- Platts biodiesel DAP Paulinia down 27% on year

- Diesel import arbitrage closed at 9%

- Price spread between Petrobras diesel and Platts spot biodiesel at 18%

![. World ethanol, biodiesel, and advanced biofuel production in million liters, 2011–2020. Source: authors’ composition based on [16].](https://energiesnet.com/wp-content/uploads/2023/09/world_diesel_grow-mdpi.jpg)

Nicolle Monteiro de Castro and Priscila Pinheiro , S&P Global

SAO PAULO/RIO

EnergiesNet.com 09 04 2023

A narrowing spread between imported diesel A and Brazilian biodiesel prices could be positive for the country’s biodiesel sector, eventually leading to higher blending rates, after a series of mandate setbacks in the past couple of years.

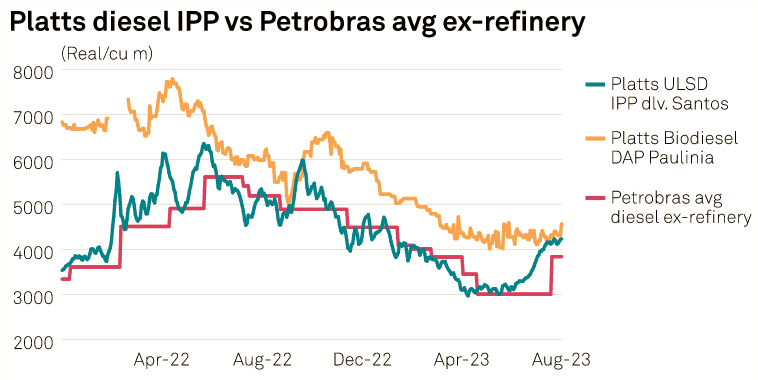

Platts assessed spot Biodiesel DAP Paulinia on Aug. 31 at Real 4,530/ cu m, up 10% on month, but down 27% on year, while the Platts assessment for ULSD S10 Santos Import Parity Price on the same day was at Real 4,179.29/cu m, up 11% on month and down 20% on year.

The price spread between Platts biodiesel spot DAP Paulinia and Platts ULSD Santos IPP was at Real 350/cu m on Aug. 31, a plunge of 64% on year.

It is relevant, however, to consider that Platts biodiesel is based on Paulinia deliveries, while the Platts ULSD IPP is assessed based on Santos deliveries. Therefore, a freight premium should be included between Santos to Paulinia, lowering further the spread between the biofuel and the diesel option if normalized all back to the main Brazilian fuel hub of Paulinia.

Brazil’s National Council for Energy Policy, or CNPE, in March approved raising the biodiesel blending rate to 12% from 10%, which was used during all of 2022, and published an agenda to increase the mandate in 1 percentage point annually until its reaches 15% (B15) in April 2026. The reduced biodiesel versus diesel price spread could be supportive for an anticipation of that agenda.

Petrobras diesel price policy

State-led Petrobras on May 16 announced changes to its fuel pricing policy, stating it would no longer follow Brazil’s Import Parity Price, or IPP, reference to price diesel and gasoline ex-refinery. Brazil needs to import roughly 25% of its total diesel demand; therefore any uncertainty about diesel price policy applied by Petrobras could increase the financial risk of diesel importers, potentially reducing imported cargo availabilities.

Considering the most recent Petrobras diesel ex-refinery average price implemented on Aug. 17 and the Platts ULSD S10 Santos IPP on Aug. 31, the diesel import arbitrage was closed at 9%.

The price spread between the biofuels and fossil fuel option is a common consideration taken by policy makers whenever discussing any change in the biofuels blending rate in Brazil; therefore, the lack of correlation between the IPP and Petrobras’ price could be considered a negative flag to promote the further usage of renewables in the road transportation sector.

Biodiesel trading model

Since January 2022, the Brazilian biodiesel trading model moved out of auctions to bimonthly contracts stipulated by the National Agency of Petroleum, Natural Gas and Biofuels for 80% of the volume traded in the same period of prior year, while any additional demand could be negotiated on the spot market.

Brazilian biodiesel term contracts have been mostly traded based on a formula considering soybean oil, a regional fee and the US dollar and Brazilian real exchange rate. The Platts calculated biodiesel price, based on the conversion of the Platts FOB Paranaguá soybean oil assessment to the biodiesel density equivalent and excluding any additional fee, was at Real 4,085/cu m Aug. 31, down 1.33% on the month and at a plunge of 36% on the year.

If the discount of Real 100/cu m considered by sources as the national average for the July-August period is applied, the biodiesel price based on the formula would have been been calculated at Real 3,985/cu m on Aug. 31, or at a discount of Real 545/cu m to the spot market.

In January 2022, the price spread between Petrobras diesel and Platts spot biodiesel was at 105% while on Aug. 31, 2023, the spread narrowed to 18%. The record low spread between those prices was on Sept. 29, 2022, when it was calculated by Platts at 3%, considering a decrease on biodiesel prices correlating to its main feedstock, the soybean oil, also having a fall in prices.

Considering that the mandate is for a minimum blend and that distributors could voluntarily increase their biodiesel content until 15%, narrowing spreads between diesel and biodiesel could encourage distributors to blend larger biodiesel volumes, to potentially be acquired through spot deals.