Mayra P. Saefong and William Watts, MarketWatch

SAN FRANCISCO/NEW YORK

EnergiesNet.com 10 31 2023

This feature is powered by text-to-speech technology. Want to see it on more articles?

Give your feedback below or email audiofeedback@marketwatch.com.

Oil futures ended lower on Tuesday, leading to the first loss in five months as the risk premium tied to fears the Israel-Hamas war could threaten crude supplies eroded.

Price action

- West Texas Intermediate crude for December delivery CL00, 0.64% CL.1, 0.64% CLZ23, 0.64% dropped $1.29, or 1.6%, to settle at $81.02 barrel on the New York Mercantile Exchange. Prices based on the front-month contract finished at their lowest since Aug. 28, down 10.8% for the month, according to Dow Jones Market Data.

- December Brent crude BRNZ23, the global benchmark, lost 4 cents, or nearly 0.1%, to end at $87.41 a barrel on ICE Futures Europe on the contract’s expiration day, settling 8.3% lower for the month after four consecutive monthly gains. January Brent BRNF24, 0.69% BRN00, 0.69%, which became the front month at the session’s end, dropped $1.33, or 1.5%, to $85.02 a barrel.

- November gasoline RBX23 rose 0.1% to $2.22 a gallon, but lost 8.9% for the month.

- November heating oil rose 0.8% to $2.99 a gallon, posting a monthly decline of 11%. The November contracts expired at the settlement.

- December natural gas NGZ23, -1.43% gained nearly 6.7% to $3.58 per million British thermal units. Front-month prices gained 22.1% for the month.

Market drivers

On the Middle East front, oil traders have “likely shifted into efficient market mode, waiting for signs of a definitive escalation that imperils supply before taking prices higher,” Stephen Innes, managing partner at SPI Asset Management, said in market commentary.

Read Israel-Hamas war has potential to fuel oil-price shock that can disrupt food security: World Bank

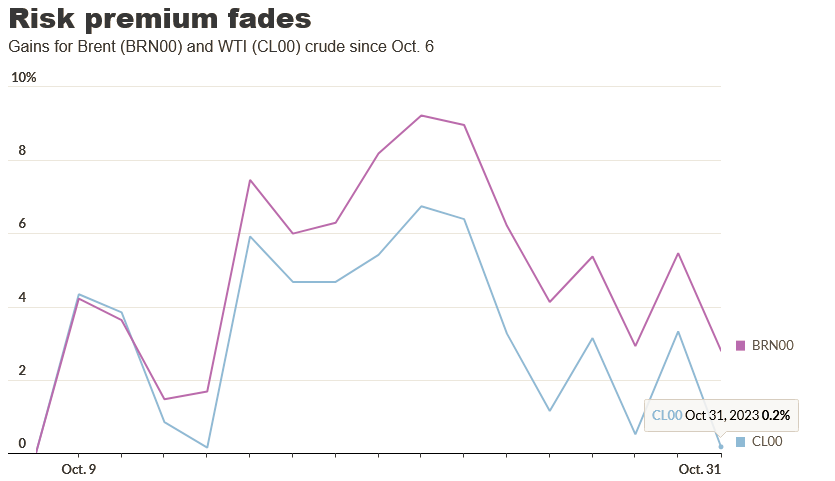

WTI has erased gains seen since the Oct. 7 attack on southern Israel by Hamas from Gaza, while Brent has significantly trimmed its gains since the start of the war despite continued risks of a wider conflict.

The biggest worry surrounds Iranian oil flows, which could see up to 1 million barrels a day of crude knocked off the market if the U.S. were to more strictly enforce sanctions on the country’s exports, said Warren Patterson and Ewa Manthey, commodity analysts at ING, in a note.

So far, however, the conflict hasn’t yet affected oil supply.

“In the absence of supply disruptions from the region, it is difficult to see a significant and sustained upside in prices,” the ING analysts said.

Still, the situation in the Middle East is fluid. Saudi Arabia’s military is on high alert after deadly clashes with Yemen’s Iran-backed Houthi rebels, who attempted to fire a missile over Saudi Arabia toward Israel, Bloomberg reported late Monday citing people familiar with the matter.

Strategists at Macquarie wrote in a recent note that they remain bearish on oil, but “recognize upside risks associated with the Middle East conflict.”

They do “not expect a supply disruption without material escalation,” and while they did not believe that a full conflict resolution was needed for the “risk premium to bleed out,” the Macquarie strategists said they were still “surprised at the rate of the pull back” in prices.

marketwatch.com 10 31 2023