- Pemex workers offered kickbacks to speed payments, people say

- Mexican oil company owed contractors $15 billion at end-March

Amy Stillman, Bloomberg News

MEXICO CITY

Energiesnet.com 07 20 2023

In a muggy cafe near the boardwalk of Mexico’s Ciudad del Carmen, a ship company manager unlocks his phone to show a list of 26 firms owed money by the state-owned oil company. The screenshot was followed by a WhatsApp message: “I can help them get paid, in case you know of any who are interested.”

Petroleos Mexicanos is the world’s most indebted oil producer. It owed contractors almost $15 billion at the end of March — a sum that’s more than doubled in four years — and suppliers say Pemex is taking as long as six months to cover the bills, leaving some service providers struggling to stay afloat.

That delay has spawned a shadow industry of people who claim they can speed up payments. In some cases, they’re offering bribes to Pemex employees to make that happen.

These fixers are known as coyotes, in reference to the middlemen who smuggle migrants across the US border. Pemex’s chief executive officer confirmed the coyotes’ existence in a 2021 speech. But the solicitations from the purported go-betweens are getting more frequent, according to almost a dozen people interviewed by Bloomberg who have detailed knowledge of the coyotes, or first-hand experience of dealing with them. The people, who either work in senior positions in Mexico’s oil service sector, for Pemex or within the federal government, asked not to be identified discussing such a sensitive topic.

Bloomberg couldn’t confirm that Pemex workers have actually accepted kickbacks, or that suppliers have used coyotes’ services to accelerate payments.

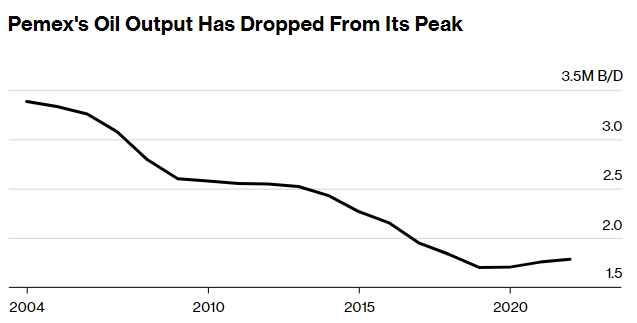

The apparent expansion of a black market tied to Pemex’s bills underscores how its ballooning debt, the highest in the industry at $107.4 billion, is rippling throughout Mexico’s economy. As the company’s oil production has fallen — even at prices above $70 a barrel, output is less than half what it was almost two decades ago — so too have its contributions to government coffers. Pemex bonds, downgraded deep into junk, pose a risk to Mexico’s sovereign debt ratings.

A Pemex spokesperson didn’t respond to requests for comment by email and phone. A representative of the office of Mexico’s federal prosecutor and a spokesperson for Mexican President Andres Manuel Lopez Obrador, known as AMLO, also didn’t reply to requests for comment.

Pemex CEO Octavio Romero pledged in 2021 to eradicate coyotes by publishing the company’s debts to suppliers online and improving transparency in the payment process. Earlier this month, he said the measures have paid off, according to national newspaper Milenio. He was quoted as saying that Pemex is developing strategies to expedite payments and that there has been “a significant change.”

While the culture of kickbacks that permeates Pemex is a “longstanding thing,” the coyotes’ emergence highlights Pemex’s worsening financial situation, said Wilbur Matthews, founder of Vaquero Global Investment LP, a Texas-based investment manager focused on emerging markets. “There’s a lot of corruption that can go unnoticed at $60 a barrel, so the idea that Pemex has problems in a high oil price environment is pretty crazy.”

Romero, who was brought in by Lopez Obrador to weed out corruption, has said he has appointed honest party loyalists to senior Pemex management posts. So far, however, the CEO’s crusade hasn’t been winning over investors, who want to see Pemex revive production.

The ship company manager said he received the screenshot with the list of 26 suppliers late last year from an acquaintance who’s now trying to make money as a coyote. Since the start of the pandemic, the contractor said, he’s receiving more of these solicitations than ever as service providers face longer delays in getting paid.

Coyotes tell suppliers they’ll expedite payment of their invoices in exchange for a fee, which is usually below 6% of the amount owed by Pemex, according to people familiar with the matter. Yet the cost can be higher, with one person saying a coyote quoted him 8% to 12% of Pemex’s bill, or roughly $32 million.

Some coyotes have links to the energy sector and work as consultants or lawyers, according to the people. They often claim to have longstanding relationships with Pemex and government officials, the people said.

One supplier said a coyote showed him an old photo in an effort to prove that he and a high-ranking Pemex official had attended the same school. That person told Bloomberg that he hasn’t taken the coyotes up on their offers since his company won’t allow it, but he hasn’t rejected their calls, either: He worries that business will suffer if he’s rude to them.

It’s not clear whether the coyotes actually have pull with Pemex employees and can expedite payments from the company to contractors.

