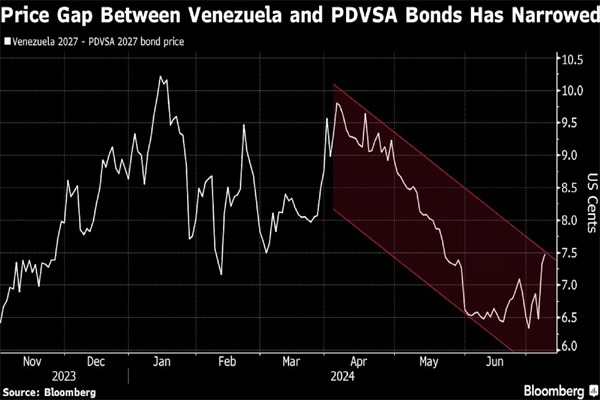

- Spreads between sovereign and PDVSA notes have tightened. Some bet both issuers to get same treatment in a restructuring

Nicolle Yapur, Maria Elena Vizcaino, and Vinícius Andrade, Bloomberg News

CARACAS/NEW YORK

EnergiesNet.com 07 18 2024

A new trade is gaining steam in the market for Venezuela’s defaulted bonds ahead of this month’s presidential elections: Buying the debt of the state oil company.

A handful of investors, including William Blair & Co., Gramercy Funds Management and Spanish firm Auriga Global Investors, are moving into the notes of state-owned Petroleos de Venezuela SA, which trade for as little as 11 cents on the dollar. They favor those over more expensive Venezuela sovereign bonds.

The securities, they argue, will be treated similarly when a long-awaited bond restructuring finally takes place. The prospect for such a process has gained steam ahead of the July 28 election in which President Nicolas Maduro is running for reelection against Edmundo Gonzalez, a former diplomat. The bonds, which total around $60 billion in principal, have been in default for nearly seven years.

“Bondholders are more optimistic that PDVSA would not be essentially left out of the fold, which is beneficial to PDVSA bonds closing the gap with the sovereign,” said Arif Joshi, a fund manager at Lazard Asset Management, who declined to say whether he’s buying the debt. Lazard held PDVSA and sovereign bonds as of early this year, according to data compiled by Bloomberg.

Robert Koenigsberger, founder and chief investment officer at Gramercy, said he sees the chance for a political transition following the vote.

“They want access to capital markets,” he said. “If you have a credit culture, you don’t think about how you screw the bondholders.”

Any restructuring is still a ways off as US sanctions would need to be lifted before it could start. But the bet on PDVSA bonds gained traction in April when JPMorgan Chase & Co. said started to include the notes in its widely followed emerging-market indexes.

Since then, spreads between PDVSA and government debt have narrowed to levels not seen since November, shortly after the US lifted a ban on trading the debt in the secondary market. PDVSA notes maturing in 2024 are exchanging hands for around 13 cents on the dollar, gaining about 2 cents over the past three months, according to traders and pricing data compiled by Bloomberg. Government bonds with similar maturities trade for around 18 cents, about the same level they were three months ago.

The prices for PDVSA are unlikely to fully catch up with the sovereign notes, which have a higher weight in the indexes and are owed more past-due interest. However, the money managers touting the trade see the gap narrowing — offering a quick pickup.

Jared Lou, an investor at William Blair, said the index rebalancing provided a buying opportunity on top of the value in the spread between PDVSA and sovereign bonds.

“The price gap between the two was unjustified,” he said.

bloomberg.com 07 17 2024