- The Kremlin was bruised, while Iran and Venezuela have benefited.

By Javier Blass

Imposing and managing economic sanctions is a game of smoke and mirrors. Nothing is what it seems, and policy often bends markets in perverse ways to achieve political aims. Nowhere is that truer than in the global oil bazaar of 2023.

US and European policymakers are trying to achieve seemingly contradictory goals: reduce the oil income of Russia, Venezuela and Iran while preventing an oil price rally.

So far this year, the sanctions regime has achieved its objective of hurting the Kremlin, halving its oil revenue from a year ago, at the unacknowledged cost of bolstering Iran and Venezuela. But the path forward is likely to get choppier, with the outcome deeply unpredictable.

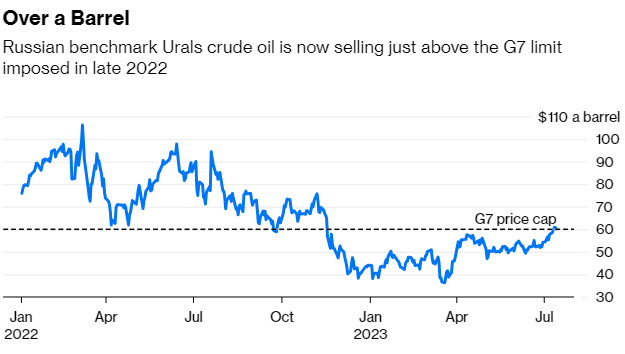

For months, Washington and its European allies claimed victory on the back of a novel piece of economic statecraft: the so-called oil price cap. Back in late 2022, the Group of Seven nations introduced a policy that allowed Russia to use Western shipping, maritime insurance, and finance only if it sold its crude under $60 a barrel. At the time, the West provided most of those services – in particular shipping insurance — so Russia would be forced to sell its crude at a discount, the policymakers argued.

The reality was — and remains — far more complicated. The sense of victory was shattered last week when the price of Russia’s benchmark Urals crude surged above the $60-a-barrel threshold.

The real drama has been invisible to those paying attention only to the price. Consider the following:

1) Since the middle of last year, containing energy prices has been a key policy aim in the US, Europe and Japan. It’s not only a domestic imperative but also an international one, linked to stopping emerging nations like India and South Africa from completely aligning themselves with Russia.

The design, and perhaps more importantly, the enforcement of the sanctions was guided by the need to keep oil prices down.

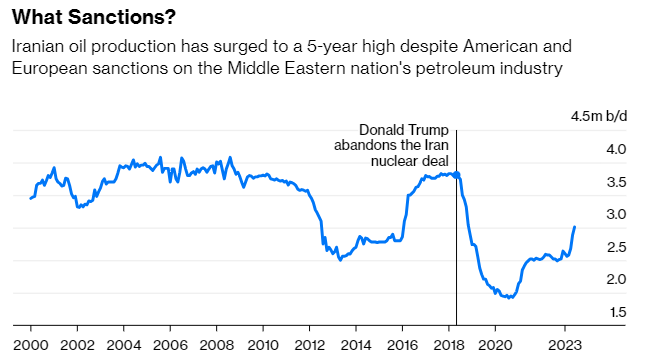

2) Hurting Russia has taken priority over afflicting Iran and Venezuela — two other oil-producing giants also under sanctions. It’s a strange variation of “the enemy of my enemy is my friend” — in this case, the West is acting as if “the friend of my enemy is my friend.” Odd! As a corollary, Washington concluded that achieving its objective of harming Russia over its 2022 invasion of Ukraine required it to accept helping Iran and Venezuela.

As a result, Iranian oil production has surged to a five-year high, making it the second largest source of additional supply in 2023, behind only the US shale industry. You read that right: Tehran will be the second-largest source of new oil this year — while formally under sanction. Officially, Washington says it’s implementing its Iran policy; in reality, it’s turning a blind eye to rising shipments from Iran, mostly to China.

Source: Bloomberg tanker tracking and International Energy Agency

3) The surge in Iranian oil flows has had two important consequences. First, it loosened global energy markets, pushing prices down, which in turn made the G-7 price cap on Russia possible. Second, it freed a significant number of tankers that until then were acting as floating storage facilities for Tehran. Those ships helped Russia move the oil that was priced above $60 a barrel. Third, Iran shipped some of its oil into Venezuela, where it acted as diluent for the Latin American nation’s heavy crude. That, in turn, helped Venezuela to increase its own production.

4) Sanctions enforcement has been non-existent. The price cap, for instance, relies on self-attestation. Ask anyone in the oil industry whether they believe on those declarations, and one gets some very sly smiles. Don’t ask, don’t tell, and carry on shipping, insuring, and financing Russian oil.

5) Everyone knows that the middlemen involved in Russian oil trade are making a fortune, capturing the price difference between the cost of a barrel at the Russian ports and at a port in India or China. The price difference has reached, at times, $20 a barrel, split between the traders and the shipping companies. Who’s profiting from that prize? Western policymakers largely claim ignorance. But every piece of the jigsaw points to Russia, whether that’s formally the Kremlin or oligarchs.

Heading into winter 2024, keeping oil prices down will become more difficult. Russia is today selling its crude between $60 a barrel and $75 a barrel, depending on the variety. The West won’t be able to rely on rising Iranian and Venezuelan output to soften the market. As Russia and Saudi Arabia cut their production, prices will rise further.

For the last year, Washington and its allies have attempted the energy policy version of squaring a circle. They would soon realize that no matter how hard they try, a circle’s a circle. And oil sanctions always hurt all sides — producers and consumers.

___________________________________________

Javier Blas is a Bloomberg Opinion columnist covering energy and commodities. He previously was commodities editor at the Financial Times and is the coauthor of “The World for Sale: Money, Power, and the Traders Who Barter the Earth’s Resources.” @JavierBlas. Energiesnet.com does not necessarily share these views.

Editor’s Note: This article was originally published by Bloomberg Opinion, on July 18, 2023. All comments posted and published on EnergiesNet.com, do not reflect either for or against the opinion expressed in the comment as an endorsement of EnergiesNet.com or Petroleumworld.

Use Notice: This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of issues of environmental and humanitarian significance. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107. For more information go to: http://www.law.cornell.edu/uscode/17/107.shtml.

EnergiesNet.com 07 19 2023