- Pemex had as much as $107.4 billion in debt by end of March

- Mexican driller has received $49 billion in government support

Amy Stillman, Bloomberg

MEXICO CITY

EnergiesNet.com 07 28 2023

Mexico’s state oil giant Petroleos Mexicanos received 70 billion pesos ($4.2 billion) from the Finance Ministry as the company seeks to pay off mounting debts.

The Finance Ministry gave the company the funds in a capital injection, according to two people familiar with the situation who asked not to be identified because the information isn’t public.

The funding comes after Pemex Chief Executive Officer Octavio Romero said on Wednesday that the government would refinance the company’s debt since it would be cheaper than if the state oil giant goes to the market itself. President Andres Manuel Lopez Obrador and Deputy Finance Minister Gabriel Yorio also reiterated the government’s support for Pemex on Thursday, without giving specifics.

The Pemex press office and the Finance Ministry didn’t immediately reply to a request for comment after regular office hours. Pemex will report second quarter earnings July 28.

Read More: Pemex Bonds Jump on Pledge Mexico to Support Driller’s Debt – Bloomberg

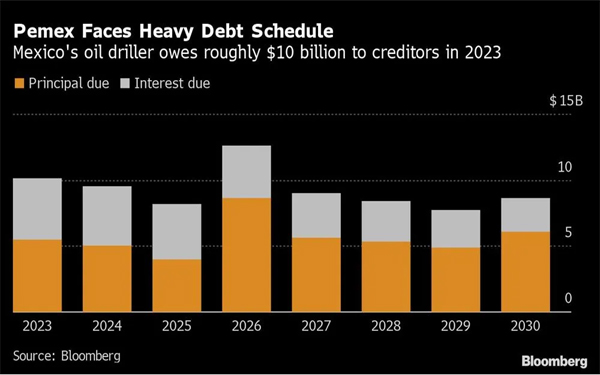

Pemex is the world’s most indebted oil company, with $107.4 billion in financial debt at the end of March. Fitch Ratings Inc. cut the company deeper into junk territory on July 14, while Moody’s Investors Service Inc. put Pemex on a negative outlook for a potential downgrade last week, citing increased credit risks.

It’s not the first time the government has given the oil company direct financial support. In 2021, it gave Pemex a $3.5 billion cash injection, and in 2019 it transferred $5 billion. In total, support under Lopez Obrador has amounted to nearly $49 billion in capitalizations, tax breaks and other assistance.

— With Michael O’Boyle

bloomberg.com 07 27 2023