- Weekly report on how to make cash flow positive

By Raul Torrealba Ramos

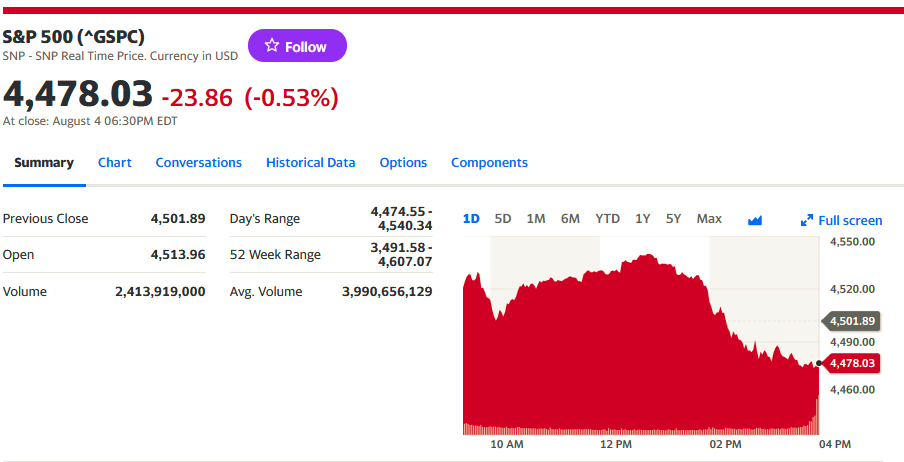

Market Report

Macroeconomic Environment:

Last Week:

They showed these indicators:

The market was not upbeat.

Next Week:

The data to be released by the Commerce Department will be very important, as it will signal which way interest rates will go, which will touch on the different positions of the FED governors.

1.- Consumer Credit

CPI on Thursday

PPI on Friday

On Monday, the Fed Governor for Atlanta, an influential state in Georgia, will discuss the economic situation and eventually answer questions on how he sees the immediate future of interest rates based on available data.

2.- Micro

Earnings period ended.

Apple -6.51%, Microsoft 1.77%, Tesla -2.31% and the SP 500 -1.92% disappointed.

Amazon stood out with +7.92% up for the week.

Source: Yahoo.com

3.- Building a long-term portfolio

It is a good time to build it especially with important and productive stocks that went down in price.

4.- Running an algorithm or method to generate cash flow on a long-term portfolio or with money in the account.

Our favorite strategy.

Let’s go to a sideways period, in terms of market movement.

5.- Analysis of the results of the previous week’s forecast.

There was no analysis the previous week.

6.- Forecast for next week:

We believe that next week will be conditional on CPI and PPI reports , however , AMZN should consolidate the rise on good earnings . APPLE, if Macro Data goes well, should rise, as should MSFT and TSLA , as should manufacturing sectors such as PG, F, BA , and financials such as GS, C, JPM, WF and BAC.

Apple Inc. quote

Source: Yahoo.com

NOTE: We do not recommend investments, we only give our opinions.

For special courses or investment management contact: EnergiesNet@gmail.com

Raul Torrealba Ramos, B.A. in Administration and Accounting, Universidad Católica Andrés Bello, Caracas; Lawyer, Universidad Metropolitana, Caracas, is an experienced financial analyst since 1990. The views expressed are not necessarily those of EnergiesNet.

Editor’s note: This article is published as an opinion and is not recommended for investment. All comments submitted and posted on EnergiesNet do not reflect either for or against the opinion expressed and is not an endorsement by EnergiesNet or Petroleumworld.

EnergiesNet.com 08 07 2023

Support EnergiesNet.com

By Elio Ohep – Launched in 1999 under Petroleumworld.com

Information and news on energy, oil, gas, renewable energy, climate,

technology, politics and social issues in Latin America.

Contact : editor@petroleuworld.com

CopyRight©1999-2021, EnergiesNet.com™ / Elio Ohep – All rights reserved

Editor’s Note: We reproduce the same for the benefit of readers. EnergiesNet en Español is not responsible for the value judgments made by its contributors and opinion and analysis columnists.

EnergiesNet encourages individuals to reproduce, reprint, and disseminate through audiovisual media and the Internet, the editorial and opinion commentaries of EnergiesNet, as long as such reproduction identifies the author and the original source, http://www.energiesnet.com and is done within the fair use doctrine of section 107 of the US Copyright Act.