- Saudi Arabia and Russia have curtailed supplies in the face of record global demand

Jamie Smyth and Myles McCormick, FT

NEW YORK/HOUSTON

EnergiesNet.com 09 14 2023

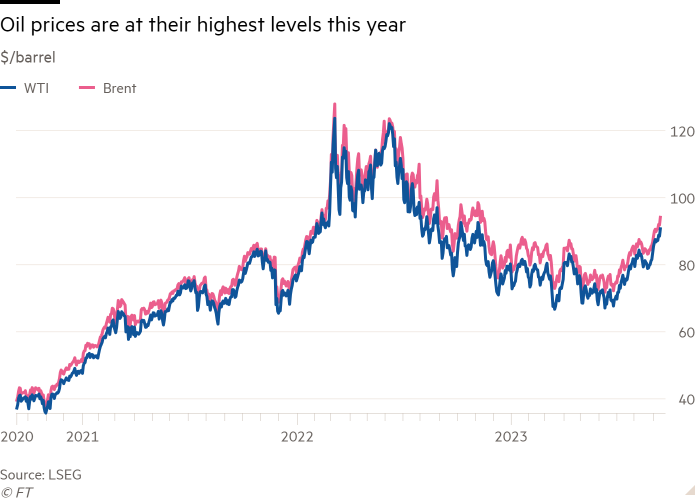

Oil prices have climbed back above $90 a barrel in recent days to their highest levels in 10 months. The rise has sparked fears of resurgent inflation that could damage a global economy that has proven surprisingly resilient.

Why are oil prices rising?

Better than expected economic conditions in big energy consuming economies such as the US have helped to drive new records for global oil demand in 2023, with the world expected to consume an unprecedented 101.8mn barrels a day this year.

A push by Saudi Arabia and Russia to restrict supply has also removed barrels from the market, depleting oil stocks. Riyadh and Moscow last week extended production and export cuts for the remainder of 2023.

“It’s a tale of oil demand numbers really holding up and very effective supply management by Saudi Arabia and Opec, which has caused a big swing in market sentiment since June,” said Raad Alkadiri, an analyst at Eurasia Group in Washington.

The International Energy Agency and Opec recently published updated forecasts that the cuts would produce a deficit in oil markets this year if they are maintained.

“The Saudi-Russian alliance is proving a formidable challenge for oil markets,” the IEA said this week.

How high can prices go?

International benchmark Brent crude settled at $93.70 a barrel on Thursday, up more than 25 per cent since June. West Texas Intermediate, the US marker, settled at $90.16. Both have hit their highest levels of 2023.

Many analysts forecast oil could breach $100 in the weeks ahead because of strong demand, tight supplies and a lack of tools available to the US administration to put a lid on prices.

“Global oil demand is at record highs,” said Al Salazar, an analyst at Enverus Intelligence Research. “We’ve never used this much and Opec is cutting production in the face of it. The third component is crude and product stocks are relatively low.”

“The simple maths means $100 Brent.”

When oil prices last surged in the aftermath of Russia’s full-scale invasion of Ukraine in 2022, US President Joe Biden intervened by releasing emergency stocks from the US strategic petroleum reserve.

In a speech in Maryland this week, the president vowed he would “get those gas prices down again”. But after draining almost 300mn barrels from the reserve, analysts say Washington has less ability to affect prices.

“The Biden administration has used a lot of its chips early and they don’t have a lot of options left now to try to tamp down prices,” said Amrita Sen, director of research and co-founder of Energy Aspects, a consultancy.

What does this mean for the economy?

Oil’s climb is stoking a rise in inflation again, threatening to blow off course a campaign by the Federal Reserve to bring prices under control just as it appeared to be bearing fruit.

Higher petrol prices were primarily responsible for a 3.7 per cent year-on-year uptick in US consumer prices in August, versus a 3.2 per cent rise in July, according to data released this week by the Bureau of Labor Statistics.

US prices at the pump — one of the most visible signs of inflation — have jumped more than a quarter since the beginning of the year to $3.86 a gallon yesterday, according to AAA, a motorist group.

The price of diesel, critical to freight, agriculture and other industries, has also been on the march, increasing nearly a fifth in the past three months to $4.53 a gallon.

What does this mean for oil producers?

Higher prices will push up profits at oil producers but are unlikely to encourage an increase in domestic production sufficient to level off the rise, say analysts.

Once known for frenzied spending on drilling, America’s shale oil industry has adopted a much more cautious approach to growth under pressure from Wall Street. It now favours returning cash to shareholders in the form of dividends and share buybacks over pumping ever greater volumes of oil.

“There is a lack of desire by shale to invest in the upstream,” said Benjamin Hoff, global head of commodities at Société Générale. Growth has decelerated, Hoff noted, with many of the privately held producers that were willing to fire up drilling rigs being snapped up by more cautious public operators.

Reiterating that message last month, Rick Muncrief, chief executive of Devon Energy, one of the biggest shale drillers, told investors: “We are deeply committed to a disciplined pursuit of per-share value creation over production volume growth.”

ft.com 09 14 2023