Nicolle Yapur and Fabiola Zerpa, Bloomberg News

The bolivar is plummeting, breaking a rare stretch of stability for Venezuela’s battered currency.

It has lost a third of its value so far this month, hitting 9.33 bolivars per US dollar on the parallel exchange market Thursday, according to data compiled by Bloomberg. That’s the steepest monthly decline since January 2021.

President Nicolas Maduro said the depreciation was “fictional” and blamed an unspecified “unscrupulous group” for manipulating it. “Let no one come to harm the economic recovery,” he said during a TV address on Thursday.

Controlling the exchange rate has been a key ingredient of President Nicolas Maduro’s strategy to halt a four-year hyperinflation bout, which ended in December. The currency, which had consistently lost nearly all of its value over the years, was relatively stable since a redenomination in October as the central bank poured hundreds of millions of dollars into the exchange market to keep it in check.

The bolivar started to show weakness in the parallel market at the end of last month, though most of the losses have occurred this week. The spread between the parallel rate and the official central bank rate of 7 bolivars per dollar is now the widest since the October, when six zeros were slashed from the currency in the redenomination.

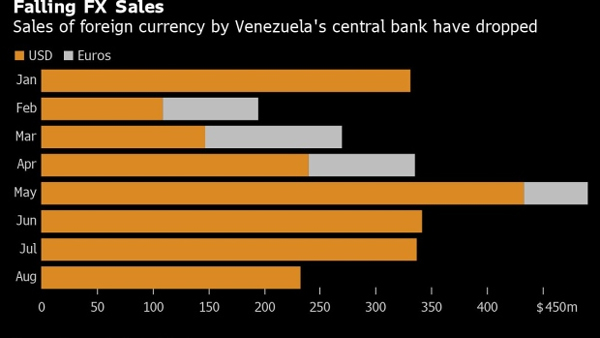

The central bank is selling less hard currency to the market while the government has increased spending of bolivars after reaching pay agreements with labor unions, fueling the depreciation.

The bank on Thursday sold $94 million to the market in an attempt to stop the slide. But in general, monthly sales had been dropping steadily since May. The trend “shows less willingness, or less capacity, to continue to intervene in the market with the same intensity,” said Tamara Herrera, director of financial analysis firm Sintesis Financiera.

The bank this week for the first time auctioned dollars to the market, according to a document seen by Bloomberg. It normally sells them directly to banks. It has also improved the terms of short-term bolivar bonds, trying to lure investors into buying them instead of greenbacks.

A weaker bolivar threatens the government’s efforts to bring inflation under control. While annual price increases run in the triple digits — according to Bloomberg’s Cafe con Leche Index — they’re a fraction of what they were during the period of hyperinflation. Prices have recently begun to creep back up, which could be exacerbated if the bolivar keeps falling.

“The inflation goal is at high risk,” Herrera said.

bloomberg.com 08 26 2022