Kaieteur

GEORGETOWN

EnergiesNet.com 12 16 2022

Saipem, an Italian multinational oil services company, announced this week that it has been awarded new contracts in Guyana and Egypt totalling approximately US$1.2B.

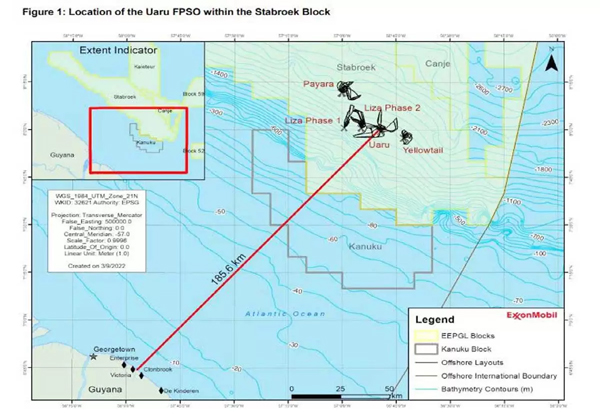

Saipem said the first contract was awarded by ExxonMobil Guyana for the Uaru field development project, located in the Stabroek block. The contract scope includes the design, fabrication and installation of subsea structures, risers, flowlines and umbilicals for a large subsea production facility. Saipem, who was previously awarded other four subsea contracts by ExxonMobil Guyana for prior developments in the same area, namely Liza Phase One and Two, Payara, and Yellowtail, will perform the operations for the nation’s fifth project by using its vessels, including FDS2 and Constellation.

Subject to the necessary government approvals, project sanction by ExxonMobil Guyana and its Stabroek block coventurers, and an authorisation to proceed with the final phase, the award will still allow Saipem to start some limited activities, namely detailed engineering and procurement.

Kaieteur News understands that Sapiem’s second contract was from Petrobel, one of the largest companies working in petroleum and energy sector in Egypt. The contract is for the transportation, installation and pre-commissioning of 170 km of umbilicals for the Zohr natural gas field.

This publication would have previously reported that several other contracts were awarded by Exxon for the Uaru Project even as it still awaits government approval. Late last month, French company Vallourec said it secured major contracts for Uaru. In November as well, Mitsui Ocean Development & Engineering Company (MODEC) which is based in Japan announced that it has signed a contract to perform Front End Engineering and Design (FEED) for a Floating Production, Storage and Offloading vessel (FPSO) for the “Uaru” development project.

American energy company, Hess Corporation, recently put Guyana on notice, that the fifth project targeting 1.3 billion barrels of oil in the Stabroek Block’s Uaru field, will cost way more than US$10B. The company had issued this forewarning about the most expensive development to come during its 2022 third quarter earnings call.

Hess Executives told shareholders that they were able to insulate development costs for Payara and Yellowtail to some extent, from inflationary pressures by locking in key contracts early. With respect to the Uaru Project, Hess officials said the circumstances will be different, adding that the cost for the Floating, Production, Storage and Offloading (FPSO) vessel, will surely reflect current market conditions, as well as scope changes.

In its project summary that was submitted to the Environmental Protection Agency, Exxon said the Uaru Project will be located in the eastern portion of the block, approximately 200 km from Georgetown and amid previous Stabroek Projects.

Current plans include drilling to produce oil from approximately 40-76 wells which costs millions of dollars. Production is expected to begin between the fourth quarter of 2026 and the second quarter of 2027, with an expected field life of at least 20 years. Exxon said the production facilities to be installed include subsea equipment attached to the seafloor as well as processing equipment on the ocean’s surface known as a Floating, Production, Storage, and Offloading vessel.

Exxon also told the EPA that it has undertaken additional studies to obtain an even more comprehensive understanding of potential impacts of effluent discharges to water, the feasibility of alternative handling of produced water, cradle to grave waste management in Guyana, emergency response capabilities, and environmental compliance monitoring and verification. The company said the learnings from current operations and environmental studies will enhance the design and implementation of the Uaru Project, thereby increasing environmental performance and economic value. It concluded that the Uaru Project will contribute positively, directly and indirectly, to economic growth in Guyana.

kaieteurnewsonline.com 12 16 2022