“There are all these people that are kind of like hangers-on to Pemex or theoretically know how to work within the system,” Matthews said. “But the other side of it is that there’s constant turnover within the company. And so, if you know somebody today, you may not know somebody six months from now.”

Dwindling oil production and reserves lie at the heart of Pemex’s debt woes. Lopez Obrador has limited private-sector investment in Mexico’s oil industry, leaving much of the financial burden of developing the country’s oil fields to Pemex. He tasked the company with focusing on easier-to-reach and less costly shallow-water blocks and onshore fields, reducing activity in deepwater areas that are more complicated to tap but widely believed by the industry to contain more oil.

According to Fitch Ratings Inc. estimates, Pemex contributions accounted for 4.9% of federal revenue in 2020 and 8.4% in 2021, down from an average of 11.6% between 2015 and 2019. In July, Fitch downgraded Pemex bonds for the third time in recent years, lowering the rating to B+ from BB-.

Pemex’s debt to suppliers surged at the start of the pandemic as oil prices plunged. In June 2020, the cash-strapped driller asked offshore service providers to take IOUs for the second half of the year in exchange for not getting their contracts suspended or canceled, people with direct knowledge of the situation said at the time.

As of mid-April, Pemex was on the hook for $2.5 billion in debt maturing this year and it remains unclear how Pemex will foot the bill. While bondholders expect that the government will step in to support Pemex, as it’s done in the past, the Finance Ministry has said there will be no new capital injection. Pemex said in May that it’s in talks to extend a deferral of profit-sharing payments it’s required to make to the Mexican government.

Feeling the Heat

In the Gulf of Mexico off the coast of Ciudad del Carmen in May, oil workers contracted by Pemex fanned themselves fruitlessly as the heat baked their offshore platform. Inspection of the ship had been delayed, and the air conditioning was busted because the state oil giant hadn’t paid the contractors responsible for the work, according to two people familiar with the matter who asked not to be named because they feared reprisals from Pemex. The company didn’t respond to questions about whether it had delayed payment to the service companies.

An explosion on a Pemex natural gas platform this month that left two people dead and one missing has cast a spotlight on the company’s safety record, which includes a spate of refinery fires. Pemex hasn’t yet commented on the cause of the platform blast.

Some industry experts say Pemex may be neglecting essential maintenance due to its liquidity crunch. The company recorded more accidents per million man-hours worked in the first quarter compared with a year earlier, despite pledging to improve its environmental, social and governance metrics. Pemex didn’t respond to requests for comment about maintenance.

“The most important thing in this industry is having enough money to provide corrective preventive maintenance and, above all, not compromise operations,” said Ramses Pech, an independent energy adviser. Pemex isn’t investing enough in maintenance because of its heavy fiscal burden, he said.

People familiar with the matter say that while Pemex suppliers sometimes have to wait half a year to get paid, there are few other companies they can work with since Lopez Obrador’s policies have slowed the pace of private investment in the energy industry.

Pemex’s financial situation “is of concern to suppliers, even though they don’t seem to be withholding deliveries,” said Luis Maizel, a senior managing director at LM Capital Group in San Diego, which holds about $40 million in Pemex bonds. “We’re going to see a lot of them dropping out because they can’t afford to wait to collect.”

It’s not just small suppliers who are feeling the effects of the delays. Major international offshore contractor SLB said in a filing in April that it had $1.2 billion of receivables related to Mexico, while competitor Halliburton Co. said in a separate filing that its unnamed “primary customer” in Mexico accounted for 11% in unpaid bills as of March 31 — more than any other country or customer. Pemex is the largest oil producer in Mexico by far, suggesting it may be the party responsible for the debts, according to Scott Levine, an analyst with Bloomberg Intelligence.

Inefficiencies in the contract process contribute to the backlog, people familiar with the situation said. For example, Pemex typically requires suppliers to provide a lump sum cost of the project at the beginning of the work, according to three people. That means they must devise a new contract for every adjustment that occurs as the project progresses, which can set payment back by several months, they said.

Read more: Unnamed Client in Mexico Owes SLB, Halliburton Over $1 Billion

Some of the smaller offshore suppliers are quietly seeking to diversify into new industries such as selling ship scrap metal or providing equipment and services for renewable energy projects, according to people familiar with the matter. Some are branching out to the few private companies that produce oil in Mexico, such as Italy’s Eni SpA, Fieldwood Energy in the US or Mexico’s Hokchi Energy SA, the people said.

One manager at a supplier, who declined to comment because he feared reprisals from Pemex, told Bloomberg that his firm has sometimes struggled to pay its own contractors because of the Pemex billing delays. In February, his company’s requests for credit from two major banks were rejected because they wouldn’t accept a Pemex invoice as a guarantee, according to the person.

Business outside of Mexico, he said, was the only thing keeping his company alive.

— With David Wethe

bloomberg..com 07 20 2023