- Secretary general criticizes ‘misguided narratives’ on oil

- OECD refinery closures could lead to fuel squeeze, Ghais says

- OPEC+ alliance with Russia critical to stabilizing markets

Herman Wang, Platts S&P Global

LONDON

EnergiesNet.com 05 18 2023

Global spare oil production capacity has shrunk and the refinery sector is not keeping pace with growing fuel demand, putting the world at risk of future supply crunches, according to OPEC Secretary General Haitham al-Ghais.

The industry is in need of significant investment, but finds itself in an increasingly challenging financial environment, exacerbated by “unhelpful criticism and misguided narratives” about fossil fuels, said Ghais, who has notably sparred with the International Energy Agency over its criticism of OPEC production cuts and messaging on the future energy mix.

The secretary general, a Kuwaiti OPEC veteran who will be a keynote speaker at the Middle East Petroleum & Gas Conference in Dubai on May 22-23, said in written response to questions that anti-fossil fuel advocacy has stoked market volatility and jeopardized global energy security, and he called for dialogue that “reflects the realities that are at stake for our energy future.”

He also addressed the demand outlook for the oil market, the growing influence of speculators, and OPEC’s continued alliance with Russia, as the group prepares to meet in Vienna on June 3-4 to review production quotas.

Below is a full transcript of Ghais’ responses to questions from S&P Global Commodity Insights.

S&P GLOBAL: Many forecasters are expecting global oil balances to be much tighter in the second half of the year. How does OPEC see market fundamentals shaping up over the next several months, and how will that influence the OPEC+ decision on June 4?

GHAIS: The OPEC secretariat monitors the oil market dynamics on a daily basis. It is our bread and butter, and helps to inform our ministers and the Declaration of Cooperation.

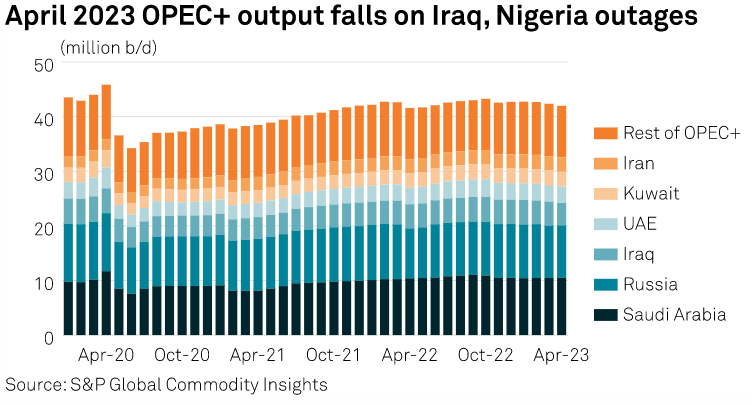

For example, back in October 2022 when OPEC and non-OPEC countries participating in the DoC took a proactive and pre-emptive decision to adjust overall production downward by 2 million b/d, it was based purely on technical market fundamentals. Given developments in the market since, many have commented that the decision was the right one.

In terms of the current outlook, on the oil demand side we see global demand growth in 2023 at around 2.3 million b/d. We also know that there are a number of economic uncertainties the world is carefully navigating through, including high inflation, higher interest rates, particularly in the eurozone and the US, the impending US debt ceiling, high debt levels in many countries and regions, and how China’s reopening plays out through the rest of the year.

As always, we will continue analyzing and closely monitoring all technical market fundamentals in great detail. Obviously, all of these technical factors will be carefully considered in the discussions and whatever decision is taken by ministers at the June meeting. However, we cannot pre-empt what will be discussed, and what any potential outcome will be.

S&P GLOBAL: Related to the first question — many members in April announced additional voluntary production cuts from May. Do you see a need for further production cuts, or do you envision market conditions allowing for those additional cuts to be scaled back in the weeks/months ahead?

GHAIS: Again, we should not get ahead of ourselves and we have to wait until ministers meet in early June. In addition, it is important to reiterate that the April 2023 announcements on voluntary production adjustments were made by individual countries; they were outside of the DoC framework. I should add too that given market developments in the period since, these voluntary adjustments have proven to be the right ones.

The DoC has repeatedly shown itself to be attentive, proactive and flexible over many years, undertaking extraordinary efforts to stabilize the oil market in these extraordinary times. This is in the interests of producers, consumers, the oil industry and the wider global economy, and I have no doubt this will continue.

S&P GLOBAL: You have been vocal in responding to the International Energy Agency for its messaging on energy markets and climate, which you say is undermining needed investment in oil. In your view, how can there be a more constructive dialogue around those issues?

GHAIS: We have an open door policy at OPEC. We are always ready to dialogue. We are always ready to cooperate. This is our mantra, and it is one I intend to fulfill.

However, we have to respond to external commentaries related to OPEC, particularly unhelpful criticism and misguided narratives.

