- Exporters that rely on spot market most vulnerable: Kpler

- Long-term contract sellers like Saudi Arabia faring better

Sharon Cho, Bloomberg News

SINGAPORE

Energiesnet.com 02 23 2023

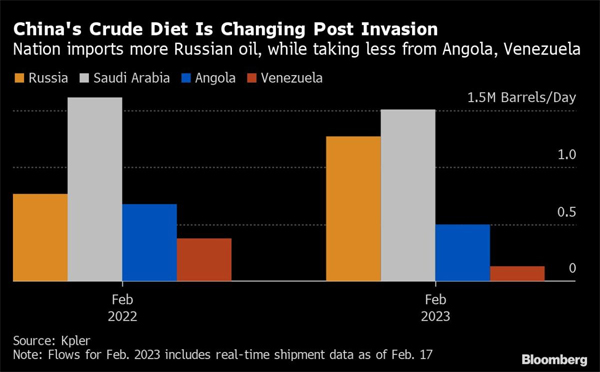

As China scoops up more and more discounted Russian oil, producers in Africa and South America are losing out.

Angola is among the hardest hit at the moment, with daily exports to China falling 27% so far this month compared with whole of February last year, according to data and analytics firm Kpler. Flows from Venezuela, Nigeria and the UK are also down.

The common denominator among the losers is that they sell more of their crude via one-off sales in the spot market, making it easy for buyers to switch to other grades to take advantage of fluctuating prices. Shipments from Saudi Arabia, by contrast, which relies mainly on long-term contracts, have held up, the Kpler figures show.

See also: Russian Oil Flows to China at Highest Since Ukraine Invasion

“It’s the spot purchases that feel the damage first,” said Viktor Katona, lead crude analyst at Kpler. Exports from West Africa are most likely to be displaced by more of the Russian Urals grade heading to China, but Brazil may start to be affected more, he said.

Chinese imports from Oman and the United Arab Emirates — producers that mainly sell via long-term contracts — were also up year-on-year, according to the data.

Still, cargoes from Angola and Brazil are likely to find new buyers in Europe as they shun Russian exports, Katona said. Varieties from those two producers will probably be in strong demand, partly due to their high diesel-yielding qualities, he said.

bloomberg.com 02 21 2023