Zignox

NEW YORK

Energiesnet.com 10 12 2023

Latin America’s traditional energy sector is regaining attention from international investors as oil, gas, and coal industries led the number of foreign direct investment projects announced in the region last year, official data shows.

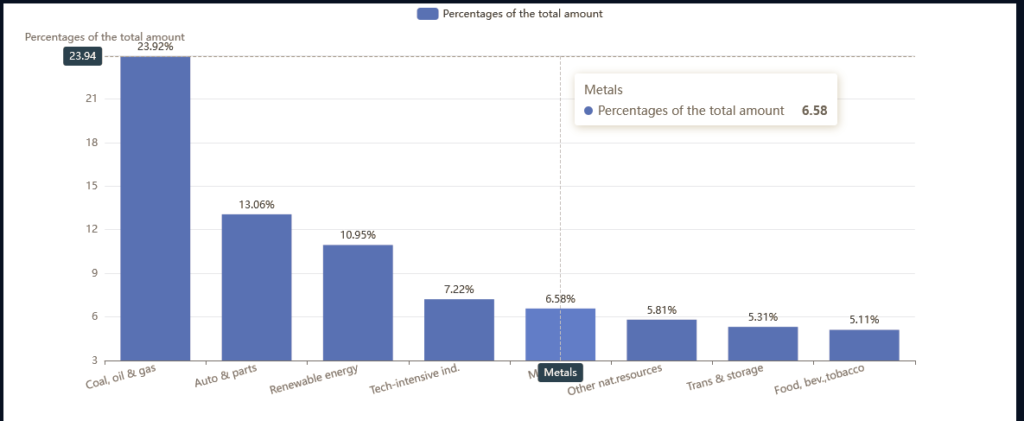

Projects in the traditional energy sector accounted for close to USD24 billion of almost USD100 billion in projects to be developed in the region in the coming years, reflecting an improved outlook for future investments, the United Nations Economic Commission for Latin America and the Caribbean, ECLAC, said in a recent study on FDI.

“For the first time since 2010, coal, oil, and gas project announcements accounted for the largest share, at 24% of the total amount, growing more than ninefold on the prior year,” the report says. The growth in coal, oil, and gas mainly came from large projects announced in Guyana and Mexico, which together totaled over USD 22 billion, or 93% of the total for projects in the sector.

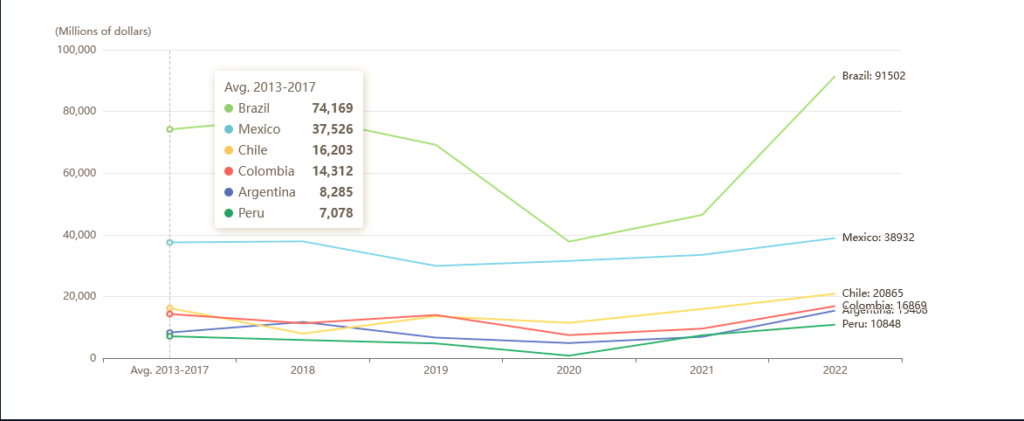

Latin America registered a record of USD224.5 billion in foreign investment in 2022, an increase of 55.2% compared to 2021, amid a recovery of the regional economies after the Covid pandemic, and the disruptions from the war in Ukraine which favored the countries of the continent. The study shows that Brazil, Mexico, Argentina, and Colombia achieved the greatest increase in the inflow of foreign capital to their financial accounts. Brazil received USD91.5 billion, an increase of 97% compared to 2021. For its part, Mexico got USD38.3 billion, while Argentina obtained USD8.5 billion and Colombia USD7.3 billion.

…and Latin America’s FDI rebounded to a record USD224.5 billion last year

(FDI inflows, by recipient country and subregion, 2013–2022)

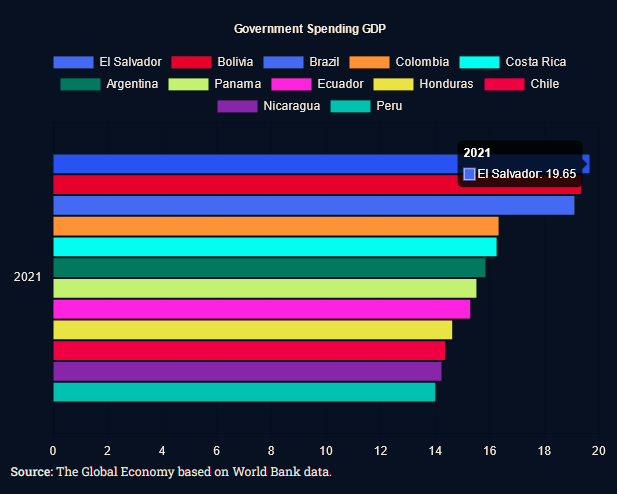

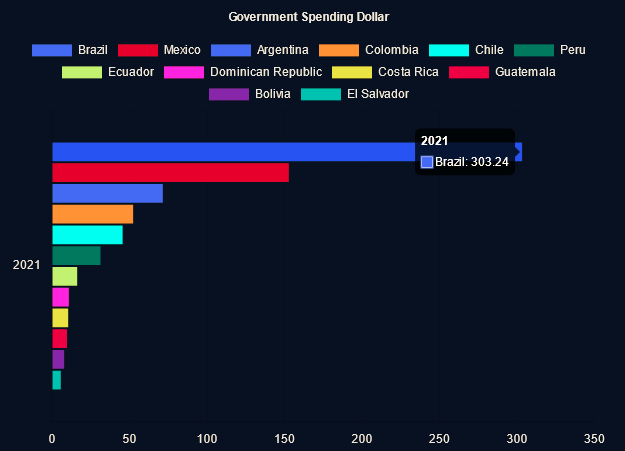

Latam Government Spending

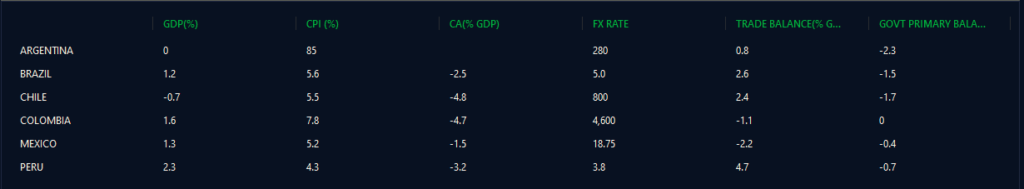

Goldman Sach’s 2023 Latam Forecast

zignox.com 10 10 2023