The world’s dirtiest energy source has seen prices more than double in 2022

Mayra P. Saefong, MarketWatch

SAN FRANCISCO

EnergiesNet.com 12 12 2022

This year marked a resurgence for coal, often known — and loathed — by environmentalists as the dirtiest energy source, with prices more than doubling since the end of last year.

Traders are now torn between prospects for a continued rally and a pullback on the heels of global efforts toward net-zero emissions.

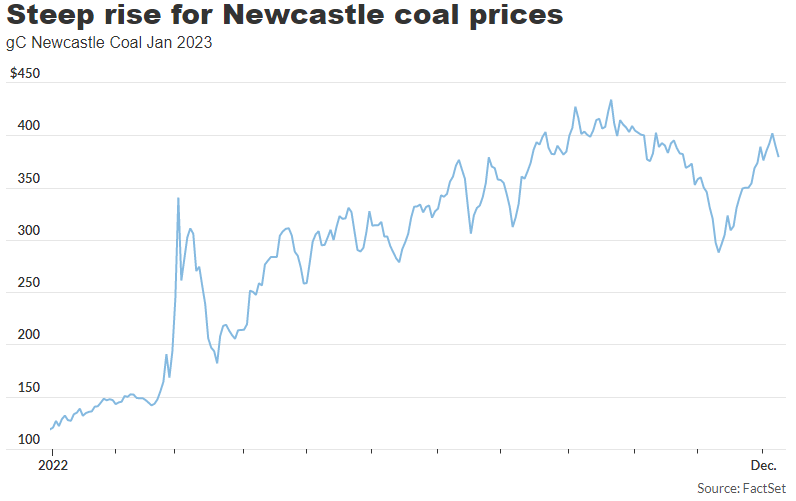

Based on the most-active contracts traded on ICE, futures for Newcastle coal NCFF23, -2.45%, the Asian-Pacific region benchmark for thermal coal that’s exported from the Newcastle coal terminal in Australia, was at $408.80 on Dec. 6, up 141% from Dec. 31, 2021, according to FactSet data. Coal’s gain this year leads the overall rise among major commodities.

“Tight supply due to wet weather in Australia hampering production; strong demand from India, China, and others; and the European energy crisis” all contributed to strength in coal prices, says Will Rhind, founder and CEO of GraniteShares, which runs the GraniteShares Bloomberg Commodity Broad Strategy No K-1COMB +0.38% exchange-traded fund COMB, +0.38%.

Following Russia’s invasion of Ukraine, European countries scrambled to replace Russian energy with alternatives, as Russian natural-gas supplies to Europe were mostly cut off. China has been “extracting record amounts of coal from its own mines as it seeks to insulate itself from the volatility seen in global energy markets,” says Rhind. “Outages from other European energy sources, such as hydro and nuclear plants…exacerbated the situation.”

Overall, “coal remains the largest source of electricity in the world,” he says. It’s the “cheapest to mine, easy to transport, and efficient to burn.”

Coal accounted for about 36.5% of the global power mix in 2021, followed by natural gas with a 22% share, according to Statista. In the U.S., coal accounted for 21.9% of the total 2021 amount of electricity generated at domestic power facilities, while 38.4% was sourced from natural gas, according to the Energy Information Administration.

Global supply of high quality thermal coal has been tight since before the invasion of Ukraine, says Wendy Schallom, coal analyst, analytics, at S&P Global Commodity Insights. The resulting ban on imports of Russian material by the European Union, Japan, and others, and the search for replacement coal, exacerbated the spot coal price rise, she adds.

There has also been a “diversion of coal supply,” originally destined for Asia, moving to Europe to replace the high-quality Russian supplies, says Schallom.

“Fuel switch price signals” had been firmly in favor of hard coal generation since the fourth quarter of 2021, she says, but the recent sharp fall in European gas hub prices means that those price signals reversed in October, with coal-to-gas switching settling in for the first time in more than a year.

If European gas prices recover as expected, fuel switch price signals will reverse again, with gas-to-coal switching likely to soon return, Schallom says. “This will put renewed pressure on German gas and support German hard coal generation.”

Meanwhile, it isn’t surprising that strong use of coal represents a setback in the world’s efforts to meet net-zero emissions by 2050. Developed nations need to entirely eliminate coal plants by 2030, and the rest of the world by 2040, to meet that goal, says GraniteShares’ Rhind. The two largest coal consumers, however —India and China — are investing even more in coal, expanding their power-plant network through the end of the next decade, he says.

Rhind expects global coal demand to remain high, but prices may “moderate” in 2023, especially if there’s a resolution to the Russia-Ukraine war. Supply will remain constrained, but ironically, higher coal prices will almost certainly contribute to increased demand for renewable energy “in order to find cheaper, more environmentally friendly, and independent sources of energy.”

marketwatch.com 12 08 2022