Nicolle Yapur and Maria Elena Vizcaino, Bloomberg News

CARACAS

EnergiesNet.com 10 25 2022

It’s one of the most outlandish bets in global credit markets: Buying up defaulted bonds sold by a country under sanctions that leave US investors locked out of the market.

Yet, for traders willing to take on the risk, there’s simply too much money to be made to pass up debt that trades for as little as 2 cents on the dollar. Somewhat akin to buying a lottery ticket, a handful of Latin American and European funds are dipping their toes into Venezuelan securities, encouraged by signs of thawing tension between Washington and Caracas.

“You can’t think of Venezuelan bonds as a normal bond — they’re more like an option,” said Guillermo Guerrero, a senior strategist at the London-based brokerage EMFI, who recommended notes from the government and state-owned oil company PDVSA to clients this month. “You are paying an extremely low price to buy exposure to a possibility.”

The possibility is a let up in sanctions that would eventually pave the way for Venezuela’s government to restructure the notes, which carry a face value of some $60 billion. While previous rounds of speculation ultimately burned investors when deals failed to materialize, recent engagement between Washington and Caracas is fueling optimism. Analysts are loathe to say a payout is imminent, but they’re increasingly hopeful that the US will ease some penalties after midterm elections.

“For investors seeking exposure to Venezuela, current rock-bottom prices are a good entry point and we don’t advise betting on better timing,” Guerrero said in a note to clients.

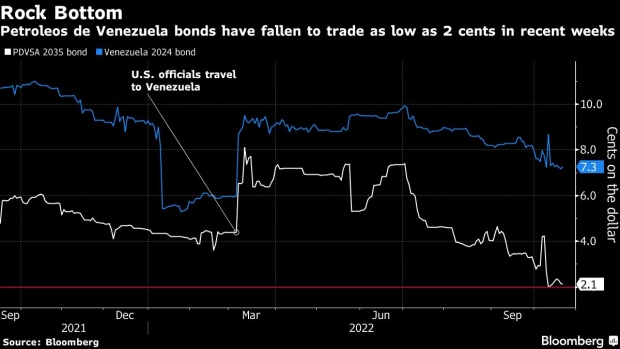

The hint of hope is a stark turnaround for a market that has shown scant signs of life in the past six months, with record-low prices at 2 cents on the dollar for Petroleos de Venezuela SA notes and near 7 cents for the government’s debt. Few other sovereign or quasi-sovereign securities trade at such distressed levels outside of some defaulted bonds from Lebanon and Russia’s state-owned VTB Bank and Vnesheconombank.

Francesco Marani, the head of trading at Madrid-based Auriga Global Investors, sees a buying opportunity. He points to a chain of events that began early this month when Venezuelan President Nicolas Maduro released seven imprisoned Americans in exchange for the freeing of two family members held in the US. That swap cleared a hurdle that was holding up any potential easing of sanctions. A first step could be allowing Chevron Corp. to increase oil production at his Venezuela joint ventures.

“We think the trading ban will stay, but other sanctions will be eased gradually,” Marani said.

Secretary of State Antony Blinken said the US is willing to consider a change to its sanctions policy — put in place by prior administrations — if Maduro takes constructive steps to restore democracy. That could start with his decision to restart negotiations with the opposition on rules for presidential elections in 2024. While those talks have been stalled for a year, expectations for a prompt resumption have risen.

To be sure, the newfound momentum could quickly fall apart, as it did six months ago after Biden officials made a rare visit to Caracas in March to meet with Maduro. That produced a spike in bond prices of as much as 56%, a rally that faded away over subsequent months.

Indeed, bond prices have barely budged this time around. Investors say that’s partially due to the fact that emerging-market debt broadly is taking a beating, and that US buyers are still locked out.

“We need a couple of sizeable buyers to absorb this current glut in supply before we see any significant turn around in prices, especially with the current poor backdrop in the global bond markets,” said Dean Tyler, the London-based head of global markets at BancTrust. “Where bonds trade currently, it could be a fabulous trade running to the next election and beyond.”

Tolling Agreement

Potential buyers have another dilemma to ponder. It has been almost five years since the bonds went into default, and rules embedded in the securities say holders forfeit their right to sue for repayment if they haven’t taken any action by the sixth anniversary.

So investors are faced with the question of whether to spend the money to file a lawsuit soon in a bid to get their money back, do nothing and assume that they’ll get taken care of whenever a restructuring finally takes place, or pursue a third option: Trying to reach a so-called tolling agreement with Venezuela that would suspend the statute of limitations while allowing bondholders to avoid filing a lawsuit.

A group of bondholders is pursuing that route. But as with everything involving Venezuela, it’s complicated because US sanctions forbid forging any agreement with Maduro. The holders could try to reach a deal with opposition leader Juan Guaido, who runs a rather impotent shadow government that’s recognized by the US, but his office hasn’t responded to investors’ proposals.

“It is surprising and disappointing,” said Richard Cooper, a senior restructuring partner at Cleary Gottlieb who works on Venezuela. He says that if no deal is reached, investors will be compelled to sue, leading to a deluge of legal fees for the Venezuelan people.

The Guaido administration made two public announcements in 2019 and 2020 promising to consider tolling proposals introduced by any creditor. But the debt commission he created was dissolved last year, leaving no one in charge for potential negotiations. The attorney general for Guaido’s shadow government didn’t respond to requests for comment.

For its part, the Maduro administration has signaled openness to the idea of a tolling agreement, but officials see no point in sitting down to negotiate because most bondholders can’t engage given the sanctions, according to people familiar with the government’s thinking.

As of now, holders with 8.7% of the defaulted debt have filed lawsuits seeking full repayment. If there’s no tolling agreement, analysts say the number will climb as the statutes of limitation on more bonds get closer to expiring.

That’s the expectation of Jay Newman, the former fund manager at Elliott Management Corp. in New York who led an epic, multi-year fight with Argentina over its defaulted bonds. As of now, the US sanctions along with a lack of interest from Guaido’s camp will make it difficult to reach a tolling agreement, he said.

“You have to have a competent authority enter into it,” he said. “Who is the legitimate authority? Is it Guaido? Is it Maduro?”

Investors could get closer to an answer to that question in coming months. Sanctions relief on Venezuela will likely progress after US midterm elections next month –when it becomes more politically palatable for the Democrats to do so — and prior to the end of the first quarter of 2023, according to Pilar Navarro, an analyst at London-based Medley Advisors.

“A negotiation between Maduro and the opposition that leads to resolving the problem of recognition of the Venezuelan government in international jurisdictions could unblock the way to a debt restructuring,” Navarro said.

bloombwerg.com 10 24 2022