Alan Crawford, Bloomberg News

BERLIN

EnergiesNet.com 07 06 2022

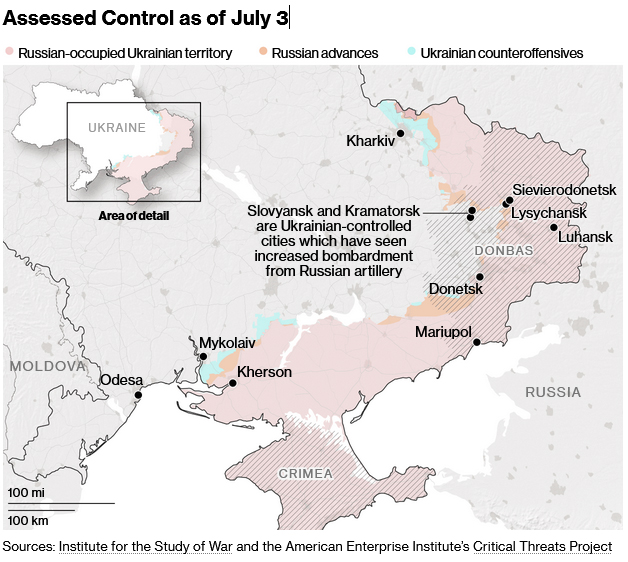

Energy shortfalls were always part of the equation in the response to Russia’s invasion of Ukraine. But few were prepared for gas becoming a second front in President Vladimir Putin’s wider conflict with the US and its allies.

In less than five months of war, Moscow has retaliated against successive waves of international sanctions by tightening its supplies of natural gas to Europe. That’s contributed to a spike in prices, stoking inflation that’s hitting consumers and governments from the UK to Bulgaria.

Key reading

- Natural Gas Soars 700%, Becoming Driving Force in New Cold War

- Putin’s War Throws Crucial EU Vote on ‘Green’ Gas Into Doubt

- Global Gas Demand Growth Forecast to Falter for Years, IEA Says

- Germany’s Uniper in Bailout Talks to Plug $9.4 Billion Hole

- Putin Swoop on Gas Plant Risks Forcing Foreign Partners Out

- European Gas Rally Shows No Signs of Easing on Supply Concerns

It’s also triggered a free-for-all as Europe competes on the global stage to secure alternatives to Russian gas. With no time to build pipelines, countries from the Americas to the Middle East and Africa are being courted for shipments of liquefied natural gas.

But there isn’t enough to go around. The result is that gas now rivals oil as the driver of geopolitics.

Plans to tackle climate change are falling victim as a result, even as a record drought in Italy highlights the costs of inaction.

A tighter squeeze is still to come.

At the outbreak of the war, Germany put on ice the Nord Stream 2 pipeline that was due to start gas flows from Russia. Now, the first Nord Stream is about to undergo maintenance and Berlin is warning that Moscow may not bring it back online, risking the collapse of industries as Putin blackmails Europe’s largest economy.

Chancellor Olaf Scholz’s government, already in talks with gas giant Uniper over a possible bailout of as much as 9 billion euros, is preparing legislation that would enable the state to take stakes in further struggling energy companies.

Ukraine is suffering the frontal assault in this war. The rest of Europe, in aligning with Kyiv against Moscow, is straining with the repercussions too.

Click here to follow Bloomberg Politics on Facebook and share this newsletter with others. They can sign up here.

Spending support | Ukraine has indicated it needs $60 billion-$65 billion this year to meet its funding requirements including emergency budget assistance and logistics infrastructure projects, billions more than its allies have so far pledged. The figure, which excludes defense and security spending, is part of a larger blueprint for reconstruction that’s estimated to exceed $750 billion over the next decade.

- Employees killed and displaced, infrastructure seized by force and relentless cyberattacks are only a few of the wartime challenges facing Kyivstar, Ukraine’s largest mobile phone operator.

Explainers you can use

- Why Saving the Climate Requires a Tough Taxonomy

- Hong Kong Travel Challenges Mount as Flight Bans Climb to 100

- What the Falling Yen Means for Japan’s Trade Partners

Rising doubts | After a year of debate and wrangling, Chile’s Constitutional Convention presented its final version of the charter to President Gabriel Boric, marking a shift away from the current document implemented under the 1973-1990 military dictatorship. As Eduardo Thomson explains, with a referendum set for Sept. 4, polls suggests voters are starting to question the broad changes it would enact on everything from social rights to political rules. Bloomberg channels and online here or check out prior episodes and guest clips here.

— With assistance by Karl Maier

bloomberg.com 07 05 2022