By Jullian Lee

Oil markets are broken. Extreme volatility and a lack of liquidity mean that crude futures have become disconnected from tight physical oil markets. At least that’s what some loud voices in the oil world are telling us. But I suspect they may be talking their own books.

Complaining that markets are broken suggests to me that somebody has traded on the wrong side of the recent tumble in oil prices, positioning for a rise that hasn’t happened.

Assertions that futures and physical markets have become disconnected aren’t new. They’ve been around for decades. When oil prices were soaring in 2007-2008, oil ministers from members of the Organization of Petroleum Exporting Countries lined up to moan that futures markets had gotten too big. The volume of oil being traded, often by people who had no intention of ever handling a single barrel of the black stuff, was many times larger than global trade in physical crude. These “speculators” were driving the price of oil to record highs, while physical supplies, producers said, were ample.

Now we’re being told the opposite by Saudi Arabia’s Energy Minister Abdulaziz bin Salman and others. There aren’t enough people trading in oil futures, and the paper market, as it’s known, isn’t reflecting the true tightness of crude supplies. This time it’s not the fault of the speculators, but too few producers seeking to hedge the value of their future production by buying futures.

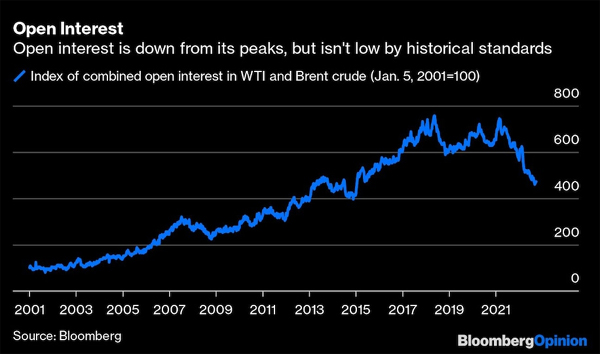

The activity in the crude futures markets is measured by the open interest, or the number of contracts open at any particular point. Although it’s true that the combined level of open interest in Brent and West Texas Intermediate crude markets has fallen sharply from its highs, reached in 2017-2018 and again last year, open interest is not low in historical terms. It’s back where it was in 2013-2014 and well above the levels seen in 2007-2008, when the paper markets were too big.

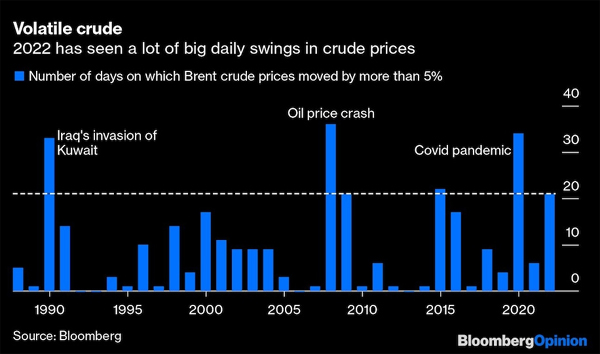

One thing is undoubtedly true, however: Crude markets are extremely volatile. The first nine months of 2022 have already put the year in the top six of the last 30 for daily moves in Brent crude in excess of 5%. The three most volatile years by this measure were the those of the financial crash of 2008, the year of the Covid-19 pandemic, and the year Iraq invaded Kuwait.

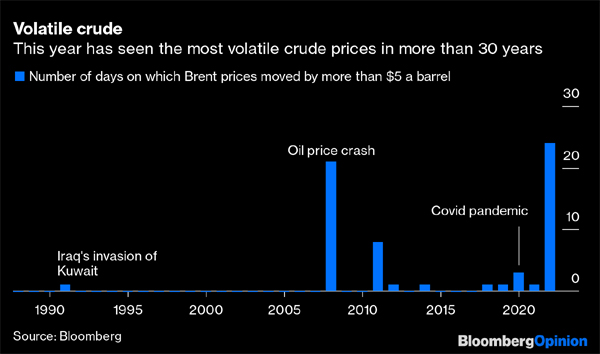

But a 5% price swing in an era when oil was about $20 a barrel, as in 1990, is very different from a 5% swing now that the price is near $100 a barrel. Looked at in absolute terms, take price moves in excess of $5 a barrel and 2022 already tops the list of the most volatile years for crude since at least 1988.

But volatility doesn’t necessarily mean a broken market. The most volatile years for oil have all been ones when major events have roiled markets, and this one’s no different. Russia’s invasion of Ukraine and the threat of sanctions on its oil exports, the post-pandemic recovery in travel in many parts of the world, lockdowns imposed as part of China’s zero-Covid policy, and now the looming fears of recession in North America and Europe have all disrupted markets in 2022.

Yes, global oil stockpiles are low after huge draws last year, when OPEC+ oil producers failed to raise output fast enough to match recovering demand. Yes, years of underinvestment in new oil production capacity, both inside and outside OPEC, have diminished spare capacity to a sliver. Yes, sanctions on some Russian oil exports could take millions of barrels a day of crude off the market in December, followed by millions more of refined products early next year.

But those legitimate concerns are outweighed, for now, by expectations of recession and demand destruction in some of the biggest oil-consuming countries. And if Europe and the US do fall into recession, if they haven’t already, the knock-on effect on lower imports of consumer goods from China is likely to dampen pickup in oil demand there when Covid restrictions are eventually lifted.

Paper oil markets are looking beyond the supply-side issues that are captivating OPEC+ oil ministers. I remain baffled that their response to a tight oil market is to threaten to make it tighter still by cutting output again.

Will oil prices surge again toward the end of the year, as the futures markets catch up with physical tightness? They might, especially if European Union sanctions hit Russian oil exports hard. But prices might just as easily continue on their downward path if recession leads to widespread demand destruction.

Hold onto your hats, 2022’s wild oil ride isn’t done yet.

______________________________________________________________________

Julian Lee is an oil strategist for Bloomberg First Word. Previously, he was a senior analyst at the Centre for Global Energy Studies. Energiesnet.com does not necessarily share these views.

Editor’s Note: This article was originally published by Bloomberg on September 26, 2022. All comments posted and published on EnergiesNet.com, do not reflect either for or against the opinion expressed in the comment as an endorsement of EnergiesNet.com or Petroleumworld.

Use Notice: This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of issues of environmental and humanitarian significance. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107. For more information go to: http://www.law.cornell.edu/uscode/17/107.shtml.

EnergiesNet.com 09 26 2022