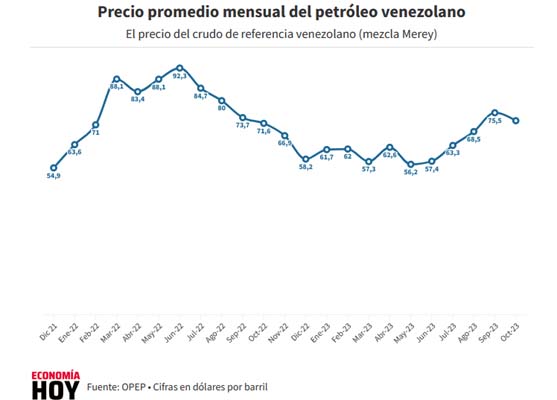

Venezuela oil monthly average price, (Merey blend the Venezuelan reference within the OPEC basket)

Economia Hoy

CARACAS

EnergiesNet.com 11 13 2023

The price of Venezuelan oil (Merey blend, the Venezuelan reference within the OPEC basket) averaged $72.54 per barrel in October 2023, a drop of 2.97%, compared to the previous month, according to OPEC data.

The average up to the tenth month of the year stands at $63.64, lower than the $79.82 it marked in the same period last year.

Crude oil prices had a strong rebound since March 2022 after the Russian invasion of Ukraine, but since June the price has shown a downward trend. Venezuelan oil reached in that month its highest value of the year ($92.25) and since then it has lost 33%.

The Venezuelan Oil Ministry stopped reporting the price of oil in the second quarter of 2020 when the price plummeted in the midst of the crisis caused in the market by the pandemic. Until then, the weekly average was published.

The figures can now be obtained from the monthly report published by OPEC and whose information comes directly from PDVSA or the Ministry of Petroleum.

In 2022, the price of Venezuelan crude marked a 50% increase in comparison with the previous year, since 2014, but the data on how much is paid into the State’s coffers for that concept is still not accurate, because in addition to the fact that they are not reported, the government of Nicolás Maduro assures that due to the sanctions they must sell at prices below the market.

According to Vice President Delcy Rodriguez, Venezuela’s “excessive costs and discounts represent around 25% of the price of crude oil”. The official reported that figure in the presentation of the Ministers’ Annual Report and Account at the end of March 2022.

“In addition, once the payment is received, additional costs must be cancelled to move the money to Venezuela. As a result of the blockade, these payments came to cost up to 15% of the gross value to be mobilized”, he added.

Venezuelan oil production fell sharply due to the US sanctions, which worsened the decline that the national industry had been dragging along as a result of a terrible administration, although they marked a recovery since 2021.

Translation by Elio Ohep , Editor EnergiesNet.com

economiahoy.digital 11 13 2023