Myra P. Saefong and Williams Watts, MarketWatch

SAN FRANCISCO/NEW YORK

EnergiesNet.com 09 14 2022

Oil futures settled at their lowest price in a week on Thursday, with the U.S. dollar continuing to strengthen and investors remaining jittery about the demand outlook, as the Federal Reserve prepares to deliver what’s expected to be another jumbo interest rate hike next week.

Price action

- West Texas Intermediate crude for October delivery CL.1, 0.76% CL00, 0.82% CLV22, 0.82% fell $3.38, or 3.8%, to settle at $85.10 a barrel on the New York Mercantile Exchange.

- November Brent crude BRN00, 0.96% BRNX22, 0.92%, the global benchmark, lost $3.26, or 3.5%, at $90.84 a barrel on ICE Futures Europe. Brent and WTI oil settled at the lowest since Sept. 8, according to Dow Jones Market Data.

- Back on Nymex, October gasoline RBV22, -0.25% fell 3.8% to $2.4287 a gallon.

- October heating oil HOV22, 1.29% dropped 5.1% to $3.2052 a gallon.

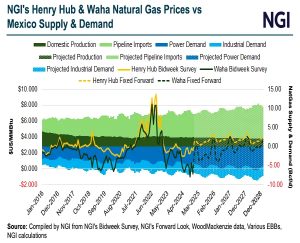

- October natural gas NGV22, -2.17% declined 8.7% to $8.324 per million British thermal units after tacking on 10% in the previous session.

Market drivers

Analysts said expectations for the Federal Reserve to raise the fed-funds rate by at least 75 basis points when policy makers meet next week continues to loom over the oil market, stoking fears of an economic downturn as central bankers attempt to rein in stubborn inflation.

“The dollar has recovered in a strong way, now holding near recent peaks, as the [Fed] continues its hawkish outlook on rate hikes in coming months to ease inflation,” analysts at StoneX’s energy team in Kansas City wrote in Thursday’s newsletter.

Expectations for an aggressive move by the Fed has lifted the greenback, with the ICE U.S. Dollar Index DXY, 0.20%, a measure of the currency against a basket of six major rivals, trading near a 20-year high seen last week. It edged up to 109.708 in Thursday dealings, and traded nearly 0.7% for the week.

“In the short-term, we maintain our cautious stance [for oil] as we see the global economy being weighed down by climbing interest rates, thus cutting into demand,” said Peter Cardillo, chief market economist at Spartan Capital Securities, in a note.

“On the other hand, we think prices are likely to remain within a $10 trading range between the $82 – $92 area over the next quarter,” he wrote.

Data from the Energy Information Administration released Wednesday showed that U.S. crude supplies rose by 2.4 million barrels, but that came on the back of a more than 8 million-barrel fall in the Strategic Petroleum Reserve.

“As government reserves look increasingly depleted, there are rumblings of a need to reverse policy and buy back supply to keep storage at a sustainable level,” said Robbie Fraser, manager, global research & analytics at Schneider Electric, in a daily note. “Current reserves now sit at their lowest point in nearly 40 years.”

Bloomberg reported earlier this week that the U.S. could begin refilling the Strategic Petroleum Reserve if crude falls to $80 a barrel. That news essentially provides support for oil at the $80 level, Tariq Zahir, managing member at Tyche Capital Advisors, told MarketWatch on Wednesday.

Meanwhile, natural-gas futures saw a sharp retreat from the 10% gain on Wednesday.

The EIA on Thursday said domestic natural-gas supplies rose by 77 billion cubic feet for the week ended Sept. 9. That was bigger than the average analyst forecast for an increase of 69 billion cubic feet, based on a survey conducted by S&P Global Commodity Insights.

Worries about further disruptions to energy transportation eased Thursday.

The White House said a tentative deal has been reached by the rail companies and unions to avert a strike that could exacerbate inflationary pressure.

Read: High fuel costs will continue to contribute to the rise in food prices

“Railroads had already begun preparing as the cooling off period was set to expire, cutting back on shipments of hazardous materials such as crude and fertilizers,” said analysts at StoneX. “The deal could still fall apart, as union members must still vote to approve the agreements at a later date.”

Backwardation and tight supplies

Currently, the oil market is in a state of backwardation — a situation where oil prices for delivery in the near future are higher than those for later deliveries.

Read: Oil’s crazy moves aren’t really crazy at all

“Inventories are low, resulting in cheap rental cost of storage, and traders are worried about physical shortages resulting in a high physical premium,” Adam Rozencwajg, managing partner of Goehring & Rozencwajg, told MarketWatch earlier this week. The backwardation is a “sign of tightness.”

And as the energy market tightens to levels not seen for many years, the “disruptive impact of ‘black-swan events’ will become much great, he warned. “Traders should probably take care and realize that ‘tail risk’ has increased dramatically because of low global inventory cushions.”

Oil demand is “much more robust than investors realize,” said Rozencwajg. “As we move into the fourth quarter, when markets are typically at their tightest, I wouldn’t be surprised to see a spike to $150” or higher

marketwatch.com 09 15 2022