1 Macroeconomic Environment:

Past Week:

These indicators were shown:

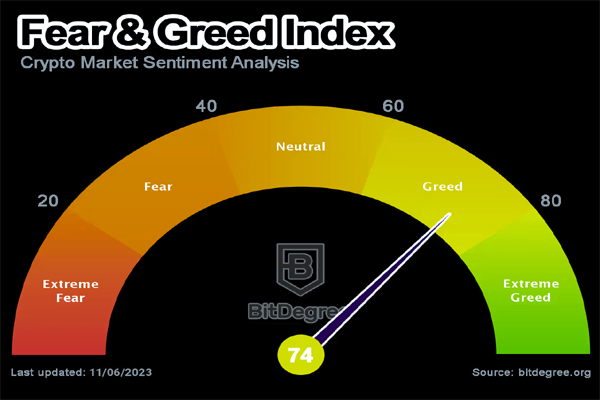

- The Bull has officially arrived and the Bear has left.

- The Fed leaves rates unchanged and optimism is in the air.

- The numbers showing the employment indexes came out well with no signs of warming, good news that boosted stock prices last Friday.

Next Week

- Consumer credit statistics and the U.S. trade balance will be released.

- This will be followed by wholesale inventories and the national treasury budget.

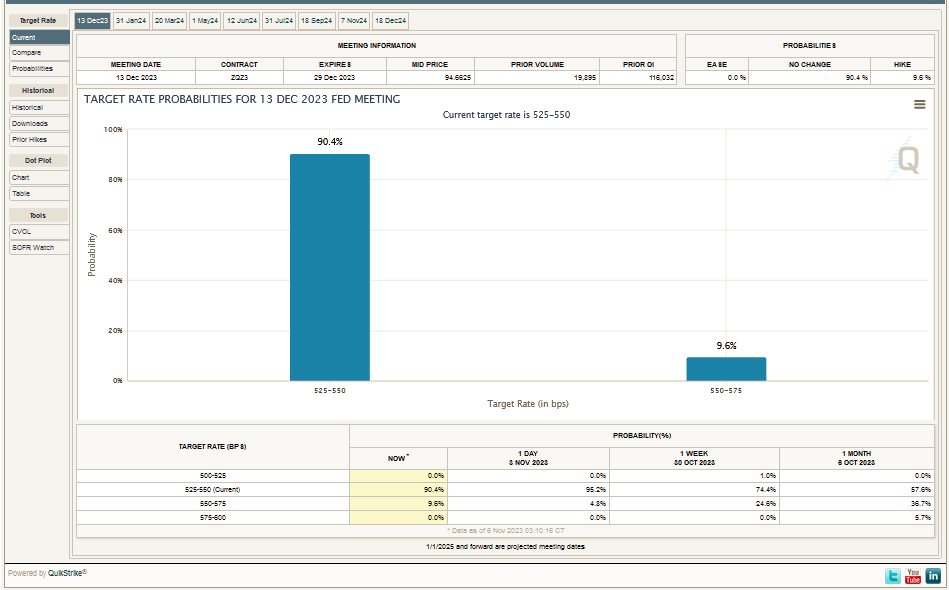

- Financial traders maintain a low probability forecast for a December interest rate hike.

CME FedWatch Tool

2 Micro

- The stock market, SP500 rebounded more than 200 points, a robust 4.83% on the week.

- It pierced the resistance at 4300 to 4358. Next resistance at 4400.

3 Building a long-term portfolio

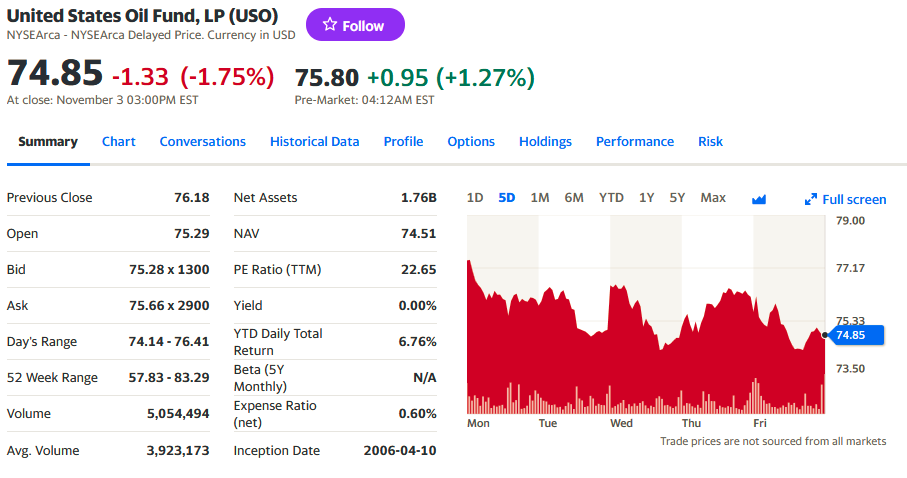

- The two Funds concentrated in energy with less volatility, this week the energy markets saw no major threats to previous weeks and moved like this:

- The ProShares UltraShort Bloomberg Bloomberg Crude Oil, SCO, which works with short crude oil futures contracts, gained 4.66% in a week.