We also need to recognize the importance of the dialogue with all energy stakeholders. We need to ensure what we say is fact driven, and reflects the realities that are at stake for our energy future.

From our perspective, and knowing that all data-driven outlooks envisage the need for more oil to fuel global economic growth and prosperity in the decades to come, it is troubling to hear calls to stop investing in oil. Our energy future is an “and” question, not an “or” question. The world desperately needs investments in all energies, and in all technologies to help reduce emissions.

Since I became OPEC secretary general, I have been clear in highlighting the very real consequences of underinvestment in the energy sector, especially oil. Underinvestment causes market volatility and endangers energy security. Underinvestment imperils economic growth and jeopardizes sustainable development.

It is vital that we get our energy future right: securing reliable and affordable energy for all while reducing emissions. This can only be achieved through international cooperation based on multilateralism and constructive dialogue.

S&P GLOBAL: When asked previously on production quotas, particularly in the summer of 2022 as oil prices surged, various OPEC+ officials responded that there was no shortage of crude available, that it was refinery closures and a lack of downstream investment creating tightness in the refined fuels markets. Is global refining capacity going to be a problem going forward for crude oil producers?

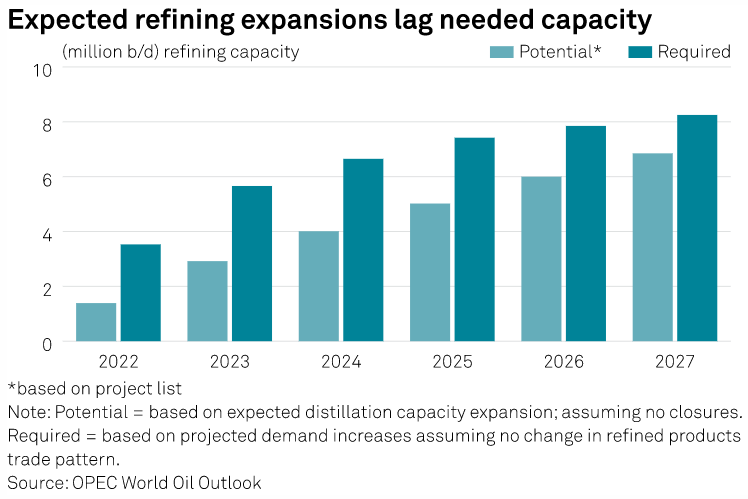

GHAIS: It is clear in recent years that there has been a lack of investment in refining, specifically in the OECD. For example, the latest grassroots refinery addition with significant capacity in the US was Marathon’s facility in Louisiana that came online in 1977. In fact, during 2020 and 2021, around 3 million b/d of refining capacity was also closed, mostly in OECD countries. This has resulted in diesel and gasoline stocks being well below the five-year average for quite some time now.

Our latest World Oil Outlook sees an investment requirement of $1.6 trillion in the downstream. It is vital that these are urgently made to avoid further downstream tightness as oil demand increases further in the years to come.

I would like to highlight here that OPEC member countries continue to invest heavily in the oil industry, especially in the downstream sector. Recent examples include ADNOC’s Crude Flexibility Project at the Al-Ruwais refinery in the UAE, the Dangote Refinery in Nigeria and the Clean Fuels project and Al-Zour refinery in my home country of Kuwait. [Kuwait Petroleum Corp.] is also constructing the Duqm refinery in Oman with OQ. Saudi Aramco has also made major investments into refinery operations in China and I recently visited the 340,000 b/d Dos Bocas refinery that is currently being built in DoC country Mexico. Despite all of this, oil demand will grow faster than the net refining capacity additions and that may lead to further petroleum product shortages.

Looking ahead, we should also recognize that the future of refining capacity will be geared more towards building refineries that are more complex. To add value, it is no longer just about extracting the margin through the complexity of refining crude, but by integrating petrochemicals. There is a growing trend to integrate the petrochemicals business with the refinery to realize maximum value.

S&P GLOBAL: Sanctions on Russia have upended global oil flows, and the geopolitics surrounding the oil market are as fraught as ever. How do you see OPEC’s relationship with Russia evolving, and how secure is the Declaration of Cooperation between OPEC and its partners?

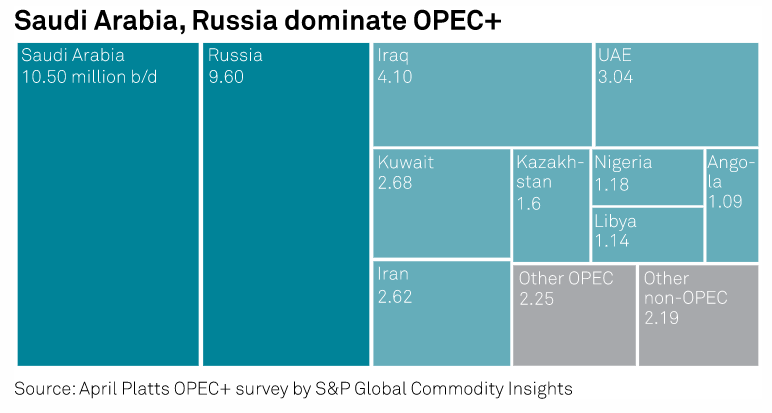

GHAIS: Russia has been part of the DoC since the end of 2016. Clearly, the DoC efforts have contributed significantly to the stability of the global oil market, especially during the market downturns in 2016 and 2020.

