MARKET REPORT

Update of material financial information.

November 19, 2023

1 Macroeconomic Environment:

Last Week:

These indicators showed:

Markets stabilize. Sideways conditions were observed until last Friday, after the rise since last week…

Ratings firm Moody’s downgraded its assessment of the U.S. credit outlook from “stable” to “negative” on Friday, highlighting the worsening U.S. fiscal situation and the implications of political dysfunction.

Other relevant information was the talks between Biden and the Chinese president in San Francisco. Much ambiguity

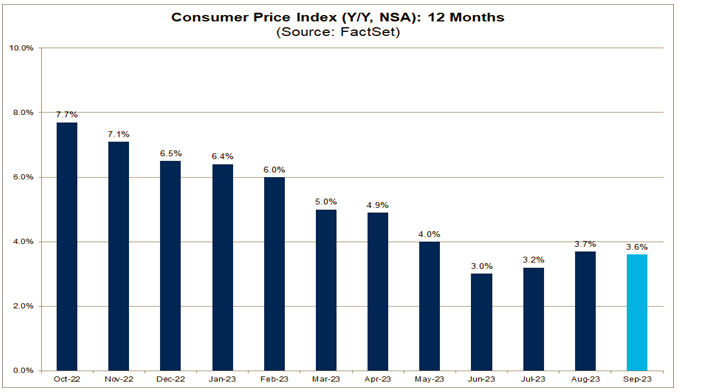

The CPI and PPI economic data were aligned with the slowing trend in wholesale and retail inflation, followed by recurring comments from Fed officials insisting that the economy is running healthy in line with inflation targets. No one is singing victory, expectations of further monetary policy implementation continue.

Consumer Price Index (CPI)

Next Week:

This week is Thanksgiving day, it will be a short week.

On Tuesday they show the minutes of the last Fed meeting, then come the records of durable goods indices, consumer sentiment and on Friday an OPEC meeting starts.

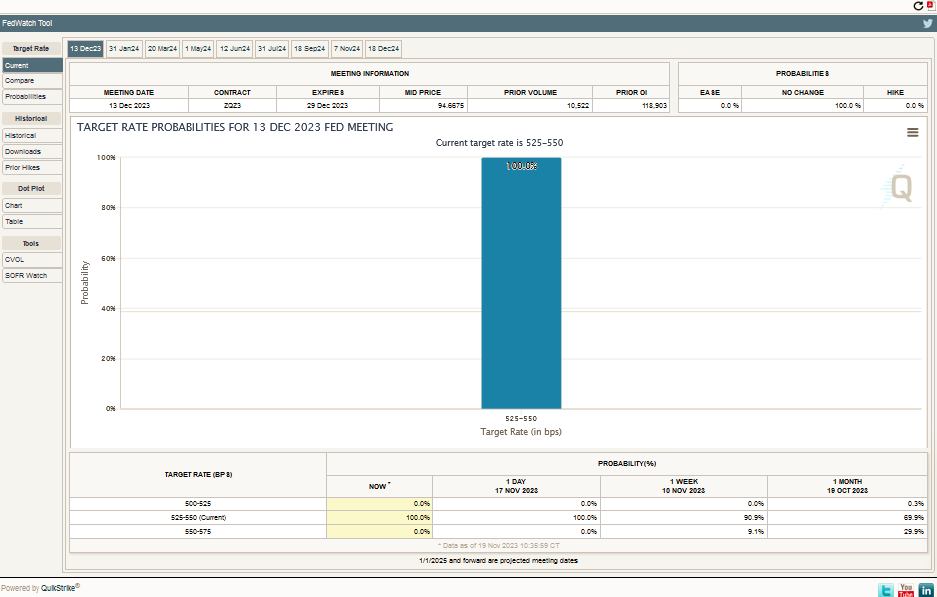

For the next monetary policy meeting on December 13, expectations of rate hikes are at 0 while those of denial are at 100, this helps the market rallies these days. An opposite news on that day would be very surprising.

CME FedWatch Tool

2 Micro

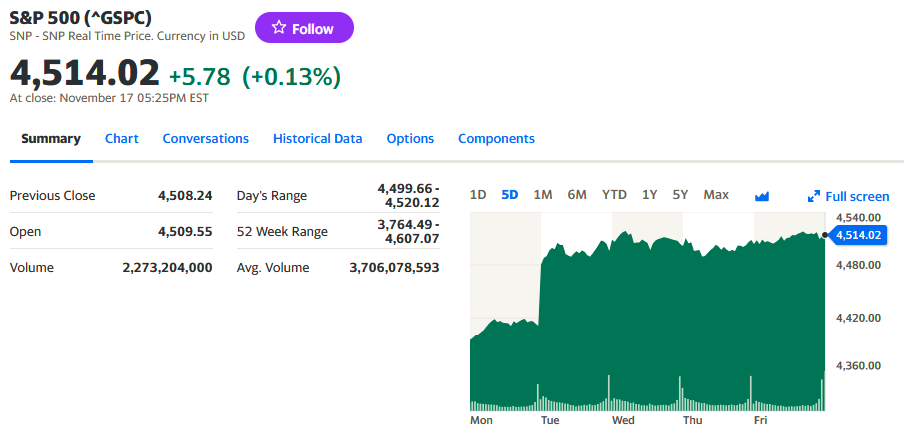

After last Monday’s rally, the market went into a sideways mode.