- Meanwhile, the United States Oil Fund USO, which contains not only crude oil futures, but also natural gas, diesel and gasoline futures, also showed volatility and fell by -3.35%.

- Positive arbitrage in the week for both Funds with a 1.3% positive difference.

4 Execution of an algorithm or method to generate cash flow on a long-term portfolio or with money in the account.

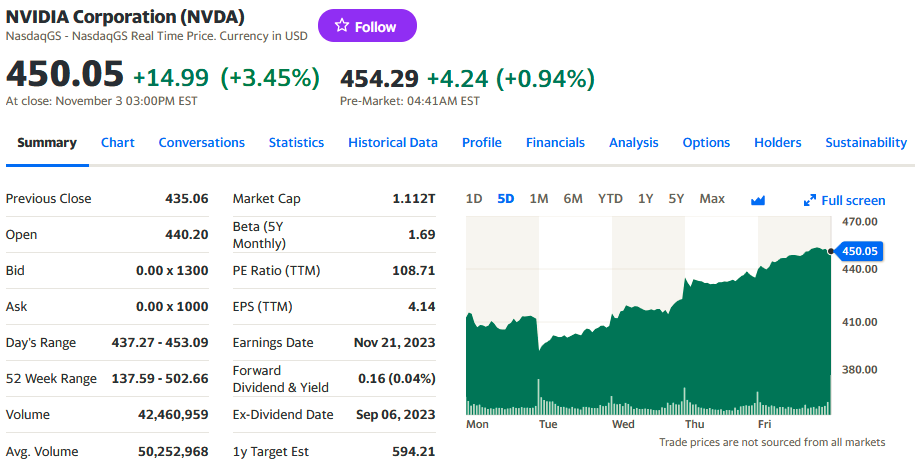

Our favorite strategy.

- The Magnificent 7, AAPL, TSLA, MSFT, GOOGL, NVDA, AMZN and META, underpinned the rise in the indices. AAPL, which rebounded in price after a more modest than expected forecast, rose 3.37% for the week. The winner in numbers was NVDA, leader in AI, which rose 9.10% in the week.

5 Analysis of last week’s forecast results.

- After the long awaited data on the FED meeting, and the earnings of AAPL, the company with the largest market capitalization with 2.7 Trillion dollars, more equity value than 80% of the countries in the world, the numbers looked like this:

Gold Unchanged

OIL -2.18%.

10 Year Bond -6.18%.

SPY +4.80%.

The good streak for stocks started.

6 Forecast for next week:

- We will again compare the yields of oil, Gold and the SPY, and the 10-year Bond.

- Anxiety over the events in Gaza and Ukraine seems to have subsided, although the markets are following it closely.

- Earnings remain positive and the U.S. economy is showing better health, although government debt continues to rise.

- We believe and will do so in our work method , that will be favorable investments in stocks for this week. We see no momentum for Gold, the 10-year bond sell-off, or oil.

Bullish.

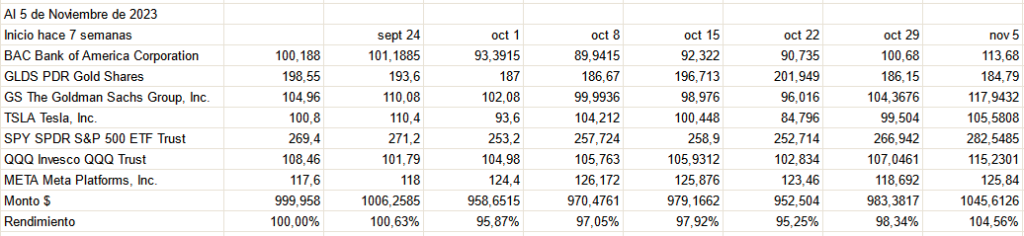

Weekly performance of the US $ 1,000 challenge, 6 weeks:

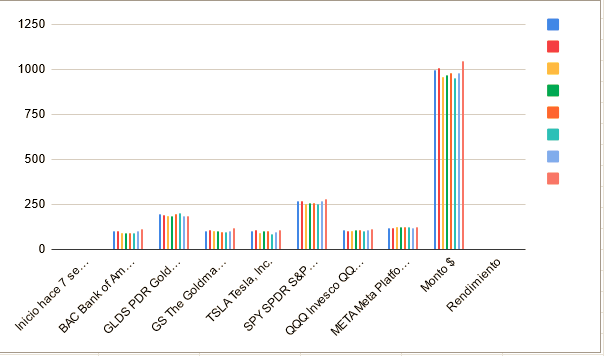

Chart of our portfolio since inception 7 weeks ago.

________________________________________________________

For inquiries about our Algo de entradas diarias, please write to : editor@petroleumworld.com

NOTE: We do not recommend investments, we only give our opinions.

For special courses or investment management contact : editor@petroleumworld.com

Raul Torrealba Ramos, B.A. in Administration and Accounting, Universidad Católica Andrés Bello, Caracas; Lawyer, Universidad Metropolitana, Caracas, is an experienced financial analyst since 1990. The views expressed are not necessarily those of EnergiesNet.

Editor’s note: This article is published as an opinion and is not recommended for investment. All comments submitted and posted on EnergiesNet do not reflect either for or against the opinion expressed and is not an endorsement by EnergiesNet or Petroleumworld.

EnergiesNet.com 11 07 2023