- We’re all paying for Baghdad’s arbitration win over Turkey, with the loss of some 47 million barrels of crude.

Julian Lee, Bloomberg News

LONDON

EnergiesNet.com 07 14 2023

In March, Baghdad won a nine-year arbitration case against Turkey over oil exports from Iraq’s Kurdish region. We’re all still paying the price of its victory.

Iraq was awarded a net $1.5 billion in compensation by an international business tribunal, which ruled that Turkey breached a 50-year-old pipeline transit agreement by allowing crude from Kurdistan to be exported without Baghdad’s consent.

Immediately after the ruling, Turkey halted the flow of crude from northern Iraq through a pipeline to the port of Ceyhan on its Mediterranean coast.

No Iraqi oil has been shipped from Ceyhan during the subsequent 109 days, and there’s little sign of flows resuming any time soon.

Iraq’s government in Baghdad quickly reached an agreement with the semi-autonomous Kurdistan region that would see exports restart under the control of federal oil marketing company SOMO.

But Ankara has other ideas.

With no realistic alternative to the Turkish pipeline for significant crude sales, operators in northern Iraq such as DNO ASA, Genel Energy Plc and Gulf Keystone Petroleum Ltd. have had to suspend production, hitting both cash flow and their share prices.

Years ago, the companies would have been able to divert their exports to Iraq’s southern terminal at Basra. But the country’s Strategic Pipeline was damaged during both Gulf wars and the US-led invasion in 2003. It hasn’t operated since.

Already struggling to replace banned Russian crudes, the Mediterranean market has lost about 47 million barrels of similar-quality supply, forcing buyers to look elsewhere.

For its part, Baghdad has lost its share of the revenue from those sales, which are valued at about $3.4 billion based on the most recent prices for Kirkuk crude. That’s more than twice the amount it’s owed by Turkey.

Ankara wants to negotiate a settlement with Iraq before the pipeline is reopened and appears willing to forgo transit revenues until it does.

Meanwhile, everybody is suffering the consequences of Baghdad’s arbitration win.

–Julian Lee, Bloomberg Oil Strategist

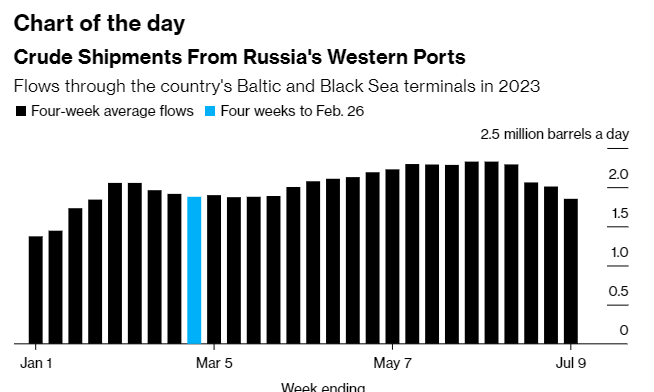

Note: Four-week average crude flows through the ports of Primorsk, Ust-Luga and Novorossiysk

Flows of Russian crude are starting to show signs of falling, more than four months after the country was due to slash production. Shipments through Russia’s western ports in the four weeks to July 9 dropped substantially below their average February level for the first time. Moscow initially said it would cut output by 500,000 barrels a day in March in retaliation for sanctions and price caps on its oil. Yet subsequent data showed no decline in exports. That changed after Saudi Arabia — a key ally in the OPEC+ group — suggested Moscow would benefit from being more transparent.

bloomberg.com 07 12 2023