- Saudi Arabia and Russia have no intention of reversing production curbs any time soon, and the repercussions are being felt around the world.

By Julian Lee

Never mind next year, high oil prices are already destroying demand.

Yesterday’s $5-a-barrel slump in the market was given impetus by weekly US data that showed gasoline consumption at its lowest seasonal level in 25 years.

The fuel typically gets a boost over the summer months as Americans take vacations, and this year was no exception. But demand remains well below its pre-pandemic level. The recovery is still fragile.

US gasoline use averaged 600,000 barrels a day — or 6% — below 2019 levels during the driving season, which runs from late May’s Memorial Day to Labor Day at the start of September.

And we can’t pin the blame for lower consumption on more people heading overseas for their holidays. US jet fuel demand also lags behind pre-Covid levels, down 9% from 2019’s summer average.

True, the oil-price plunge wasn’t just a reflection of lower fuel use.

A broad malaise in global financial markets has stoked concern that the Federal Reserve may not be done raising interest rates, while a stronger dollar has hurt buyers paying for their oil imports in the currency.

Real demand destruction — the result of high and rising prices in the midst of tighter economic conditions — has already begun, and consumers from South America to Africa are under pressure.

In Nigeria, the government scrapped unaffordable fuel subsidies that cost $10 billion last year. Gasoline sales subsequently fell 27% year-on-year.

As my Bloomberg Opinion colleague Javier Blas has noted, the countries where consumption is being pummeled aren’t, yet, the global centers of demand growth. But the peripheries matter.

Growth in countries such as China, Brazil and India needs to be even stronger to offset declines elsewhere, if producers are to see an expanding market for their output. There’s no sign that’s happening.

India has already told producers that oil is too costly. “High prices lead to demand destruction,” Pankaj Jain, secretary at the Ministry of Petroleum and Natural Gas, said earlier this week.

OPEC+ members, led by Saudi Arabia and Russia, have slashed supply to balance the market. They have no intention of reversing those cuts before the end of the year.

The repercussions of those decisions are being felt. The steady upward march in prices — benchmark Brent crude rose by more than a third in the three months to Sept. 27 — hit the buffers last week.

–Julian Lee, Bloomberg Oil Strategist

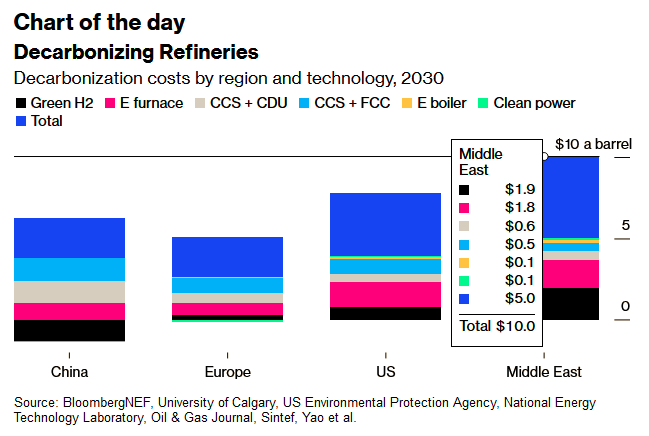

Oil refineries accounted for as much as 4% of global greenhouse-gas output in 2021 — more than shipping and aviation combined. But more than 20% of those emissions could be cut

by 2030 at no net cost, according to BloombergNEF. Switching to clean hydrogen and installing carbon capture and storage would curtail pollution, with costs contained by policy support in regions such as Europe and North America.

— With assistance by Philip Geurts and Sisi Tang

________________________________________________________

Julian Lee is an oil strategist for Bloomberg First Word. Previously, he was a senior analyst at the Centre for Global Energy Studies. Energiesnet.com does not necessarily share these views.

Editor’s Note: This article was originally published by Bloomberg on October, 05, 2023. All comments posted and published on EnergiesNet.com, do not reflect either for or against the opinion expressed in the comment as an endorsement of EnergiesNet.com or Petroleumworld.

Use Notice: This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of issues of environmental and humanitarian significance. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107. For more information go to: http://www.law.cornell.edu/uscode/17/107.shtml.

EnergiesNet.com 10 05 2022