…now appears unable, unwilling to do same for taxes and royalty – Chris Ram

Kaieteur News

GEORGETOWN

energiesNet.com 02 22 2023

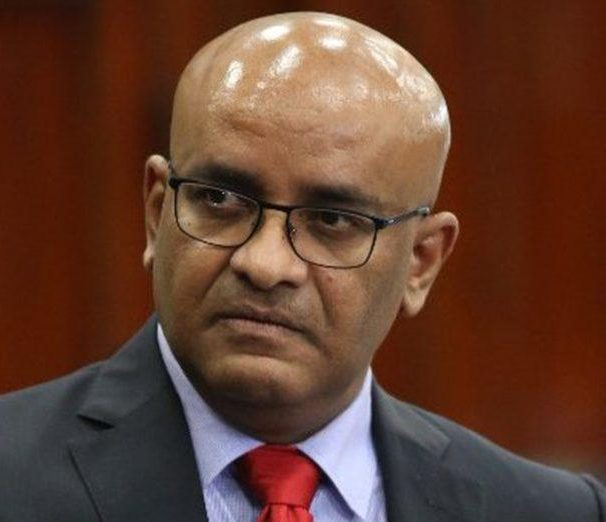

Based on utterances by officialdom in the persons of Vice President Bharrat Jagdeo and Chairman of the Taskforce leading the Gas-to-Shore Project on the Guyana end, Winston Brassington, Guyana did in fact manage to re-negotiate the 2016 Production Sharing Agreement (PSA) on the matter of the treatment of natural gas but appears unwilling or unable, to re-negotiate other terms of the agreement, moreso royalty and taxes.

The nexus was drawn by eminent Chartered Accountant and Attorney-at-Law, Christopher Ram, who yesterday in a public missive observed that this was made even more clear during the course of the recently concluded International Energy Expo and Conference held at the Marriott Hotel in Georgetown. “While the Government waits for the appropriate time to share information, it also tells us that Exxon will recover the money as cost oil under the 2016 Agreement,” Ram prefaced. Ram in his missive, pointing specifically to a presentation had by Brassington in which it was disclosed that Guyana will in fact be paying some US$55M yearly, posited “we are left to guess whether Exxon will be allowed to claim only US$55M per annum as recoverable cost and if that amount is factored into the cost ceiling of 75 percent.”

He elucidated further, suggesting that Brassington cannot be unaware that the 2016 PSA expressly provides for production sharing on a 50/50 basis of Profit Gas at Article 11 of the Agreement. Additionally, the PSA at the subsequent Article dictates “friendly negotiations” where Exxon believes that improved terms are necessary and further the contract dedicates a whole Article 13 to the valuation of Natural Gas.” As such, he surmised, “I must be cynical” and questioned “does the Government not wish Guyanese to know that it submitted itself to Exxon on [re]negotiation of the Gas terms of the Agreement but was unwilling or unable to have Exxon [re]negotiate on royalty and taxes?”

Ram noted too that while our Government does not consider it appropriate at this time to share with Guyanese any information on the Gas-to–Energy project, Brassington did disclose that that Guyana’s payment to the Exxon Mobil co-venture partners for the US$1B investment in the pipeline will be US$55M per annum, over a 20-year period, “…this comes up to US$1.1B”

Having disclosed the investment however, Ram observes that Brassington went on to offer “some overelaborate, technical explanation which confused more than explained.”

He pointed out for example, to reportage in the local media, representing Brassington’s account of how, “they came up with the US$55M” figure. Ram reminded that according to reports, the figure, according to Brassington, was arrived at by “convert[ing] to a unit price per gas, calculated at 50 MMCFD [one million cubic feet per day] x $2.40 for MMBTU [one million British thermal units] x 365 [number of days in a year] x 1.26 [conversion factor of MMBTU to MMCFD].” In the 2016 PSA signed with the Guyana Government and Esso Exploration and Production Guyana Limited (EEPGL)—ExxonMobil Guyana—and their co-ventures, Hess Guyana Exploration and CNOOC Guyana, it treats specifically with cost recovery and production sharing, not just for crude oil but associated and non-associated gases.

According to the provisions under this Article of the 2016 contract, the contractor shall bear and pay all contract cost incurred in carrying out “Petroleum Operations and shall recover Contract Cost as Recoverable Contract Costs, only from Cost Oil and/or Cost Gas.”