It shows resistance at 4,515 on the upside. Below it shows support at 4,490.

Earnings have continued solid with layoff announcements at some companies like Amazon, with projections of lower sales but watch profit margins. We shall see.

3 Building a long-term portfolio

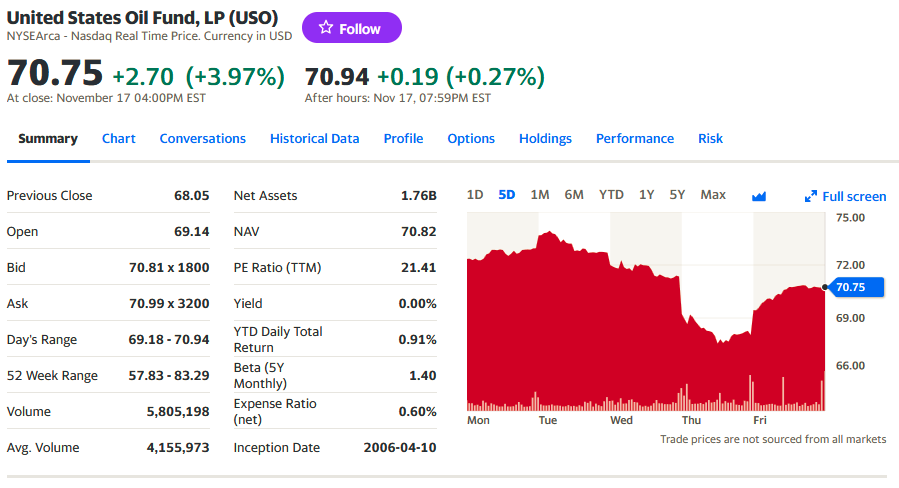

The two funds concentrated in energy reflected the fall in crude oil prices and its derivatives with a lot of volatility, this week the energy markets moved like this:

The ProShares UltraShort Bloomberg Bloomberg Crude Oil, SCO, which works with short crude oil futures contracts, gained only 1.96% in a week, with a lot of volatility.

Meanwhile, the United States Oil Fund USO, which contains not only crude oil futures, but also natural gas, diesel and gasoline futures, also showed volatility, falling by -2.22%.

%.

Positive arbitrage in the week for both Funds with a 0.26 % positive spread. Although it was not as profitable as in previous weeks. Lateral Market.

This news drives the whole market, because of the importance of global energy costs.

Energy costs went down this week…..

4 Execution of an algorithm or method to generate cash flow on a long-term portfolio or with money in the account.

Our favorite strategy.

