Marianna Durao, bloomberg News

RIO

EnergiesNet.com 11 28 2023

A year since the election of Brazilian President Luiz Inacio Lula da Silva, Petrobras investors are finally getting a clearer sense of what he means for the country’s state-controlled oil company.

Petroleo Brasileiro SA last week released its latest five-year spending plan. Coming in at $102 billion, it certainly put to rest any doubts that the days of limited expenditures are over.

It’s the company biggest budget since 2015, up 31% from last year, with chunky increases for oil exploration, production and refineries.

The blueprint also includes an $11.5 billion commitment for solar, hydrogen, wind and other clean-energy projects to help catch up with peers in the green transition.

Petrobras’ forecast range for dividends, meanwhile, fell to between $40 billion and $55 billion, a decrease of about 35% from the last plan. And unlike past budgets, the Rio de Janeiro-based company didn’t mention selling assets. Rather, it will shift toward making acquisitions.Jean Paul Prates, chief executive officer of Petroleo Brasileiro SA (Petrobras), gestures in support of Luiz Inacio Lula da Silva, Brazil’s president, during a 70th anniversary event in Rio de Janeiro on Oct. 3.Photographer: Dado Galdieri/Bloomberg

While it was largely what investors feared, it was also what they expected.

Lula has criticized Petrobras for showering investors with record dividends and, more recently, not doing enough to help control Brazil’s inflation.

Yet the budget did offer investors some hope that spending may ultimately come in lower than projected. About $11 billion is contingent on the company undertaking feasibility studies.

While the plan gives shareholders a degree of certainty over where the company is heading, there are other shoes at Petrobras threatening to drop.

Lula’s handpicked chief executive officer, Jean Paul Prates, faces mounting pressure from the administration to tailor corporate strategy to complement efforts to reduce inflation and boost the economy.

That includes cutting fuel prices, prioritizing the hiring of Brazilian contractors and other moves private investors would loathe.

It’s put the CEO in the middle of a tug of war, and some within Lula’s government are getting increasingly impatient that Prates isn’t pulling hard enough in their direction.

Officials aren’t actively pushing to oust Prates, people with knowledge of the situation said last week. But there are apt to be more twists and turns to come on what the Lula era holds for Petrobras.

–Mariana Durao, Bloomberg News

Chart of the day

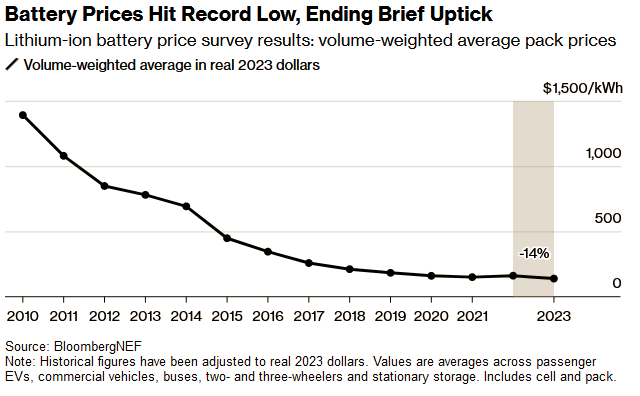

Battery prices are back on their long-standing downward trajectory following an unprecedented upward turn last year. According to BloombergNEF, average lithium-ion battery pack prices in 2023 have fallen to $139 per kilowatt-hour — a 14% decline from the previous year. Raw material prices also dropped, thanks to significant growth in production capacity across the battery value chain. Meanwhile, demand is still growing yet fell short of industry expectations.

bloomberg.com 11 27 2023