Velda Addison, Hart Energy

HOUSTON

EnergiesNet.com 12 14 2023

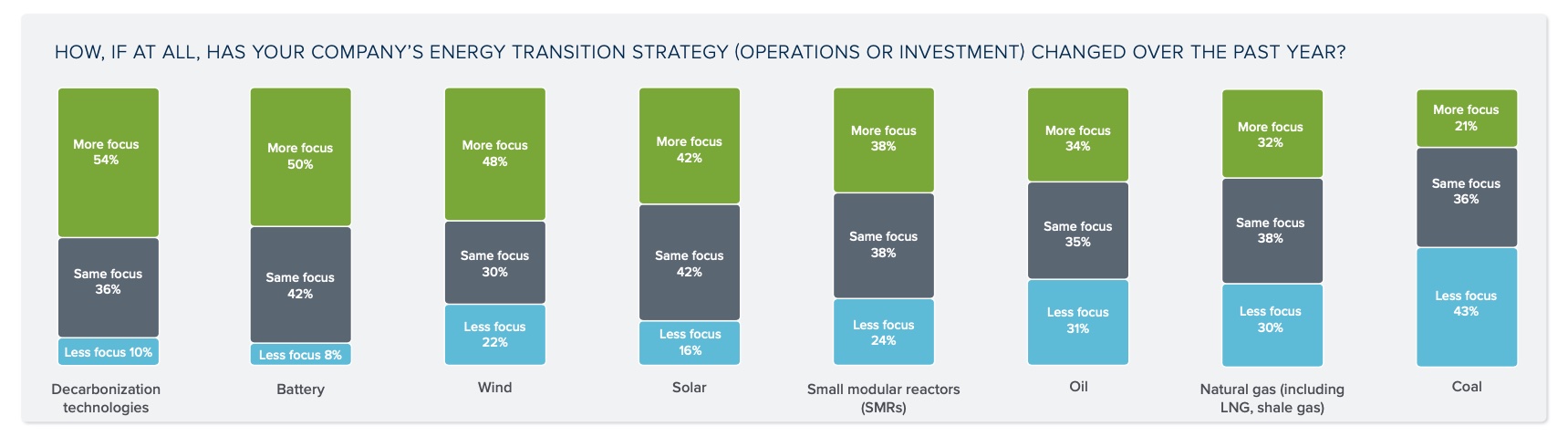

Despite apparent economic risks, infrastructure buildout challenges and fossil fuel demand realities, most energy company executives and investors increased focus on energy transition strategies in the past year, according to a recent survey by the Womble Bond Dickinson (WBD) law firm.

The pace of movement has slowed, however, and some companies — particularly oil and gas — are opting to stick to areas that complement their core. The firm’s 2024 Energy Transition Outlook Survey Report showed that 56% of the executives and investors polled are deepening their focus on their transition strategies, but most believe more government and public sector support will be needed to start and complete infrastructure projects in the U.S. and globally.

“There seems to be some hesitation to move forward too quickly in areas where the infrastructure and support is not there,” Jeffrey Whittle, head of Womble Bond Dickinson’s Global Energy and Natural Resources Practice, told Hart Energy. He noted that companies are looking to the government and other business enterprises to de-risk investments in infrastructure buildout. “There seems to be more thinking in partnership with the government.”

The pullback in some areas is expected to continue in 2024, he said.

More than 450 executives and investors in renewable energy, oil and gas, utilities, mining, electric vehicles and nuclear were polled. Respondents included executives in Asia-Pacific, Europe, Latin America, the Middle East and North America.

The survey, which took place between Aug. 22 and Sept. 28, occurred as many parts of the world worked to reduce greenhouse-gas emissions by utilizing more renewable energy and lower carbon energy resources. Governments have rolled out incentives and policies encouraging development of such resources, but the need for reliable and affordable energy as well as profits persists.

Among the survey’s findings:

- Cost and economic impact are key obstacles to the energy transition;

- Infrastructure and grid modernization pose significant challenges;

- Forward movement requires favorable regulatory and legislative policy and ongoing government support;