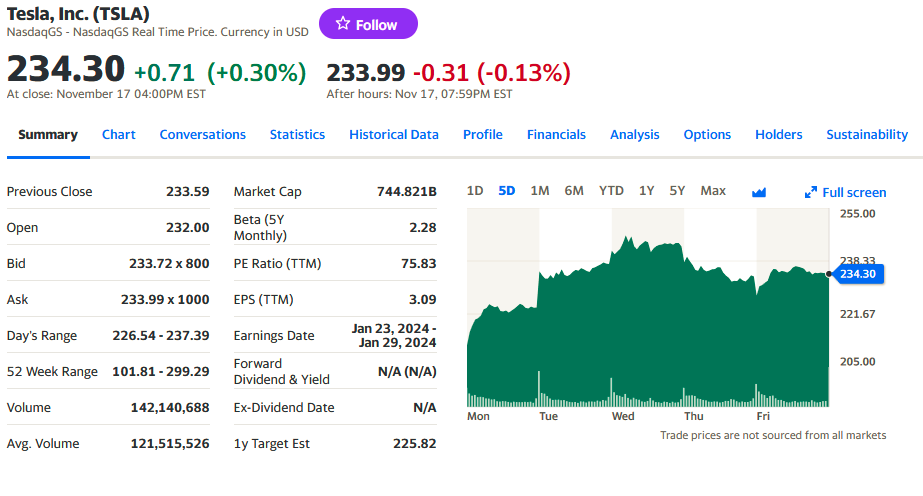

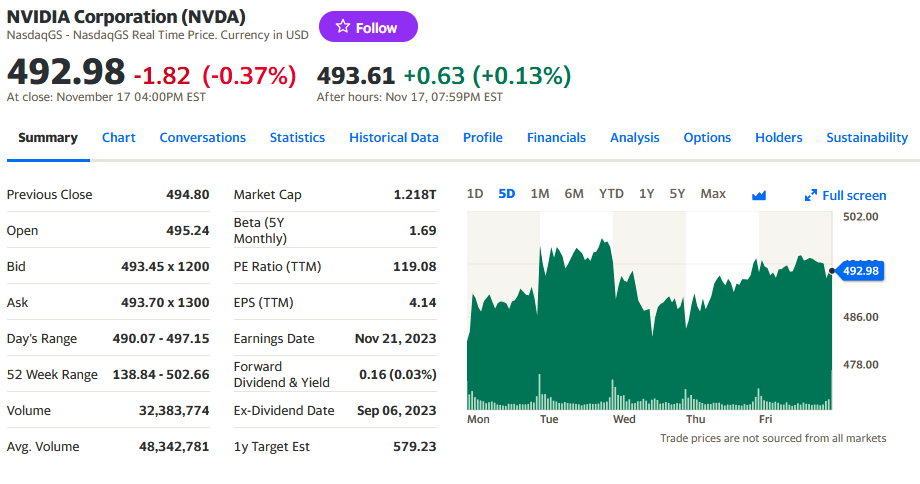

The Magnificent 7, AAPL, TSLA, MSFT, GOOGL, NVDA, AMZN and META, had positive performances, highlighting TSLA up 10.9% (against HSBC’s downgrade) and NVDA +5.4%, reporting earnings next Tuesday.

5 Analysis of the results of the previous week’s forecast

Signals confirmed as energy costs improved weekly. The 10-year bond fell again, indicating the markets’ eagerness to buy them. There is no superior credit rating with placement capacity to the US bond, despite the fiscal and balance of payments deficits. Companies are also positioned in bullish territory..:

Gold + 2.7%.

OIL – 2.6%.

10 Year Bond – 3.7%.

SPY +2.73%.

Ahora mercado lateral.

6 Forecast for next week:

We will again compare the yields of oil, Gold, the SPY, crude oil and the 10 year bond.

The SP500 should remain sideways, without much volatility. If it breaks above 4.515, it breaks the resistance marked on open futures and options trades and will move up towards 4.550.

Otherwise it may pull back to 4,490.

Using our method in those ranges we will make entries in those ranges. We think the rally will continue, more towards the month of December.

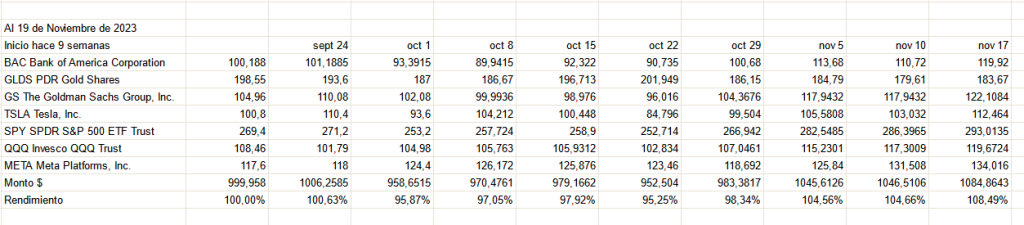

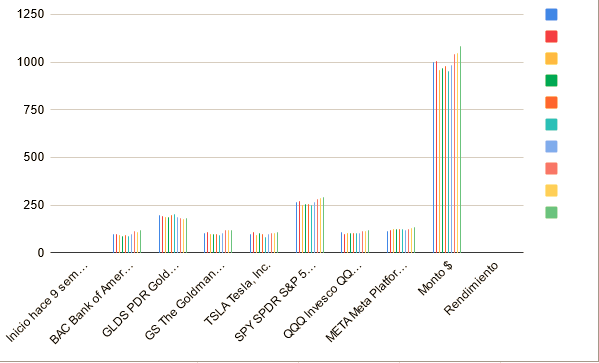

Weekly performance of the US $1,000 challenge, 9 weeks:

In nine weeks the portfolio is returning 8.49%, equals 48% annualized. We are doing well.

Venezuelan market

Price of the dollar vs Bs

BCV : Bs 35.33 +0.25%.

Unofficial : Bs 36.72 -1.21%.

There was slippage of both exchange rates in Venezuela. The unofficial or parallel exchange rate dropped 1.21% while the official rate appreciated 0.25%. The BCV continues to intervene in the banking tables. There are only 6 weeks left in 2023, we will see how the exchange rate behaves, and the economic expectations are more encouraging…

Caracas Stock Exchange

Fixed Income

OPERATIONS NOMINAL AMOUNT (BS.S) CASH AMOUNT (BS.)

2 2.012.916,86 2.001.141,296369

Equities:

TRANSACTIONS SECURITIES TRADED AMOUNT IN CASH (BS.)

146 1.997.654 1.534.533,44

Up: 5

Low: 12

Equals: 10

_____________________________________________________

For inquiries about our Algo daily entries, please write to : editor@petroleumworld.com

NOTE: We do not recommend investments, we only give our opinions.

For special courses or investment management contact : editor@petroleumworld.com

______________________________________________________

Raul Torrealba Ramos, B.A. in Administration and Accounting, Universidad Católica Andrés Bello, Caracas; Lawyer, Universidad Metropolitana, Caracas, is an experienced financial analyst since 1990. The views expressed are not necessarily those of EnergiesNet.

Editor’s note: This article is published as an opinion and is not recommended for investment. All comments submitted and posted on EnergiesNet do not reflect either for or against the opinion expressed and is not an endorsement by EnergiesNet or Petroleumworld.

EnergiesNet.com 11 19 2023