By Julian Lee

We’d better hope the forecasters at OPEC have got their numbers wrong. If they haven’t, then the members of the oil producer group may struggle to supply as much crude as the world will need next year.

Their latest forecast, which extends the outlook to the end of next year, shows global oil demand rising strongly again in 2023, despite growing fears over inflation and warnings of impending recession. A lack of investment in new crude production capacity elsewhere means that the OPEC group will need to pump more to meet that extra demand.

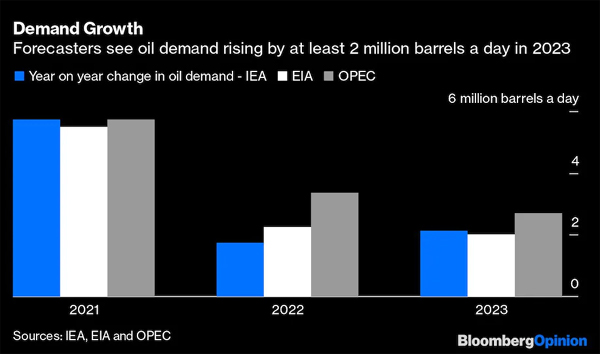

OPEC’s outlook for demand is more robust than that of analysts at the International Energy Agency or the US Energy Information Administration, both of which also updated their outlooks last week. All three bodies see global oil demand increasing by at least 2 million barrels a day next year, taking it back above the 2019 level for the first time since the Covid-19 pandemic struck in early 2020. But the producer group’s increase of 2.7 million barrels a day makes it the most optimistic on demand for a third year in a row.

This Panglossian view assumes that neither lingering Covid, Russia’s invasion of Ukraine, nor financial tightening amid soaring inflation undermines global economic growth to a significant degree. It does note, though, that the uncertainties around its forecast “remain to the downside.” We’d better hope for some downside revisions.

The growth that OPEC foresees will take global oil demand to 103 million barrels a day on average in 2023, well above it’s pre-pandemic level. The group is also much more sanguine than its counterparts about supply. It sees no impact on Russia’s oil production from European Union sanctions due to come into effect in early December, or maybe it anticipates that the price cap sought by the US on Moscow’s exports will support flows.

Combine the demand and supply outlooks, and it looks like the 13 members of OPEC will need to deliver more than 30 million barrels a day on average in 2023, according to both OPEC and the IEA. The EIA outlook puts the figure at 29.4 million barrels a day.

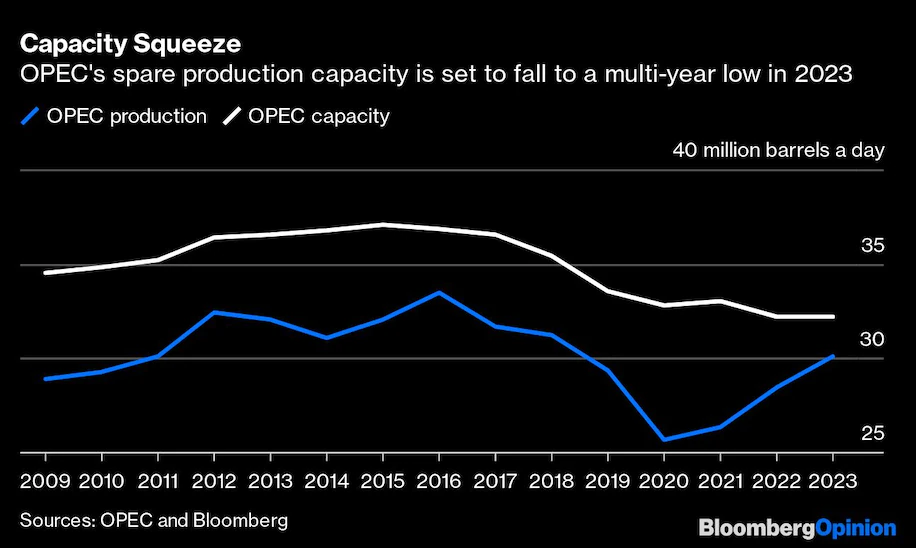

That’s not a record for the group, but it would be the highest since 2018, according to OPEC’s own figures. More importantly, it would push the group’s spare capacity to a multi-year low of about 2 million barrels a day, based on Bloomberg’s assessment of sustainable production capacities.

