Williams Watt, MarketWatch

NEW YORK

EnergiesNet.com 02 23 2023

Oil futures rose Friday, finding support as investors weighed the outlook for supply from Russia as production cuts kick in, while also gauging the outlook for Chinese demand.

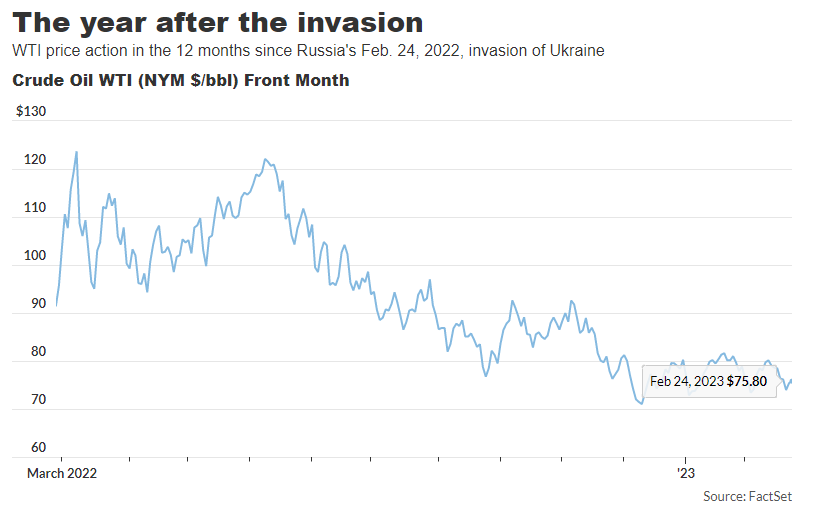

The U.S. benchmark was trading around 17% below the level seen just ahead of Russia’s invasion of Ukraine a year ago.

Read: Why U.S. fuel prices continue to feel the effects of Russia’s invasion of Ukraine

Price action

- West Texas Intermediate crude for April delivery CL00, +0.17% CL.1, +0.17% CLJ23, +0.17% rose 93 cents, or 1.2%, to finish at $76.32 a barrel on the New York Mercantile Exchange, after snapping a seven-day losing streak in the Thursday session. The U.S. benchmark saw a 0.3% weekly gain.

- April Brent crude BRNJ23, +0.08%, the global benchmark, rose 95 cents, or 1.2%, to close at $83.16 a barrel on ICE Futures Europe, for a 0.2% weekly gain. May Brent BRN00, +0.04% BRNK23, +0.04%, the most actively traded contract, rose 87 cents, or 1.1%, to finish at $82.82 a barrel.

- Back on Nymex, March gasoline RBH23, +0.19% fell 0.9% to $2.359 a gallon.

- March heating oil HOH23, +0.01% rose 3.3% to $2.796 a gallon.

- March natural gas NGH23 rose 5.9% to $2.451 per million British thermal units, leaving it with a 7.7% weekly gain.

Market drivers

Crude has fallen as Russian supply has continued to flow into the market, though it plans to cut production by 500,000 barrels a day in March as it reacts to a further round of price caps and sanctions in response to the invasion of Ukraine.

At the same time, U.S. crude inventories have continued to build, with domestic inventories rising by 7.6 million barrels last week, according to government data released Thursday.

Don’t miss: The real impact of Russia’s invasion of Ukraine on commodities

However, two Russian companies have announced that they plan to reduce their exports in March, presumably due at least in part to low prices, said Barbara Lambrecht, commodity analyst at Commerzbank, in a Friday note.

“If there are increasing signs that this is likely to happen, and if the [International Energy Agency’s] assessment of declining Russian production proves accurate, prices are likely to be pushed up,” she wrote.

Meanwhile, a slight upturn in purchasing managers’ index readings for the manufacturing sectors in the U.S. and China — the two largest markets — should lend additional support, Lambrecht said.

The number of U.S. oil rigs fell by seven this week to 600, according to oil-field-services firm Baker Hughes. Gas rigs were unchanged at 151 and miscellaneous rigs were steady at 2. Compared with a year ago, the oil-rig count was up 78, gas rigs were up 24 and miscellaneous rigs rose by 1.

marketwatch.com 02 23 2023