Marianna Parraga and Mircely Guanipa, Reuters

HOUSTON/MARACAY, Venezuela

EnergiesNet.com 11 03 2022

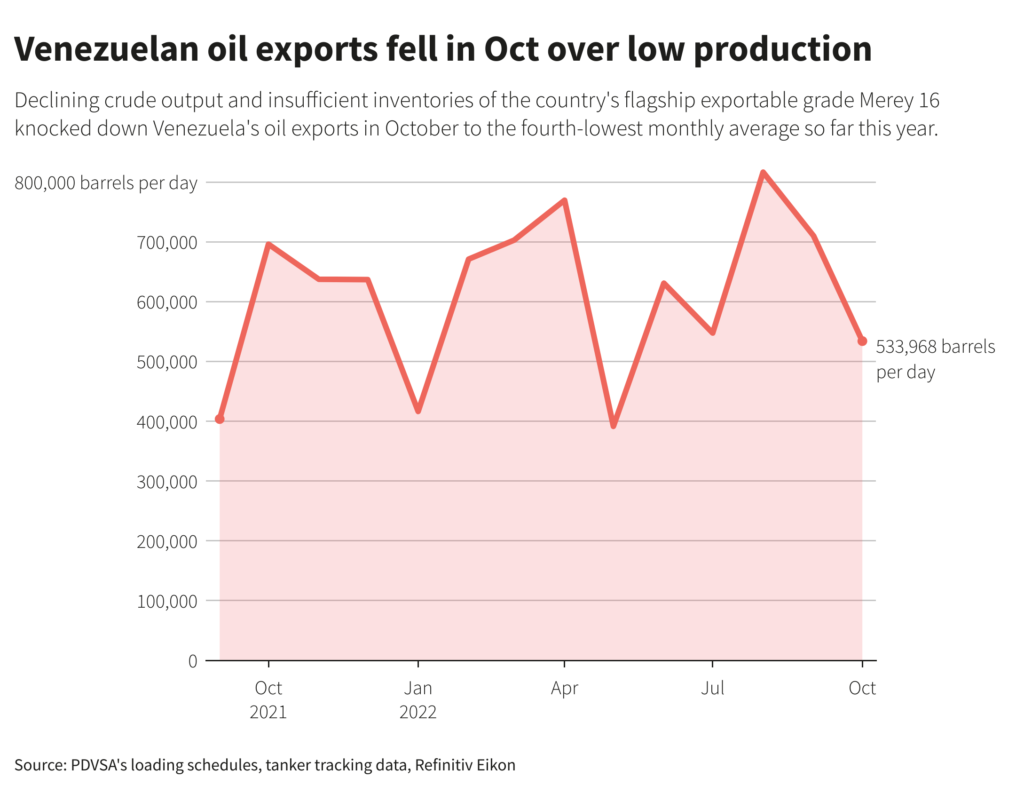

Falling production knocked Venezuela’s October oil exports to the fourth lowest monthly average this year, according to vessel monitoring data and documents from state-run oil firm PDVSA.

Oil production and exports by PDVSA and its joint ventures have fluctuated this year due to outages, a lack of sustained investment and a shrinking pool of partners willing to continue operating in the U.S-sanctioned South American nation.

Venezuela reported to the Organization of the Petroleum Exporting Countries a 57,000-bpd fall in its crude output in September to 666,000 bpd, the second lowest monthly figure this year. Last December, PDVSA celebrated hitting 1 million bpd of oil output, but the increase was short-lived.

More recently, stocks of PDVSA’s most popular exportable grades have shrunk. The firm reported low inventories of its flagship Merey 16 export grade, which fell to less than 1 million barrels at month’s end, and an overproduction of the less popular diluted crude oil (DCO).

Most oil cargoes shipped in October headed to Asian destinations, mainly Malaysia and China, through intermediaries.

Another 52,000 bpd of crude, fuel oil, diesel and jet fuel were sent to political ally Cuba, which is struggling to meet domestic fuel demand amid increased consumption and insufficient imports after a large fire damaged its main oil terminal in August.

Also in October, Venezuela discharged most imported crude and condensate that arrived from Iran in September as part of a key oil swap between state energy companies from both nations. A 1.9-million-barrel cargo of Venezuelan heavy crude was shipped last month as partial payment for the imports.

Reporting by Marianna Parraga in Houston and Mircely Guanipa in Maracay, Venezuela; editing by Richard Pullin

reuters.com 10 02 2022