- Week 39 in 2023, Report on ideas on how to make positive cash flow.

Market Report

Update of material financial information

September 24, 2021

1 Macroeconomic Environment:

Last Week:

These indicators were shown:

Wednesday: Fed decision and press conference by its chairman Jerome Powell. U.S. Oil Inventory Status.

Thursday: Philadelphia manufacturing indicator and existing home sales index.

Friday: Preliminary Composite Purchasing Managers’ Index (PMI) provides an early estimate of current private sector output by combining information obtained from surveys of about 1,000 firms in the manufacturing and services sectors.

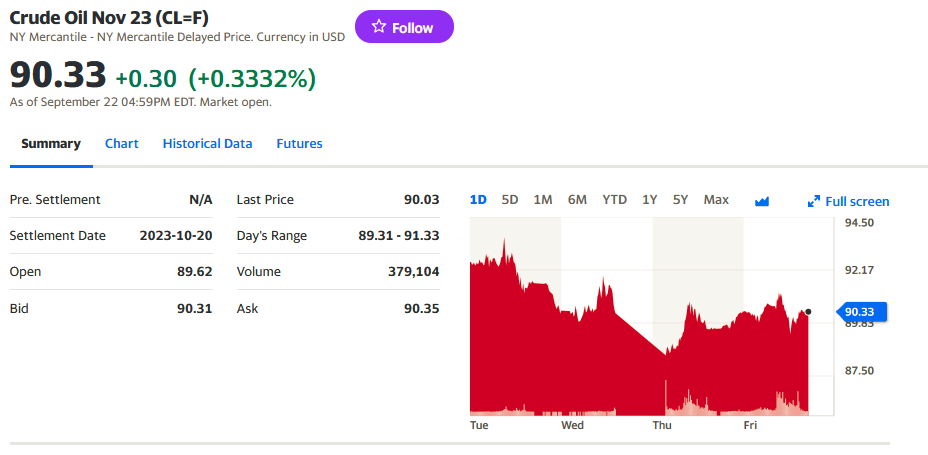

The WTI crude oil marker was down -2.26% for the week.

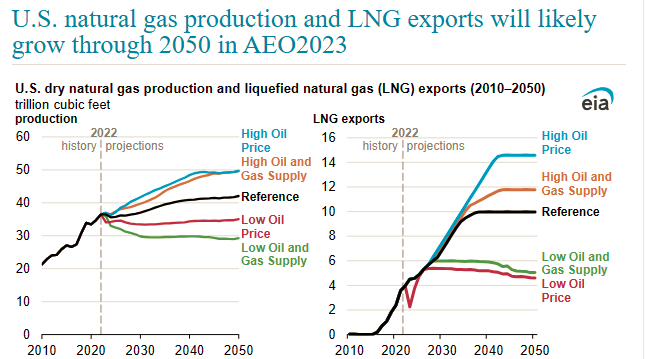

Meanwhile, the EIA reported the Natural Gas inventory change rose from 57 bcf to 64 bcf.

Here is the chart with projections:

Data source: U.S. Energy Information Administration, Annual Energy Outlook 2023 (AEO2023)

(U.S. Energy Information Administration – EIA – Independent Statistics and Analysis)

Next Week

The influence of the Fed meeting was felt in the first three days.

Next week, prices of major indices and assets are expected to touch new support levels, which could mark a technical rebound to enter buying zones from the end of September to mid-October, the start of the quarterly earnings reporting period.

2 Micro

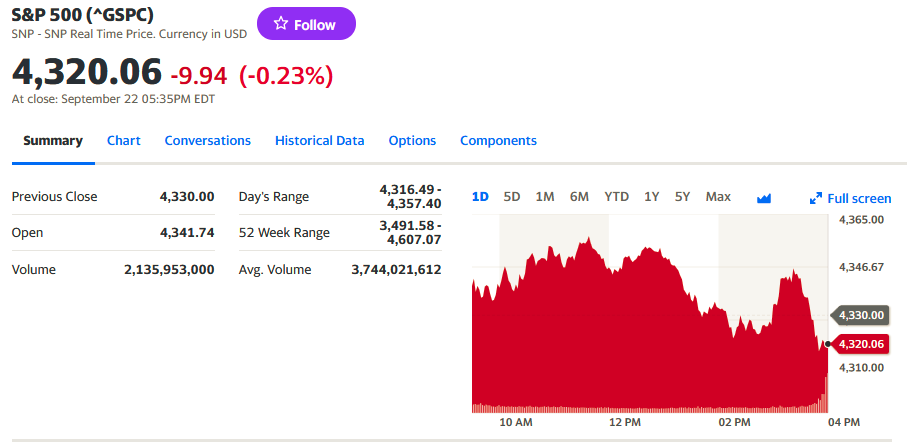

The stock market, SP500 gave up space by -2.83%.

New home sales, consumer confidence, durable goods and the Energy and Oil reports are due on Wednesday.

Thursday will be Gross Domestic Product.

Friday will be personal income and goods traded abroad.

There will also be public speeches by 3 Fed Governors on Thursday and Friday.

