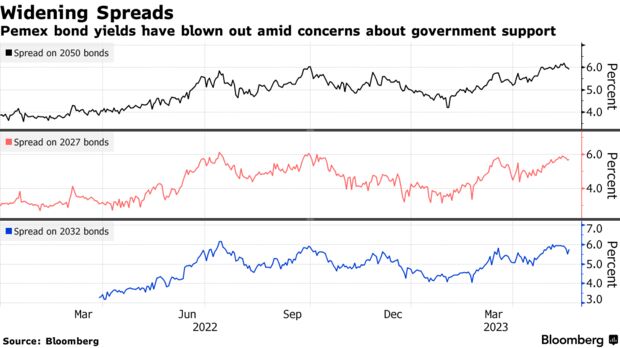

- Spread to similar sovereign bonds near highest since pandemic

- AMLO has scaled back support for the state-owned oil major

Michael O’Boyle, Bloomberg News

MEXICO CITY

EnergiesNet.com 05 22 2023

Heavily indebted Petroleos Mexicanos is testing the resolve of even its most ardent supporter, President Andres Manuel Lopez Obrador.

After channeling some $45 billion to Pemex since coming to office in late 2018 through last year, the president has curtailed aid as he keeps a tight rein on spending. That pushed the oil producer to make two new issues in the past year, cheapening its bonds and leaving the spread on many of the notes over comparable sovereign dollar bonds near the highest levels since the pandemic.

What’s more, concern over the government’s commitment is only set to grow. While his ruling party is expected to remain in power after the 2024 elections, AMLO — as the president is known — is not allowed to run again, casting doubt on the government’s continued support for the state-owned behemoth.

“The next president is going to be, at best, a little bit less enthusiastic about the relationship,” said Andrew Stanners, an emerging markets fund manager at abrdn in London.

Bonds of the Mexican oil producer are down an average 3.8% this quarter, underperforming a broad gauge of energy firms, which has declined 0.9% over the same period, according to data compiled by Bloomberg.

While Pemex is “one of the cheapest quasi sovereigns out there,” Stanners is skeptical the low levels will lure buyers. “Is this the new level it should be at because of these tensions? Perhaps.”

Stanners isn’t alone. Pacific Investment Management Co., one of the world’s biggest bond investors, told Bloomberg last week that it was now keeping its exposure to Pemex limited to shorter-term issues amid concern over eroding government support going forward.

Pemex hasn’t always enjoyed unlimited government backing. The prior administration siphoned funds out of the company, adding debt even as production declined as it moved to clear the way to the return of private oil companies into Mexico. The debt load now stands at $108 billion, the most among all the oil majors, but little changed since AMLO came to office

AMLO’s support for Pemex is running up against his refusal to increase the country’s debt burden, which has left the company to sort out how to pay for its extensive liabilities. But some support remains: The government has cut a profit sharing duty to 40% from 54%, effectively providing billions of dollars in support this year and the next.

Aaron Gifford, an emerging-market sovereign debt analyst at T. Rowe Price in Baltimore, said the government still has plenty of levers to pull, including letting the company’s tax payments slide. And if Mexico continues to grow, so will the government’s capacity to back Pemex, whoever wins the elections.

“There’s a bit of a mismatch with what you see in terms of pricing Pemex and the euphoria around Mexico,” Gifford said. “Everyone talks about Mexico being an EM darling, yet there’s this orphaned credit in the complex named Pemex. I don’t think you can decouple the two.”

— With assistance by Ezra Fieser and Amy Stillman

bloomberg.com 05 19 2023