William Watts, MarketWatch

NEW YORK

EnergiesNet.com 12 23 2021

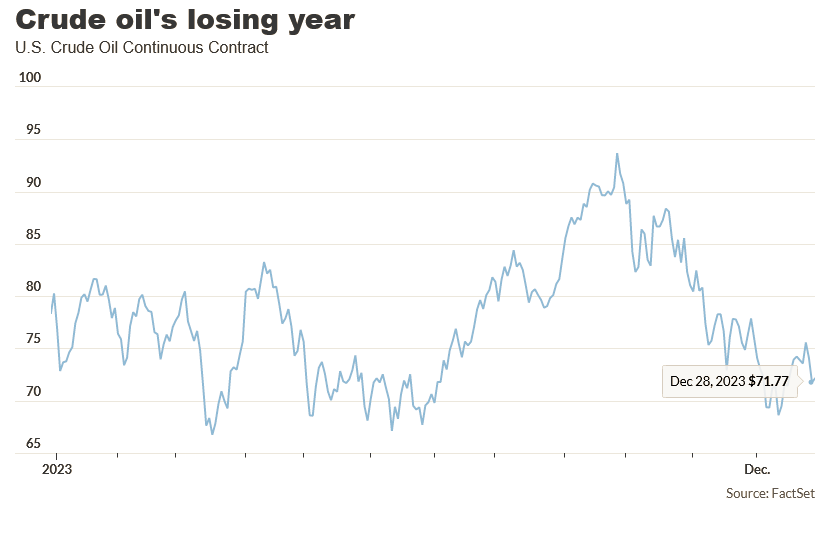

Oil futures ended slightly lower Friday on the final trading day of 2023, capping crude’s first losing year since 2020 as concerns about the demand outlook outweighed potential supply disruptions and efforts by OPEC and its allies to limit production.

Price action

- West Texas Intermediate crude for February delivery CL00, -0.60% CL.1, -0.60% CLG24, -0.60% fell 12 cents, or 0.1%, to close at $71.65 a barrel on the New York Mercantile Exchange.

- March Brent crude BRN00, +0.05% BRNH24, +0.05%, the global benchmark, fell 11 cents, or 0.1%, to settle at $77.04 a barrel on ICE Futures Europe.

- Back on Nymex, January gasoline RBF24, -0.07% rose 0.8% to $2.103 a gallon.

- January heating oil HOF24, -0.88% fell 0.1% to $2.553 a gallon.

- February natural gas NGG24, -2.31% declined 1.7% to finish at $2.514 per million British thermal units.

Market drivers

WTI, the U.S. benchmark, slumped 21.1% in the fourth quarter and suffered a yearly fall of 10.7%. Brent tumbled over 19% in the final three months of the year, posting an annual loss of 10.3%. 2023

Gasoline futures dropped 14.5% in 2023, while heating oil declined 24.1%. Natural gas plunged nearly 44%.

Crude had rallied over the summer as the Organization of the Petroleum Exporting Countries and its allies, together known as OPEC+, maintained production cuts, with Saudi Arabia throwing in a voluntary reduction of 1 million barrels a day beginning in July and Russia moving to curb exports. While production cuts have been rolled over into early 2024, oil peaked in late September as expectations for a significant supply deficit failed to materialize.

Increased production by the U.S., which saw its output hit record levels in 2023, and other non-OPEC producers have also capped the upside for crude, analysts said.

Read: Why oil may not see a return to $100 a barrel in 2024

Oil futures jumped in the wake of the outbreak of the Israel-Hamas war in October on fears that a broader conflict could cramp supplies from the Middle East, but crude failed to challenge its September highs and soon eroded its geopolitical-risk premium. Prices bounced somewhat in December as attacks by Yemen’s Iran-backed Houthi rebels on shipping vessels in the Red Sea sparked a round of rerouting, but gains have proven difficult to sustain.

Instead, investors “have started to focus on the risk that there may be excessive supply in oil markets next year, and insufficient demand,” said Marios Hadjikyriacos, senior investment analyst at XM, in a note.

“Even though OPEC+ has taken repeated steps to rein in production and support prices, it is unlikely to pursue the same strategy for much longer, as it would forfeit more market share to U.S. producers who have dialed up their own production to record levels,” he wrote.

Natural-gas prices, meanwhile, have slumped recently on a warmer-than-normal winter, said Lu Ming Pang, senior analyst at Rystad Energy, in a Friday note.

The number of heating-degree days (HDDs), which reflect the extent of heating required, has been below normal so far, with a deviation of 28 fewer HDDs from the normal reported on Dec. 15, the analyst noted. HDDs are forecast to rise through Jan. 5 but remain slightly below normal.

“Gas demand for heating is likely to rise as a result but will still remain below seasonal norms,” Pang said. “A combination of warmer weather, high underground-storage levels, and high domestic gas production is expected to keep U.S. prices suppressed.”

marketwatch.com 12 29 2023