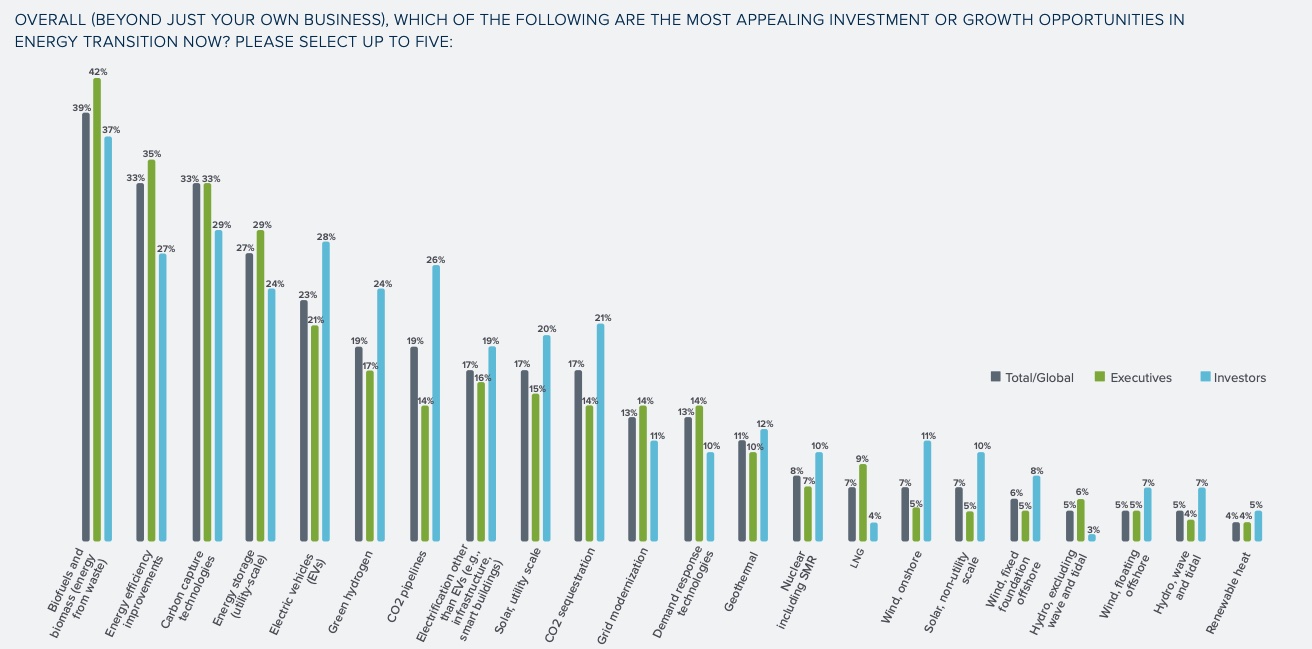

- Biofuels and biomass (waste-to-energy), efficiency improvements, carbon capture, energy storage and EVs are among the most appealing growth and investment opportunities; and

- Politics is seen as the key obstacle to net-zero goals.

(Source: Womble Bond Dickinson’s 2024 Energy Transition Outlook Survey Report)

(Source: Womble Bond Dickinson’s 2024 Energy Transition Outlook Survey Report)

“Considerable innovation and investment will continue, and over time disruptive solutions will come to the fore,” according to the survey report. “While the pathway to achieving net zero ambitions is currently challenged, commitment to a lower emissions future remains.”

‘Money is no longer cheap’

