Elena Mazneva and Anna Shiryaevskaya, Bloomberg News

LONDON

EnergiesNet.com 10 25 2023

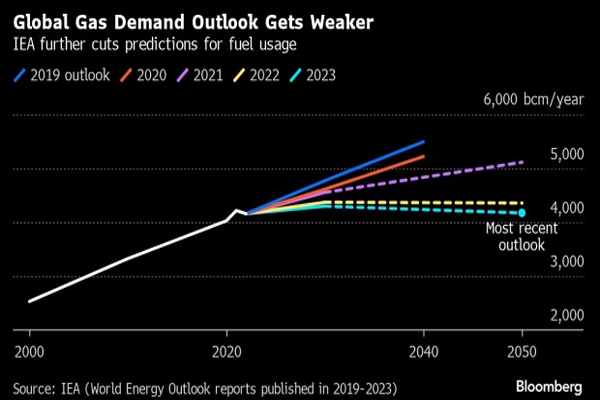

The world’s demand for natural gas is set to be even lower than anticipated through 2040 as renewables take up a greater share of the energy mix, while Russia’s gas-market share is set to dwindle, according to the International Energy Agency.

For a fourth straight year, the IEA lowered its projections for gas consumption, the agency said in its latest annual World Energy Outlook. Europe cut demand after Russia drastically reduced pipeline flows to the region last year. Meanwhile, the US and Qatar are ramping up supplies of liquefied natural gas, helping to keep markets well supplied.

The IEA now expects gas demand to peak in all forecast scenarios by 2030, with “little headroom remaining for either pipeline or LNG trade to grow beyond then,” it said.

The outlook illustrates a major shift in the global energy mix. Europe accounts for about 75% of the agency’s downward revision in gas demand, and China’s future consumption is uncertain. At the same time, Russia — previously Europe’s top supplier — is losing market share amid a growing glut of LNG.

“There are very limited opportunities for Russia to secure additional markets,” the IEA said. The country’s share of internationally traded gas, which stood at 30% in 2021, is now expected to halve by the end if the decade in the agency’s base-case scenario.

As a result, even Russia’s push toward Asia will face “major difficulties,” according to the IEA. Earlier this month, Russian gas giant Gazprom PJSC said it sees pipeline gas flows to China in the near future at the levels similar to its historical shipments to Western Europe.

The European Union’s push for renewables — together with gas savings by industries and households — contributed to the region’s record reduction last year, when its consumption fell by 55 billion cubic meters. It’s set to reduce gas demand by another 50 billion by 2030, the IEA said.

Still, European companies are relying on long-term LNG contracts to boost energy security, even as they seek to reduce greenhouse gas emissions. Three majors — TotalEnergies SE, Shell Plc and Eni SpA — clinched 27-year gas deals with Qatar this month, with supplies to France, the Netherlands and Italy scheduled beyond 2050.

“There is still space to contract more gas without falling foul of the European Union net zero emissions by 2050,” the IEA said. “Whether these contracts are at odds with global ambitions to reach net zero emissions is another matter.”

bloomberg.com 10 24 2023