At Articles 12 and 13 there are in excess of 40 clauses and sub-clauses to treat specifically with the valuation of crude oil or natural gas.

Article 12 specifically treats directly with Associated and Non-Associated Gas.

To this end, it directs that associated gas produced from any oil field must, as a priority be purposed related to the operations of production and production enhancement of oil field, such as gas injection, gas lifting and power generation. While the company has been powering its Floating, Production, Storage and Offloading (FPSO) vessels, using natural gas, the Environmental Protection Agency has since allowed the payment of a marginal fine for the flaring of the excess gas. Additionally, the PSA or contract goes on to provide for feasibility studies to be conducted to determine the commercial viability of any excess gas discovered and where and how funding will be met. According to all and sundry involved in the Project, Exxon Guyana has agreed to supply some 50 MMCFD of Natural Gas by way of pipeline to the Wales Development Zone, West Bank Demerara from the Liza Destiny and Unity FPSOs.

To this end, it would be apposite to note that at sub-clause ‘B’ of Article 12, which provides for the treatment of natural gas, it states; “if the Contractor believes that excess Associated Gas of an Oil Field has further commercial value, the Contractor shall be entitled to, but not required, to make further investment to utilize such excess Associated Gas subject to, at least those that are attractive as those established for crude oil in Article 11, including but not limited to, cost recovery as recoverable cost for such further investment.” To this end, it would also be poignant to note that ExxonMobil Guyana has already signaled an imminent Final Investment Decision (FID), it addition the fact that Guyana has already inked agreements with the oil operators and others in pursuit of the overall project. Additionally, the PSA/Contract states further that if the contractor believes improved terms are necessary for the development of the excess gas, “then Parties shall carry out friendly negotiations in a timely manner to find a new solution to the utilization of said Associated Gas and reach an agreement in writing.”

At sub-clause ‘F’ of that Article in the contract, it cements further that expenses related to the studies and infrastructure for the use of the gas, shall be cost recoverable. Vice President Jagdeo, during a widely circulated interview earlier this month did disclose “we are developing this jointly with Exxon (Mobil Guyana), we are financing it out over cost oil, so we have our share of paying back because it’s coming from cost oil.” He elucidated further, that contrary to previously announced positions, the 50 MMCFD of gas, and the pipeline being sponsored initially by ExxonMobil Guyana was not free. According to the Vice President at the time, “we have to pay back, because it’s not free, they’re putting in some money, we have to put in some money.”

He sought to explain further saying, “we decided that over 20 years say the pipeline is 1 billion we don’t know the exact cost as yet or it could be lower but we put a notional figure one billion dollars, how much money do we have to pay to amortize a billion dollars over 20 years and our share of that, Exxon has to put up 52 percent of that cost we have to come up with 48 of it.”

To this end he said, “we come up with a figure 50 something million dollars that we have to pay yearly to amortize the pay for our share of the pipeline over 20 years to pay back.”

According to Jagdeo’s in responding to ExxonMobil Guyana’s request on payments said, “we took the figure to pay back for the pipeline and we divided that figure by 50 million cubic and so we say this is like the commercial agreement, it’s not like we’re paying for the gas we’re just as convenience taken the figure to amortize,” He posited this was the reason why ExxonMobil officials would claim no profits are to be had by that company for its share of capital injected. “There’s no profit but it’s reflected almost like a gas payment but we’re paying zero for the gas, we’re paying to amortize the pipeline that’s the exact figure; because it’s easier commercially for us to do that to reflect it commercially.” To this end, he re-iterated “we’re paying back over 20 years for 48 percent of the pipeline, simple as that,”

Addressing the payments to be made on the Guyana end, he went further to say, “so where would this money come from,” and posited “when we sell the liquids alone—and that is for the pipeline and to operate the pipeline. According to the Vice President, “when we sell the liquids, remember we take the gas, we take out, extract all the liquids, the cooking gas and everything else, at the current price we will get enough money to pay back for our share of the pipeline as reflected in in the in the price of gas.” He further suggested “you will (also) be able to pay for the power plant and the NGL (Natural Gas Liquefaction) facility from just selling the liquids, so what happens effectively we’re financing this whole project from the sale of our liquids, which we are getting for free, we’re financing the whole project, so you’re practically getting electricity, no not just gas, electricity for free.”

kaisteurnewsonline.con 02 21 2023