- Pesce and Royon met with oil executives Wednesday morning

- Officials discussed how oil companies have to finance imports

Ignacio Olivera Doll and Jonathan Gilbert, Bloomberg News

BUENOS AIRES

EnergiesNet.com 05 25 2023

Argentina’s government will tighten access to the foreign exchange market for oil companies that need to import amid a severe shortage of dollars, according to people with direct knowledge.

Central Bank President Miguel Pesce, Energy Secretary Flavia Royon and other officials informed oil company executives Wednesday morning that they will be required to finance import payments for 90 days, one person said. The policy makers met with executives of Raizen, Axion, YPF and Trafigura at the monetary authority to discuss the changes.

Oil companies must now obtain financing from international banks or their parent companies to pay for their imports. At the same time, the central bank may allow companies to deposit pesos in accounts or assets that adjust with Argentina’s official exchange rate, one person said.

Read More: Argentina Is Going Broke to Stall a Full-On Currency Collapse

Central bank board members discussed the measure during their weekly meeting Wednesday, according to one person. Press offices for the central bank, government and all four companies didn’t respond to a request for comment after business hours Tuesday.

Last week, the central bank tightened import controls by requiring many industries to finance their own imports instead of tapping the central bank’s reserves via the official foreign exchange market. Until Wednesday, oil producers had thus far maintained access to the reserves as a means of importing.

Read More: Argentina April Inflation Surged to 109% Amid Peso Selloff (1)

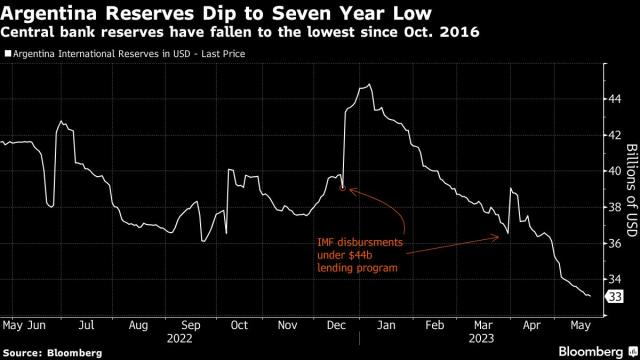

The South American nation has already spent all of its liquid international reserves, plus another estimated $1 billion, according to Buenos Aires-based consulting firm 1816 Economia & Estrategia. A renewed peso selloff in recent months has pushed Argentina to seek larger disbursements or new loans to shore up reserves from Brazil, China and the International Monetary Fund.

Without easy-to-spend cash on hand, questions are swirling about how much longer the government can continue to defend the peso from an all-out collapse. At risk is a currency devaluation that stands to fan 109% inflation and exacerbate high levels of social unrest ahead of October’s presidential elections.

bloomberg.com 05 24 2023