By Liam Denning

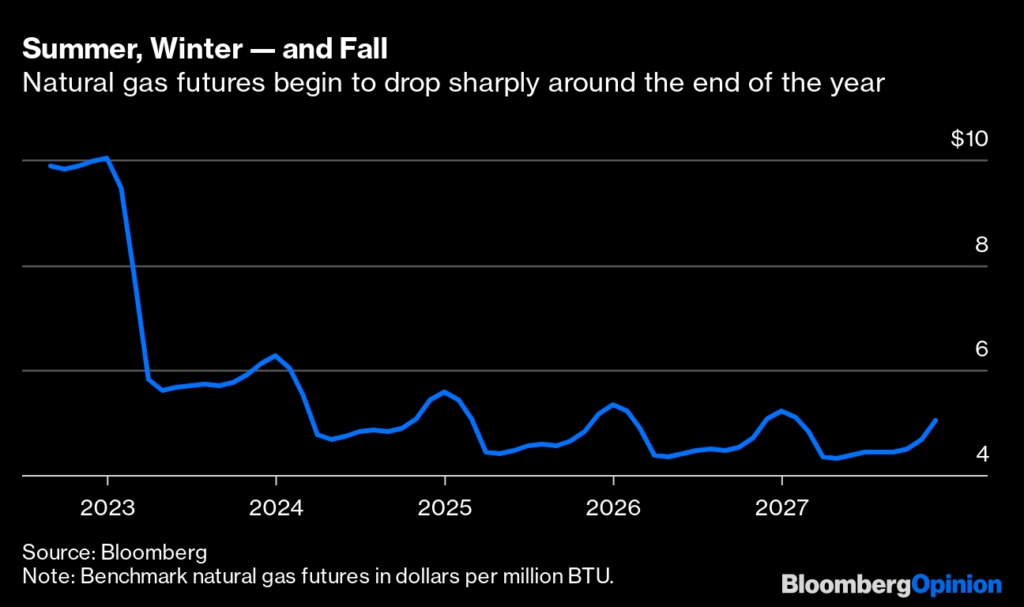

The phrase “$10 gas” is liable to put Americans in the hospital. This is a linguistic hazard, however: The latest energy shock doesn’t concern gasoline prices — which have been falling — but rather natural gas. After long years where natural gas crawled along at $2 per million BTU or thereabouts, it is suddenly back in double figures, briefly nosing above $10 Tuesday morning for the first time since 2008.

Gas is in demand globally because of Russia’s disruption of supply to Europe as part of its war against Ukraine. US export capacity is effectively maxed out, apart from the Freeport liquefied natural gas facility being repaired after an explosion in June. In effect, therefore, the intrigues of Russian supply aren’t really moving US gas prices; high exports are factored in already and, barring Freeport’s expected restart in the fall, they can’t go much higher for now.

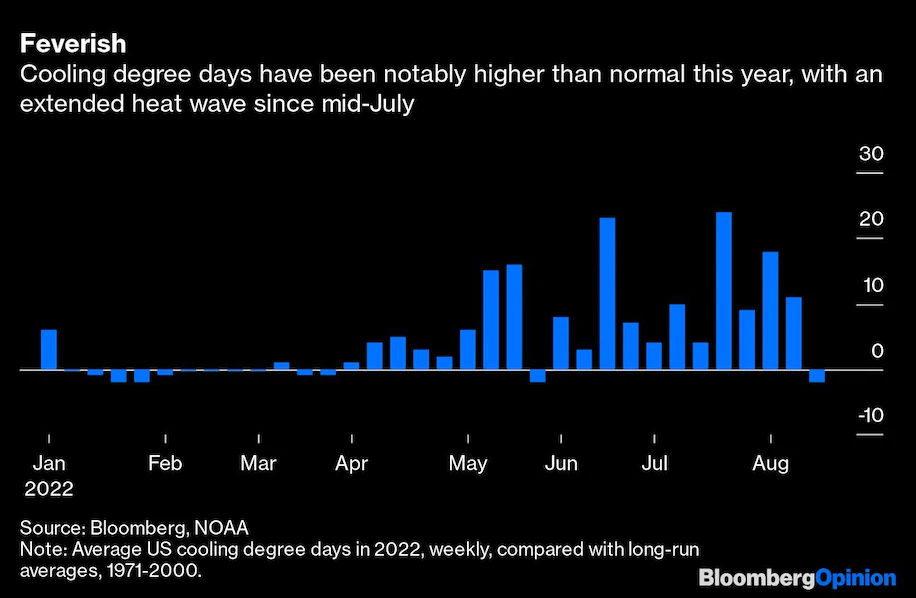

Instead, those high gas prices are largely a result of the weather. Often at this time of year, that means hurricanes taking down supply. But this hurricane season has been unusually quiet so far, without a single named storm since early July. Instead, you could say a lack of wind is juicing gas prices: Muggy, hot weather across much of the country has kept those air conditioners humming and, in Texas, slowed wind turbines.

The result has been record quantities of natural gas being burned in power plants. Average gas burn hit an all-time high in the week ended Aug. 10, according to Bloomberg NEF.

This matters because US gas demand is, by and large, relatively flat. Industrial and residential consumption, representing 40% to 45% of demand, has been flat or growing only slowly for years. Commercial demand is up this year but accounts for only about a tenth of the pie. Exports of liquefied natural gas have been the only sustained source of growth in recent years, but they are capped for now. So those power plants working overtime in the heat are the bullish case right now.

Depending on the weather is a longstanding state of affairs in the natural gas market and, given its unpredictability, to be treated with caution. The end of summer is approaching, and while winter isn’t far off, early long-range forecasts point to milder-than-usual temperatures across much of the US. Those can be wrong, of course. In May, the National Oceanic and Atmospheric Administration was predicting an above-average hurricane season.

Still, gas futures — while not a prediction of gas prices per se — suggest the current strength is predicated to a large degree on the weather, with all the volatility that comes with that.

On the supply side, it is worth noting this sort of gas curve is the stuff of long-suffering producers’ dreams. The days of inexpensive gas funded by investors willing to burn their own cash are over. Even with that cliff, futures are priced mostly above $5 for years out.

That should encourage more supply. The number of rigs operating in the Haynesville shale area began increasing markedly in the middle of February, coinciding with near-month gas futures rising sustainably above $4, suggesting that’s a profitable threshold in a basin toward the higher end of the cost curve. Meanwhile, high crude prices should mean increasing amounts of associated gas from higher oil production, which accounts for about a third of supply. And even the mighty Marcellus shale basin in Appalachia, constrained by lack of new pipeline capacity, may yet get an extra outlet through the concessions extracted by Senator Joe Manchin for his assent to the Inflation Reduction Act. As so often in the past, a change in the weather and a few extra rigs would be all that’s required to knock gas prices back down.

_______________________________________________________________

Liam Denning is a Bloomberg Opinion columnist covering energy, mining and commodities. He previously was editor of the Wall Street Journal’s Heard on the Street column and wrote for the Financial Times’ Lex column. He was also an investment banker. Energiesnet.com does not necessarily share these views.

Editor’s Note: This article was originally published by Bloomberg on August 23 , 2022. EnergiesNet.com reproduces this article in the interest of our readers. All comments posted and published on EnergiesNet.com, do not reflect either for or against the opinion expressed in the comment as an endorsement of EnergiesNet.com or Petroleumworld.

Use Notice: This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of issues of socially, environmental and humanitarian significance. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107. For more information go to: http://www.law.cornell.edu/uscode/17/107.shtml.

EnergiesNet.com 08 23 2022