3 Build a long-term portfolio

The two energy-focused Funds continued with high energy volatility. as it should be, performance was crossover:

The ProShares UltraShort Bloomberg Bloomberg Crude Oil, SCO, which works with short crude oil futures contracts, gained 3.31% in one week

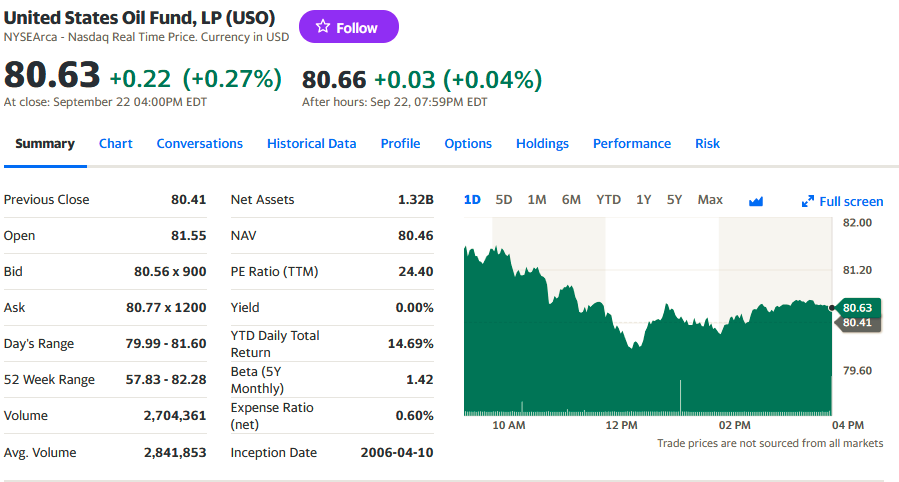

Meanwhile, the United States Oil Fund USO, which, in addition to crude oil futures, holds futures on natural gas, diesel and gasoline, rose +1.07% for the week.

4 Execution of an algorithm or method to generate cash flow on a long-term portfolio or with money in the account.

Our favorite strategy.

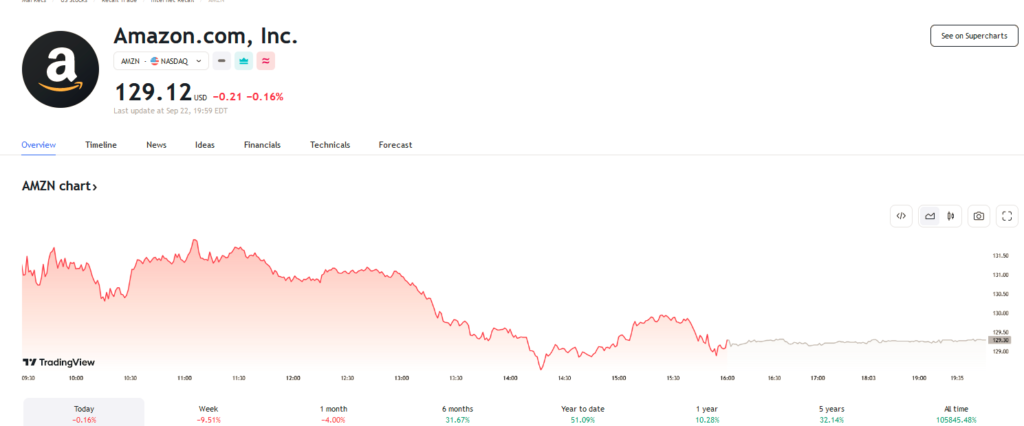

The Magnificent 7, AAPL, TSLA, MSFT, GOOGL, NVDA, AMZN and META, had downside moves on the results of the Fed Chairman’s comments that he expects higher rates for longer than estimated, although they did not touch them this week. CME’s FedWatch tool shows that the market is pricing in a 74% chance that rates will not change at the November meeting and a 55% chance that nothing will change by mid-December. All were down , the least affected META -0.3%, the most affected TSLA -8.02% and AMAZN with 8.26% reaching visible entry points.

5 Analysis of previous week’s forecast results

There was no forecast due to the wait on the results of the FED meeting.

Fear prevails these days…

6 Forecast for next week:

Support points will be touched which will determine further declines or entry of investors in view of opportunities due to the decline of certain prices in some assets, especially TSLA and AMZN. Quarterly earnings periods are approaching. We will see.

Weekly performance of the US $ 1,000 challenge to compare between:

Energy investments: USO +1.07%.

Technology investments: META, NVDA META -0.3% NVDA -2.34%.

Investments in financials: BOFA, GS BAC -3.32% GS -3.83%

Investments in Global ETFs: SPY, QQQ SPY -2.71% QQQ -3.51% QQQ -3.51%

Gold Investments: GLD GLD -4.73% GLD -4.73% GLD -4.73% GLD -4.73% GLD -4.73

BITCOIN stable in the week. BIT -2.24%.

As we can see , the sectors we follow in this report were down, watch out for next week.

For questions about our Algo daily entries, please write to: editor@petroleumworld.com

NOTE: We do not recommend investments, we only give our opinions.

For special courses or investment management contact: editor@petroleumworld.com

___________________________________________________________________________

Raul Torrealba Ramos, B.A. in Administration and Accounting, Universidad Católica Andrés Bello, Caracas; Lawyer, Universidad Metropolitana, Caracas, is an experienced financial analyst since 1990. The views expressed are not necessarily those of EnergiesNet.

Editor’s note: This article is published as an opinion and is not recommended for investment.

All comments submitted and published on EnergiesNet do not reflect either for or against the opinion expressed and is not an endorsement by EnergiesNet or Petroleumworld.

EnergiesNet.com 25 09 2023