Sudarshan Varadhan and Marianna Parraga, Reuters

CHENNAI, India/HOUSTON

EnergiesNet.com 08 16 2022

Indian companies are importing significant volumes of petroleum coke from Venezuela for the first time, trade sources and shipping data show, as the OPEC nation boosts exports not specifically targeted by U.S. sanctions.

India’s growing appetite for Venezuela’s petcoke – a byproduct from oil upgrading and an alternative to coal – is being driven by a scramble for inexpensive fuel to power industries as global coal prices have surged.

This could boost cash flow for the South American producer, where state and private companies have increased exports of petrochemicals and oil byproducts, and the more competitively-priced Venezuelan supplies could displace cargoes from traditional suppliers.

Indian cement companies imported at least four cargoes carrying 160,000 tonnes of petroleum coke from April to July, according to three trade sources, Refinitiv shiptracking data and Venezuelan shipping schedules.

Another 50,000-tonne cargo is expected to reach the port of Mangalore on India’s south western coast in the coming days while a 30,000-tonne shipment is scheduled to depart later in August, the data showed.

India, which counts the United States and Saudi Arabia as major petcoke suppliers, received its first ever cargo from Venezuela in the beginning of 2022, according to two of the sources and the documents.

A surge in global coal prices to record highs since the Russia-Ukraine war has pushed Indian cement makers including JSW Cement, Ramco Cements Ltd (TRCE.NS) and Orient Cement Ltd (ORCE.NS) to import petcoke from Venezuela, trade sources said.

“The quality of petcoke is very good and it has very low sulphur,” Ramco Cements Chief Financial Officer S. Vaithiyanathan said, adding the downside is that the cargoes take nearly 50 days to arrive in India.

Ramco Cements booked two 50,000-tonne cargoes of Venezuelan petcoke, which were delivered in June and July at a discount of $15-20 per tonne to the market price, Vaithiyanathan said.

Ramco paid $214.40 and $221 per tonne for the June and July cargoes, respectively, while Orient imported about 28,300 tonnes in April for $220 per tonne, Indian customs documents reviewed by Reuters showed.

JSW Cement imported over 30,000 tonnes in June, according to two trade sources, ship tracking data and customs documents.

JSW Cement and Orient did not immediately reply to requests for comment.

SUPPLIERS

The petcoke cargoes were shipped in April-July by Shimsupa GmBH, a Germany-headquartered scrap trading firm, which has an exclusive arrangement with Switzerland-based Maroil Trading to supply Venezuelan petcoke to India, China, Pakistan and Turkey.

“We are exclusive partners of Maroil Trading AG and have all necessary approvals of OFAC and the German government,” Annamalai Subbiah, who owns 100% of Shimsupa, told Reuters.

Annamalai confirmed supplying Venezuelan petcoke cargoes for Ramco, Orient and JSW Cement.

The cargoes were shipped from Venezuela’s main oil terminal of Jose, according to the sources and documents. Maroil has in recent years revamped petcoke operations to increase export capacity.

Maroil, owned by Venezuela-born shipping magnate Wilmer Ruperti, did not immediately reply to a request for comment. The U.S. Treasury Department, which has so far not targeted Venezuelan exports of petrochemicals and byproducts, declined to comment.

Venezuela’s oil sector has been under U.S. sanctions since 2019. Washington imposed sanctions on the country’s most important global business as the former Trump administration ratcheted up its bid to force socialist president Nicolas Maduro out of power.

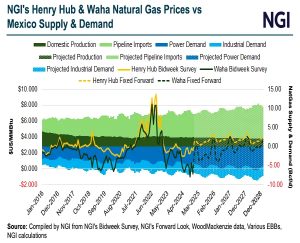

Higher Venezuelan supplies have weighed on global prices this year, according to petcoke traders in Houston.

“Those extra supplies have had an impact on the global market,” one of the traders said. “They are increasing the offer and diversifying Venezuelan cargoes’ destinations.”

Venezuelan petcoke is being offered at discounts of 5-10% to petcoke from the United States, Indian traders and cement company officials said.

A tonne of petcoke is more expensive than coal, but produces more energy when burnt. It is generally not used as fuel because of toxic emissions, but is widely used by the cement industry – its largest consumer, as sulphur dioxide emissions are absorbed by limestone.

(The story is refiled to correct 4th, 13th para to say April-July, not April-June)

Additional reporting by Matt Spetalnick in Washington; Editing by Florence Tan and Jacqueline Wong

reuters.com 08 16 2022