The last time the current members of OPEC collectively pumped more than 30 million barrels a day, the combined output of five of them — Algeria, Iran, Libya, Nigeria and Venezuela — was almost 2.75 million barrels a day higher than it is now. But only three members pumped more last month than they did on average in 2018 — Iraq, Saudi Arabia and the United Arab Emirates.

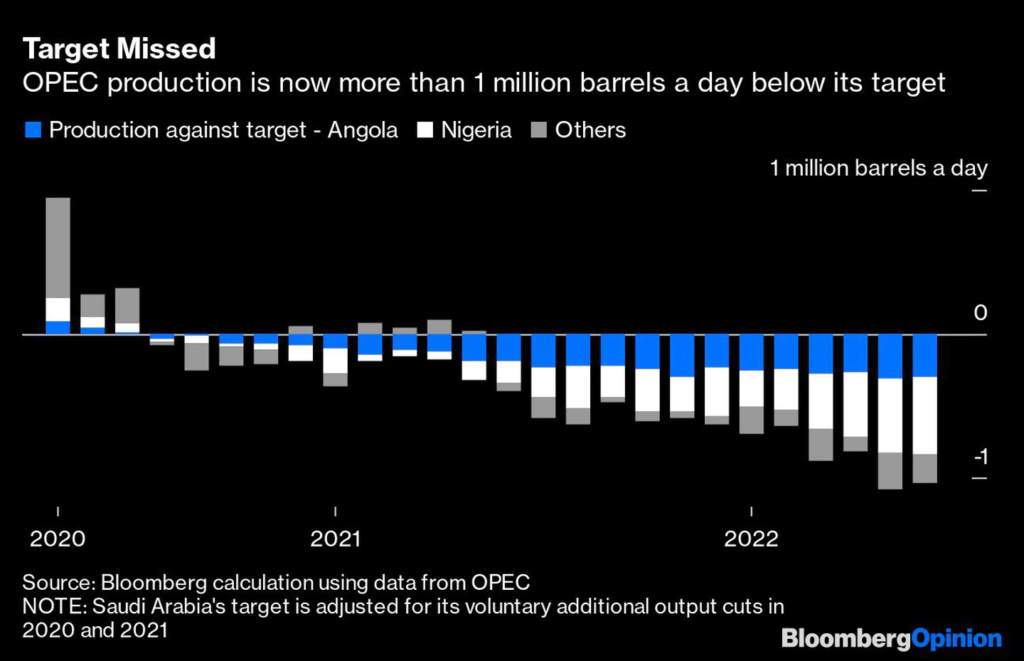

That’s not a result of voluntary restraint. Collectively, the OPEC members haven’t pumped as much as they were permitted since July 2020.

Initially, that helped balance over-production by the allies with whom they struck an accord in 2020. More recently, it has reflected an inability to boost output in line with rising targets. The combined production of the 10 members of OPEC bound by the deal was more than 1 million barrels a day below the permitted level in both May and June, with Angola and Nigeria falling way behind.

OPEC producers’ inability to raise production rates when oil prices are above $100 a barrel and demand for their crude is soaring doesn’t bode well for the future. The group will need to pump about 1.36 million barrels a day more on average next year than it did last month if it’s to balance supply and demand.

Yet only Saudi Arabia and the UAE have significant amounts of spare capacity, and they are already facing requests from the US to pump more oil now in an attempt to rein in inflation. Boosting output by the amount required would require both of them to sustain output for many months at levels they haven’t achieved before.

With little new OPEC production capacity expected next year, that’s going to leave the world uncomfortably short of a supply cushion. Unless, of course, demand growth turns out to be nowhere near as strong as the forecasters are suggesting. Maybe if we’re lucky.

__________________________________________________________________________

Julian Lee is an oil strategist for Bloomberg First Word. Previously he worked as a senior analyst at the Centre for Global Energy Studies.@JLeeEnergy, Energiesnet.com does not necessarily share these views.

Editor’s Note: This article was originally published by Bloomberg, on July 17 , 2022. All comments posted and published on EnergiesNet.com, do not reflect either for or against the opinion expressed in the comment as an endorsement of EnergiesNet.com or Petroleumworld.

Use Notice: This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of issues of environmental and humanitarian significance. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107. For more information go to: http://www.law.cornell.edu/uscode/17/107.shtml.

energiesnet.com 07 19 20022