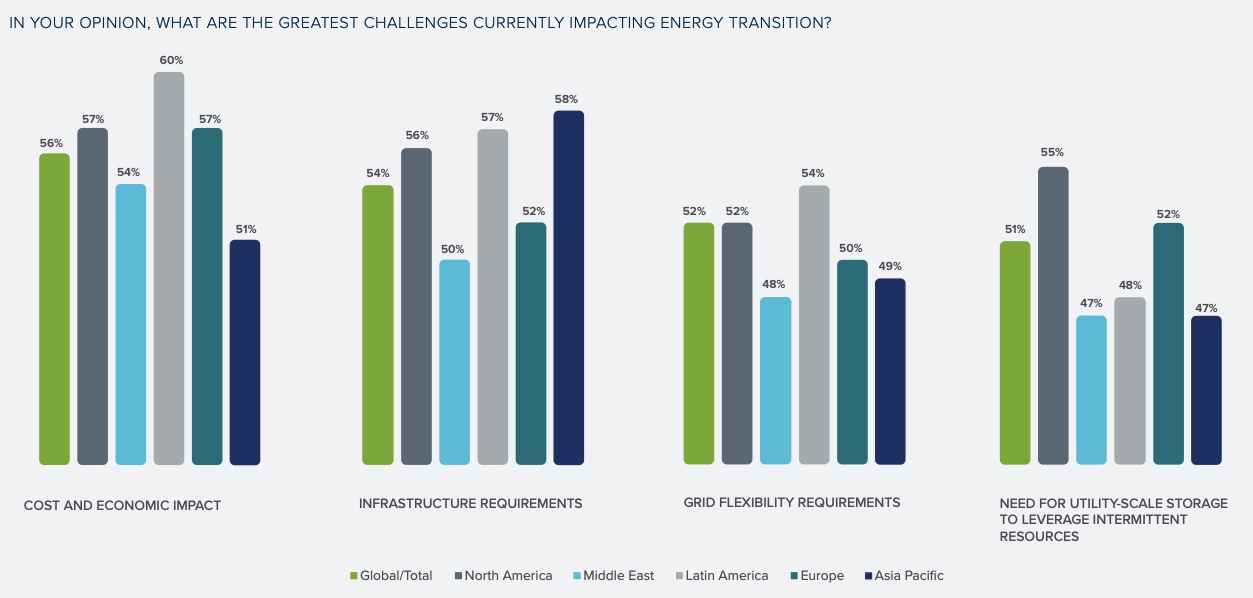

Looking at total global responses, 56% of the participants said the greatest challenges impacting the energy transition are cost and economics. That was followed by infrastructure requirements at 54%; grid flexibility requirements, 52%; and the need for utility-scale storage to leverage intermittent resources, 51%.

Cost concerns were greatest in Latin America, selected by 60% of the respondents, compared to 57% in North America and Europe, 54% in the Middle East and 51% in the Asia-Pacific.

While the need to cost-effectively provide basic services in Latin America and difficulties associated with expensive infrastructure upgrades are of concern for developing countries, the survey results pointed to rising interest rates, high costs and inflation as concerning factors elsewhere.

“Money is no longer cheap, and that was clearly a top concern for our survey respondents,” the report found. “Central banks have raised interest rates significantly over the last two years and may well have to keep rates higher for longer.”

Respondents considering hydrogen projects also identified low-cost financing and low-cost renewable energy as obstacles to deploying utility-scale green hydrogen projects, according to the survey report.

Infrastructure challenges

Renewable energy companies have increased output but power grids have not kept up the pace. In the U.S., survey respondents pointed out interconnection challenges, grid instability caused by renewable energy integration, aging infrastructure and other factors.

“The realization is spreading across the industry that creating a clean energy system requires more than deploying solar, wind and storage assets at scale,” Belton Zeigler, co-head of WBD’s U.S. Regulated Utilities Team, said in the report. “It also requires modernizing and expanding the transmission grid so that it can serve customers efficiently and reliably as electrification proceeds and increasing levels of renewable resources are added to the system.”

Top of the list of factors driving demand for grid modernization was the need for greater capacity and shorter connection lead times (54%), followed by the need to accurately monitor, protect and control grid conditions (53%) and grid imbalances and power flow issues associated with renewables (52%).

“As you see in the U.S., with the interest rates increasing, it makes infrastructure more expensive and … permitting is still difficult,” Whittle said. Solving the permitting issues would help get infrastructure projects moving. The process for getting permits—whether it’s wind, solar, hydrogen or something else—is time-consuming. “Nobody can quite put their finger on why, but they’re hoping maybe in the future that it will change.”

Reliance on the government

Survey respondents see governments having a major role to play in the transition. Executives identified several areas in which legislation, regulation and incentives could be most effective in accelerating the energy transition. The top three: funding of grid upgrades and efficiency improvements (40%); establishment of carbon national market pricing and scheme (37%); and construction of wind and solar and establishment of a carbon global market pricing and scheme (tied at 35%).

“When it comes to achieving future net-zero goals, more than one-third of respondents said insufficient government support (e.g., tax credits and grants) was one of their top three challenges,” the report said.

Regulation and policy support were also seen as critical to advancing several key clean energy technologies, including nuclear. “’Streamlined regulatory processes outranks capital as an issue for the advancement of nuclear power,” according to the report. “Of those who see it as an overall area of opportunity, 71% say a less complex regulatory climate would make nuclear energy more appealing to their organization.”

What to look for in 2024

Survey results showed that oil and gas companies were among those that spent less time focusing on energy transition strategies in the past year. That doesn’t mean they are not investing in renewables or lower carbon technologies.

“If you think of their core business as oil and gas, what they seem to be doing is using renewables or other technology to try to enhance their main, core business,” Whittle said, pointing to investments in carbon capture, electrification of facilities and other emissions reduction efforts. “But they’re still trying to keep their main, core investment in oil and gas because they see that there for the long term. … I think [that trend] will continue into 2024.”

Looking ahead, Whittle also expects to see more action on hydrogen hubs, including in the U.S.

“I think that all the multinationals and investors see that as a real possible pathway forward on a lot of levels,” he said.

More investment in biofuels and sustainable aviation fuels could also be on the horizon, Whittle added, with more downstream companies investing in related technologies and midstream companies stepping in to help figure out transportation needs.

Survey respondents selected biofuels and biomass as the most appealing investment in the energy transition now, outranking energy efficiency improvements, carbon capture technologies, utility-scale energy storage, EVs and green hydrogen.

hartenergy.com 12 14 2023