Myra P. Saefong and Williams Watts, Market Watch

SAN FRANCISCO/NEW YORK

EnergiesNet.com 08 30 2022

Oil futures dropped by more than 5% on Tuesday, with worries over the economic outlook and energy demand, along with news reports that helped to ease concerns over tight supplies, sending prices to their lowest finish in more than a week.

Price action

- West Texas Intermediate crude for October delivery CL.1, 0.39% CL00, 0.40% CLV22, 0.39% fell $5.37, or 5.5%, to settle at $91.64 a barrel on the New York Mercantile Exchange, with the front-month contract marking the lowest finish since Aug. 22. Prices had gained 4.2% Monday to settle at $97.01, the highest finish for a front-month contract since July 29.

- October Brent crude BRNV22, 0.32%, the global benchmark, lost $5.78, or 5.5%, at $99.31 a barrel on ICE Futures Europe — also the lowest since Aug. 22, after rising 4.1% Monday. The most actively traded November contract BRN00, 0.40% BRNX22, 0.40% fell $5.09, or nearly 5%, to $97.84 a barrel.

- Back on Nymex, September gasoline RBU22, +0.04% dropped 6.4% to $2.6944 a gallon.

- September heating oil HOU22, 0.20% fell 2.4% to $3.8171 a gallon.

- October natural-gas futures NGV22, 1.03% declined nearly 3.2% to $9.042 per million British thermal units.

Market drivers

Oil investors are worried about inflation weakening global economies, analysts on the StoneX energy team in Kansas City wrote in a Tuesday newsletter. “Inflation is near double-digit territory in many of the world’s biggest economies, causing more aggressive interest rate hikes that will likely curtail economic growth and weigh on fuel demand.”

News reports Tuesday also helped to ease tight supply concerns.

A source in one of the OPEC+ delegations told Russian news agency TASS that the Organization of the Petroleum Exporting Countries and their allies are not currently discussing the possibility of oil production cuts. That’s contributing to pressure on oil prices Tuesday, said Phil Flynn, senior market analyst at The Price Futures Group.

The news report is contrary to remarks last week by Saudi Arabia’s energy minister, who signaled that OPEC could consider production cuts. OPEC+ will hold their next meeting on Monday.

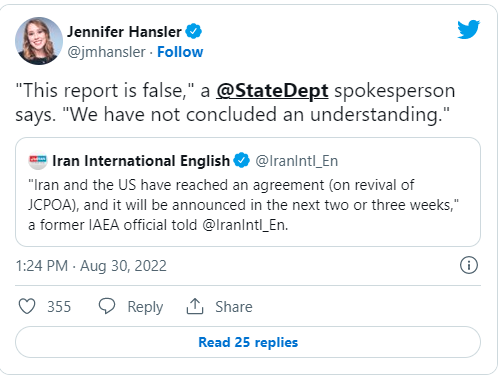

Also weighing on oil prices Tuesday, according to Flynn, was a tweet from a news organization called Iran International which said that Iran and the U.S. have reached an agreement on the revival of the Iran nuclear deal. The report, however, was branded false by a State Department spokesman, according to news reports.

Unrest in Libya and Iraq served to help boost crude prices Monday, while traders were also keeping an eye on protests in Iraq after influential cleric Moqtada al-Sadr said he was quitting politics. Sadr supporters have surrounded the Majnoon oil field near Basra since Monday evening, as well as the 210,000 barrel-a-day Basrah refinery, Reuters reported. The report, however, said that crude exports from Iraq, OPEC’s second-largest producer, were so far unaffected.

Crude’s rally on Monday also came as U.S. equities tumbled for a second day, with financial markets rattled by remarks last Friday by Federal Reserve Chairman Jerome Powell, who dashed hopes the Fed would relent on monetary policy tightening given signs inflation may be peaking.

Meanwhile, the Energy Information Administration will release its weekly data on U.S. petroleum supplies Wednesday morning.

On average, analysts expect the EIA to report a fall of 1.9 million barrels in domestic crude supplies, according to a poll conducted by S&P Global Commodity Insights. They also forecast inventory declines of more than 1.3 million barrels for gasoline and nearly 1.2 million barrels for distillates.

marketwatch.com 08 30 2022