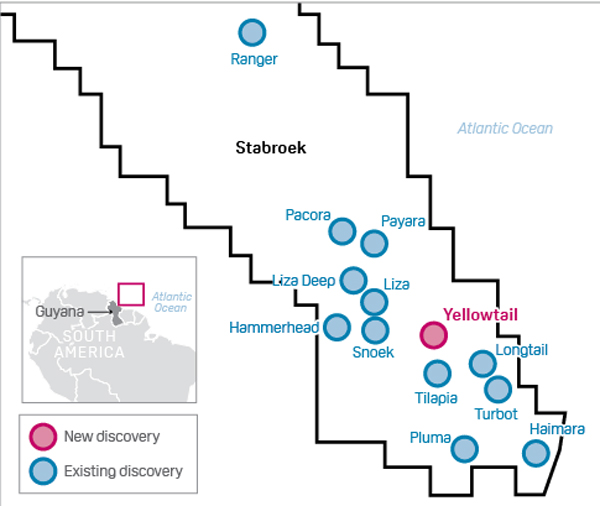

The Ministry of Natural Resources on Thursday last issued an invitation for interested consultancy firms, to provide their technical and financial proposals by January 20, 2021, to review the Field Development Plan (FDP) for ExxonMobil’s US$9B Yellowtail Project in the Stabroek Block.

The bid documents state that the firms are required to consider Guyana’s legislative and contractual framework, international best practices and industry standards, and the specific conditions present in Guyana, then proceed to conduct an in-depth review of the Yellowtail Kaieteur News – The Ministry of Natural Resources on Thursday last issued an invitation for interested consultancy firms, to provide their technical and financial proposals by January 20, 2021, to review the Field Development Plan (FDP) for ExxonMobil’s US$9B Yellowtail Project in the Stabroek Block.

The bid documents state that the firms are required to consider Guyana’s legislative and contractual framework, international best practices and industry standards, and the specific conditions present in Guyana, then proceed to conduct an in-depth review of the Yellowtail Field Development Plan (FDP).

Government said, the review must include all supporting and reference documentation, along with the related Environmental Social Impact Assessments (ESIA) submitted by the Stabroek Block Licensees.

It was further noted, that the review must include at minimum, an assessment of the strategy and the development model, as well as the criteria for the choices that have been made by the Licensees, including cost effectiveness, and potential alternatives; engineering, geological and geophysical interpretations, simulations, and estimations, including recovery factor efficiency using natural gas injection and available natural gas for export; and the well and reservoir management strategy, taking into consideration the government’s objectives of maximizing the recovery of hydrocarbon resources and having no gas flared.

Interested firms would also be expected to review documents pertaining to the proposed oil and gas surface facilities, the associated financial models, economic analyses and cost estimates and reports, towards ensuring financial optimization of oil and gas recovery profiles; the Health, Safety, Environment and Social (HSES) impacts and proposed mitigation; the Decommissioning Plan and Budget; the natural gas utilization plan for the field; and the overall risk management strategy.

According to government, the successful firm would be required to examine how ExxonMobil and its partners have incorporated the learnings from previous FDPs and related studies, as well as identifying how the Licensees have addressed these findings in the context of a new FDP. Consideration would also have to be given to any revisions needed to ensure deficiencies have been adequately addressed.

Furthermore, Kaieteur News understands that, the successful applicant would be required to prepare a report, setting out the opinions formed in the evaluation of the FDP and ESIA, addressing at minimum, compliance or non-compliance with the requirements of the existing legislative and industry standards including any deficiencies, unresolved issues and areas of additional assessments or technical analysis that the government should request before making a determination on the FDP.

According to the government, it expects support for the Natural Resources Ministry through engagements and information exchanges, with the Licensees as well as the provision of on-the-job training to Guyanese during the FDP evaluation process.

The project documents note that the duration of the assignment is expected to be 50 days, with the possibility of work starting by February 7, 2021, should all go as planned.

TRILLION DOLLAR PROJECT

Kaieteur News previously reported that development costs for the Yellowtail project are poised to exceed US$9B or GY$1.8 trillion.

ExxonMobil has said the costs are expected to be higher, since there would be a greater number of development wells and associated drilling costs, when compared to its Payara project which will also cost Guyana $1.8 trillion.

Despite the astronomical costs, Exxon believes that the project should be supported as it would generate benefits for the citizens of Guyana in several ways, which would otherwise not be there in the absence of the project.

The Company said these benefits include revenue sharing with the Government of Guyana and stressed, that the type and extent of the benefits associated with revenue sharing will depend on how decision-makers in government decide to prioritise and allocate funding for future programmes, which is unknown to the company and outside the scope of the EIA.

Apart from the revenue sharing, Exxon said Guyanese stand to benefit from the procurement process that will follow for goods and services from local businesses in alignment with the Petroleum Agreement and the Esso Exploration and Production Guyana (EEPGL)—ExxonMobil Guyana—Local Content Plan, approved by the Ministry of Natural Resources in June 2021.

According to project document, Yellowtail will consist of drilling approximately 41 to 67 development wells; installation and operation of Subsea, Umbilicals, Risers, and Flowlines equipment; installation and the operation of a Floating Production Storage and Offloading (FPSO) vessel in the eastern half of the Stabroek Block; and— ultimately—project decommissioning.

The FPSO will be designed to produce up to 250,000 barrels of oil per day. The initial production is expected to begin by the end of 2025–early 2026, with operations continuing for at least 20 years.

The project is expected to employ up to 540 persons during development well drilling, approximately 600 persons at the peak of the installation stage, and 100 to 140 persons during production operations.

______________