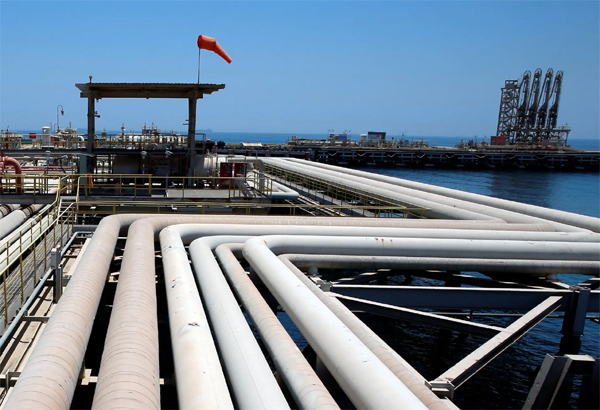

(Ahmed Jadallah/Reuters)\

By Ellen R. Wald

Washington is furious at Saudi Arabia: Members of Congress are demanding to freeze all cooperation, halt arms sales for a year and remove American troops and missile systems from the kingdom. President Biden warned of “consequences.”

American rage followed the Oct. 5 decision by OPEC Plus — 23 oil producers led by Saudi Arabia, which includes Russia — to cut oil production quotas by two million barrels per day starting in November.

If the United States follows through on its threats, the Biden administration would be a true maverick in Middle East policy, because no other administration — Republican or Democratic — has ever retaliated against Saudi Arabia in any serious manner for its oil policies.

Saudi Arabia, the leading producer in the energy cartel, pushed for the decision despite intense lobbying by the Biden administration against it. The cut helped drive up the price of American benchmark oil almost $10 per barrel, from $80, though it has since lost half those gains. Rising oil and gasoline prices are hurting American consumers across the retail landscape and at the gas pump.

The White House has framed OPEC Plus’s decision as an act of support for Russia, which relies significantly on oil and gas revenues, but Saudi Arabia had legitimate, self-interested economic reasons for pushing these cuts. The expectation of a global economic slowdown means reduced demand for oil. Forecasting agencies, including the U.S. Energy Information Administration, the International Energy Agency and OPEC have predicted a decline in global oil demand from October to December.

Saudi Arabia is looking at economic indicators that point toward a global recession within the next six to nine months, which could lead to an oil price crash. In 2008 the global financial crisis caused oil prices to plunge from $100 per barrel in September to $40 per barrel by December. OPEC was unable to forestall further declines, and prices bottomed out at $32 per barrel while the Saudis worked unsuccessfully to persuade Russia to join OPEC in a major production cut. Extreme price volatility of this sort hurts oil-producing countries, and halting production abruptly can damage oil fields. Saudi Arabia is hoping to prevent a similar situation by reducing production now.

Cutting production quotas makes sense for OPEC Plus. The energy cartel is already producing 3.6 million barrels per day less than its quota of 42.2 million barrels per day. In reality, most OPEC Plus producers won’t cut much production, if any. The relatively large production cut is more a statement to move the market than an impediment to OPEC Plus profits. Prince Abdulaziz bin Salman, the Saudi oil minister, predicted that the OPEC Plus countries will probably cut production by a total of only one million barrels per day.

Despite these justifiable economic reasons for cutting oil production, American policymakers are understandably dismayed by Saudi Arabia’s decision. It will hurt American consumers, and midterm elections are close. On March 31, responding to increasing energy prices after the Russian invasion of Ukraine, the Biden administration decided to release one million barrels of oil per day for six months from the Strategic Petroleum Reserve to help reduce gas prices. The OPEC Plus cuts will coincide with the conclusion of that initiative. The timing will amplify the impact, and Mr. Biden is considering releasing more oil reserves intermittently through the winter.

When Saudi policies negatively affect American consumers, the United States has reacted in various ways. In October 1973, in retaliation against the Nixon administration’s decision to resupply the Israeli military during the Arab-Israeli war, the Arab members of OPEC placed an embargo on oil to the United States and its allies, and OPEC allowed the price of oil to increase more than sevenfold. America witnessed memorably long gas lines and price hikes.

The Nixon administration considered retaliating by sending troops to seize oil fields in Saudi Arabia, Kuwait and the United Arab Emirates but did not do so. There were no consequences for the embargo, which was resolved diplomatically in 1974.

In March 1999, Saudi Arabia, which had accumulated a debt of $130 billion after years of low oil prices, assembled OPEC and non-OPEC producers and engineered a cut in oil production. Consequently, from January 1999 to mid-2000, the price of a barrel of oil nearly tripled. Some lawmakers suggested imposing sanctions on Saudi Arabia. President Bill Clinton chose diplomacy over retaliation, and that worked.

America’s longstanding policy not to disturb its relationship with Saudi Arabia, despite the kingdom’s abysmal human rights record, seems to have been motivated by a combination of factors: not upsetting the global oil market, combating Soviet influence in the Middle East during the Cold War and counterbalancing Iran after the Islamic Revolution of 1979.

A committee in the Senate has advanced the No Oil Producing and Exporting Cartels bill, or NOPEC, and lawmakers are likely to debate it after the midterm elections. If enacted, it will allow the attorney general to sue OPEC members for antitrust violations. It may satisfy the anger, but it would end up hurting American consumers.

Under NOPEC, the United States could seize assets of the members of the energy cartel in U.S. jurisdictions. Saudi Arabia’s most valuable asset in America is the Motiva refinery in Port Arthur, Texas, which is wholly owned by Saudi Aramco. Motiva is the largest refinery in the United States and produces gasoline, diesel and other petroleum products that are vital to American consumers. America’s oil-refining capacity is already precariously tight, and disrupting Motiva would devastate American consumers and the economy.

The Biden administration simply has no legislative or legal avenues to retaliate against Saudi Arabia that wouldn’t also hurt American consumers, because we are part of the global oil economy.

The most effective action to counteract the cut in Saudi oil production would be to ease the regulatory burden and offer unabashed support for the American oil and gas industry. This would lower global oil prices and cut into Saudi Arabia’s oil profits.

Even with the environmental provisions from the Inflation Reduction Act, the Biden administration could make a significant difference for American producers by speeding up regulatory processes and easing certain tariffs. But it is very unlikely to make such a drastic move in contravention of its energy and environmental policies.

For decades, the Saudi royal family has used the image of a close relationship with the United States to help legitimize and strengthen its rule. The Biden administration can affect Saudi oil policy by showing the royal family that it is in danger of losing that image. Mr. Biden could publicly halt, delay or interfere with the sale of American military equipment to Saudi Arabia, as various members of the House and the Senate have demanded.

But don’t count on Washington imposing costs on Saudi Arabia. American consumers won’t benefit, and the Washington establishment won’t realize any political gains from upsetting the status quo.

______________________________________________________

Ellen R. Wald (@EnergzdEconomy) is the author of “Saudi, Inc.: The Arabian Kingdom’s Pursuit of Profit and Power” and a co-founder of Washington Ivy Advisors.nergiesnet.com does not necessarily share these views.

Editor’s Note: This article was originally published by TThe New York Times (NYTimes), on October 24, 2022. All comments posted and published on Petroleumworld, do not reflect either for or against the opinion expressed in the comment as an endorsement of Petroleumworld.

Use Notice: This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of issues of environmental and humanitarian significance. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107. For more information go to: http://www.law.cornell.edu/uscode/17/107.shtml.

energiesnet.com 10 25 2022