Herman Wang, Robert Perkins, Jennifer Gnana and Aresu Eqbali, Platts S&P Global

LONDON/RIYADH/TEHRAN

EnergiesNet.com 10 19 2023

OPEC appears set to sidestep calls by Iran for an oil embargo against Israel Oct. 18 after regional tensions were stoked further following the explosion at a Gaza hospital that killed about 500 people. Both Israel and Iranian-backed Hamas deny responsibility for the blast.

Saudi Arabia, the biggest oil exporter in the world, called for a meeting of Muslim countries in the Organisation of Islamic Cooperation to discuss the ongoing conflict in Israel and Gaza. But an OPEC delegate said he did not expect an extraordinary meeting of the oil producers group to be called on the issue.

“We are not a political organization,” the delegate said, on condition of anonymity.

A Gulf OPEC delegate, who also wished to remain anonymous, said the group had not discussed an oil embargo on Israel.

Iran’s foreign minister, Hossein Amir-Abdollahian, was earlier cited by Iran’s official IRNA news agency saying; “Islamic countries that have diplomatic relations with the Zionist regime [should] cut their relations with that counterfeit regime immediately, expel the Zionist regime’s ambassadors from their countries and stop any oil exports to that regime.”

Amir-Abdollahian’s comments followed the late Oct. 17 hospital blast and triggered condemnation by Arab governments after Hamas blamed it on Israel. Israel has denied it was involved, saying the blast was the result of a misfired rocket from Gaza launched by Hamas ally Palestinian Islamic Jihad.

Other OPEC officials were quick to downplay the possibility of an oil embargo on Israel.

An Algerian OPEC delegate said the possibility of an oil embargo did not concern them “because we do not sell them [Israel] any oil or gas. We do not have diplomatic and commercial relations with them. The question may arise for other questions but not for us,” he said.

Israel’s oil supply

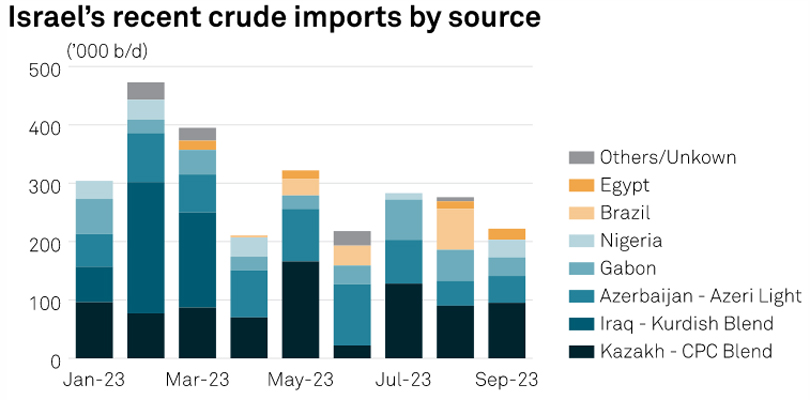

With almost no domestic crude or condensate production, Israel has been importing around 300,000 b/d of crude this year to process at its two refineries in Haifa and Ashdod.

Israel’s biggest source of oil is the Kazakh-sourced CPC Blend crude exported via Russia’s Black Sea port of Novorossiisk and Azeri Light which is shipped from Turkey’s Mediterranean port of Ceyhan. Together they accounted for over half of Israel’s crude imports this year, according to data from S&P Global Commodities at Sea.

Although largely secular, Kazakhstan and Azerbaijan are both members of the OIC which refers to itself as the “collective voice of the Muslim world” to “safeguard and protect the interests of the Muslim world.”

Iraq’s Kurdish crude exports from Ceyhan had also been a key crude source for Israel up until March, but it has had to diversify its crude imports after an ongoing legal spat halted Iraqi flows from Ceyhan. Since then, Israel has sourced more crude from Gabon and Nigeria and turned to Brazil and Egypt to help fill the gap. Israel’s fuel imports have also averaged about 50,000 b/d this year, mostly sourced from India and the US.

“An oil embargo on Israel would be more symbolic rather than damaging,” said Jim Burkhard, vice president and head of research for Oil Markets, Energy and Mobility, S&P Global Commodity Insights. “The US alone exports 3 million-4 million b/d of crude oil, so the US, at the very least, could replace any lost oil,” he said, acknowledging, however, that there may be an issue with crude quality.

Iraq’s oil ministry, which supplied the Kurdish blend crude until March before the shut-in of the Ceyhan pipeline to Turkey, was not available for comment.

spglobal.com 10 18 2023