The past 15 months or so has evidently witnessed major shifts in global crude and product flows patterns. As you know, it is a global marketplace for oil, and this enables both producers and consumers to adapt to accommodate new shifts in trade patterns. DoC countries realize the stability they bring to oil markets, and not only to producers, but also to consumers, and accordingly for the global economy. Therefore, the DoC remains a cornerstone of market stability, and some often underappreciate its value.

It is worth noting that if the global oil market lost Russian oil and product volumes, we would observe heightened and unprecedented volatility. This is why every country participating in DoC is focused on ensuring this cooperative framework remains in place in the years ahead.

Indeed, the DoC has a proven record of accomplishment and we should ask ourselves the question: Where would the oil industry and the global economy have been heading without the unwavering support of the DoC?

S&P GLOBAL: OPEC has warned for a while about the need for sufficient upstream investment to meet future demand. Are your members finding it difficult to find the financing necessary to maintain and expand their crude oil production? How can this investment gap be solved? Are you seeing any uptick in investment globally in the industry?

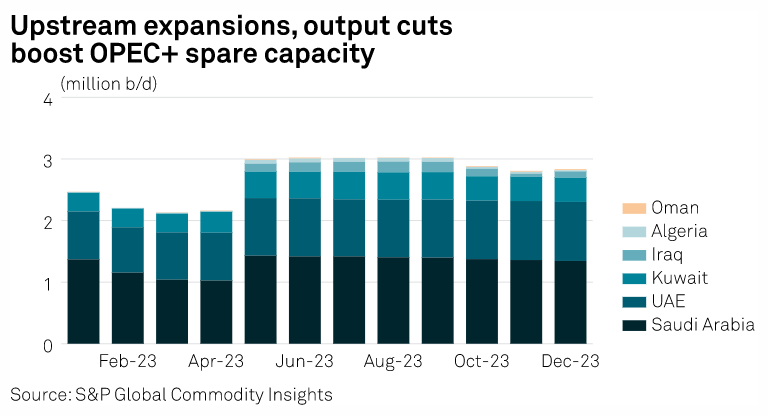

GHAIS: I have touched upon the issue of investment in a number of the earlier questions. The chronic underinvestment we have been witnessing is truly a global challenge, manifesting itself in production constraints, shrinking spare capacity and reduced refinery output. It is a challenge that we cannot keep procrastinating on and leave to tomorrow.

We continue to face efforts to create a policy rulebook that stigmatizes hydrocarbons and that seeks to divert much-needed investment away from the industry, including movements by financial institutions to limit and stringently control how money is invested into oil under environmental, social and governance. This situation has stoked uncertainty and volatility to the detriment of producers and consumers — and ultimately global energy security.

It is also disheartening, and particularly impactful on developing countries with oil and gas resources, many of whom rely on revenues from these commodities to build their economies and social infrastructure.

Upstream capital expenditure has picked up as the markets have rebalanced and more stability has returned, yet the results of recent underinvestment may become more apparent in the medium term. Steady and stable investment is also essential if the industry is to innovate and further lower its carbon footprint. With respect to OPEC, our member countries are leading by example with significant investments in clean hydrocarbon technologies, carbon capture, as well as in renewables.

S&P GLOBAL: Lastly, OPEC officials have from time to time complained about the influence of speculators on the market. We have seen OPEC+ go from monthly meetings to now holding more irregularly scheduled meetings. Has the group evolved in its thinking on how hands-on to be in stewarding the market, and how do you strike a balance between communicating too much or too little to the market?

GHAIS: On the financial side of the oil market, we have been observing an accelerated trend in speculative trading, with investors and other players trading futures and options at faster rates, sometimes severely impacting market liquidity and hindering price discovery mechanisms. There has also been a visible and more prominent role of Commodity Trading Advisors and algorithm trading.

To put the role of financial markets in some perspective, the volume of ICE Brent and NYMEX contracts traded in 2022 was 50 times the volume of the actual oil produced in the physical market. The role of financial markets has been evident this year, with significant price volatility, despite the fact that supply and demand fundamentals have shifted very little. The market was being driven by speculation.

OPEC and OPEC+ remain focused on market fundamentals, and complement this with regular and transparent dialogue with consumers and all stakeholders.

The Joint Ministerial Monitoring Committee meeting every two months remains in place, and as we have shown over the years, we are flexible and agile. The JMMC has held 48 meetings since 2017, so we have honed our capacity to judge when is it is necessary and appropriate to hold meetings.

spglobal.com 05 18 2023