Julian Lee, Bloomberg News

LONDON

EnergiesNet.com 03 29 2023

Russia says it’s close to fully implementing the output cut threatened in response to Western sanctions and price caps on its oil exports. That’ll be welcome news for Vladimir Putin’s partners in the producers’ group known as OPEC+.

Russia vowed to retaliate against both the ban on oil imports from its closest customers and the price caps that prevent shipments to buyers elsewhere from accessing industry-standard services unless the cargoes are sold at prices below externally imposed thresholds. Moscow’s retribution is to cut crude production by 500,000 barrels a day until the end of June.

The loss of nearby markets in Europe has forced Russia to ship crude and refined products on long voyages from the Baltic Sea to India and China, and to offer big discounts to the buyers in its remaining two major markets.

The intention of the Russian government in cutting supply is to punish those nations arrayed against it by pushing up oil prices and, in the words of Alexander Novak, Russia’s deputy prime minister, reducing the discount for its barrels.

But time and the oil market have moved against Moscow.

Brent crude fell below $75 a barrel earlier this month, the first time it’s been that low since December 2021. Its recent recovery has yet to go back above $80, a level long seen as a floor for many OPEC+ producers.

And there’s no guarantee that Russia’s output decrease will have the impact the country’s leaders desire.

Any production cut will be offset initially by reduced demand from the nation’s refineries during a period of seasonal maintenance. That means flows out of the country — which is what really matters for oil markets — may be unaffected. Lost pipeline deliveries to Europe, which fell sharply at the start of the year, are also adding to volumes available for export by sea.

The drop also may turn out to be significantly smaller than the headline figure suggests.

The reduction will be made from a baseline level of about 10 million barrels a day, Novak said. But January and February output rates were both assessed below that by the International Energy Agency. The actual production cut could be as little as 300,000 barrels.

Even so, Russia’s OPEC+ partners may welcome a unilateral output decline from the group’s second-largest producer.

Oil market forecasts show a surplus in the first half of the year, and Russia’s reduction should ease pressure on the rest of the group to trim their own supplies.

–Julian Lee, Bloomberg Oil Strategist

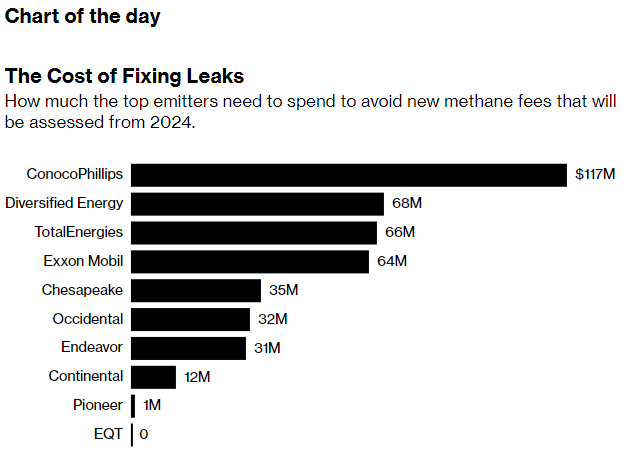

Note: Pioneer’s estimated cost is less than $1 million

The top 10 emitters of methane in the US oil and gas industry would have to spend a combined total of at least $426 million by 2024 on abatement technologies to become exempt from a tax on the greenhouse gas from their onshore operations. Excess methane emissions from the industry will be subject to a levy from 2024 under the Inflation Reduction Act, with the rate initially set at $900 per metric ton of methane and rising to $1,500 by 2026. Taken together, the companies account for 24% of onshore upstream methane emissions, and the cost of halting those discharges is, on average, equal to 10% of their total upstream capex spend in 2022. But the burden isn’t shared equally, with oil majors and large cap E&Ps having a clear advantage.

Today’s top stories

A major oil producer in Iraqi Kurdistan — Norway’s DNO ASA — started lowering production as a dispute between the region’s government and Baghdad drags on. A legal fight is halting roughly 400,000 barrels a day of Iraqi crude exports from Turkey and helping push up global prices.

The European Union and the US are nearing an agreement on critical minerals that would provide EU companies access to some of the massive green subsidies offered in the Inflation Reduction Act. Cobalt, lithium and nickel are essential for electric car batteries.

Iberdrola SA’s ScottishPower unit signed a £1.5 billion ($1.9 billion) deal with Siemens Gamesa to supply wind turbines for an offshore project in a boost for the UK’s stalling renewable-power sector.

The nickel revolution has Indonesia chasing battery riches tinged with risk. A wave of new supply from the Southeast Asian nation is challenging metal markets and threatening a pristine environment.

Europe negotiated its way through the winter of a crisis that threatened to choke energy supplies and overwhelm economies, but officials warn that the squeeze may not be over. This summer will be full of risks for gas.

Best of the rest

- Stimulating infrastructure investment would boost China’s oil demand this year by 1.4 million barrels a day, a 40% increase over what would be seen in a more managed recovery. That’s the view Wood Mackenzie analysts argue in their assessment of what the end of the Covid Zero strategy means for global energy and natural resources.

- The inclusion of West Texas Intermediate Midland crude in the forward Brent contract from June will raise more-complex issues than its introduction into the Dated Brent contract in June 2022, researchers at the Oxford Institute for Energy Studies say. The authors discuss their conclusions in a podcast.

- EU countries may end up paying Russia anywhere between €14 billion and €69 billion ($15 billion and $75 billion) for energy supplies in the second year of Moscow’s invasion of Ukraine, according to analysts from the Bruegel think tank. That’s down from €140 billion the first year.

- CNN looks at how Antarctica’s record low sea ice is affecting penguin populations. One species is adapting to the impacts of climate change – and that may offer lessons to us all.