Argus Media

HOUSTON

EnergiesNet.com 01 05 2024

Heavy sour crude supply is expected to tighten on the US Gulf coast as major infrastructure projects in Canada and Mexico pull supplies away from the region.

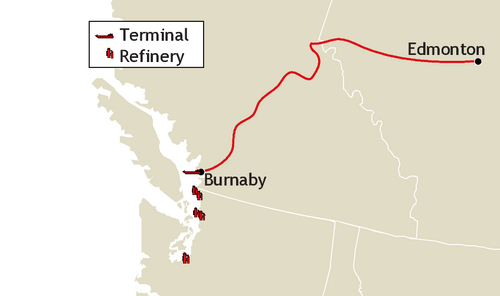

The start-up of the 590,000 b/d Trans Mountain Expansion (TMX) pipeline in Canada could divert Canadian crude to the international markets at the expense of the US. The line runs from Edmonton, Alberta, a key hub for oil sands producers, to the docks at Burnaby, British Columbia, on Canada’s Pacific coast, from where it can be shipped to other markets without transiting the US (see map). Producers expect roughly 4.5mn bl of TMX linefill injections to start this year, drawing oil sands production to Burnaby rather than its typical markets in the US midcontinent and on the Gulf coast.

Canadian heavy crude deliveries to the US Gulf coast averaged close to 275,000 b/d in January-October, according to the EIA (see graph). TMX could come on stream as early as the second quarter. But the project could also be delayed by up to two years after regulators rejected a request for changes to a section of the project, the operator said in December.

Heavy crude supplies from Mexico also look likely to tighten with the start-up of the long-delayed 340,000 b/d Olmeca refinery, part of the Mexican government’s ambitious goal of making the country self-sufficient in gasoline and diesel.

The launch of commercial operations at the plant — which has been in a testing stage — is expected to lead to a fall in heavy sour Maya exports, leaving a supply gap that other Latin American producers could fill. Maya shipments could drop by up to 58pc to 250,000 b/d based on 2023 average exports of 590,000 b/d,if the Olmeca plant were to run at full capacity, Argus estimates. This would leave a big hole in US Gulf coast refinery supply. But that scenario is considered unlikely, as market sources say the refinery will not be fully operational until the end of 2024 at the earliest and even then, average run rates are unlikely to pass 90pc of nameplate capacity.

On its Merey way

An increase in Venezuelan Merey crude imports to the US could help offset any declines from Mexico and Canada. Venezuelan crude returned to Gulf coast refineries in January 2023 following a three-year hiatus, after the US partially eased sanctions on the country in November 2022. US imports from Venezuela more than quadrupled to 166,000 b/d in October from 40,000 b/d in January, according to the latest EIA data.

Crude imports from Venezuela could increase further after the US lifted more sanctions on the Venezuelan oil sector on 18 October. The sanctions waiver is expected to last until 18 April, and could be extended if Venezuelan president Nicolas Maduro’s government makes good on its pledge to hold free elections next year and to release hundreds of political prisoners. But it is uncertain whether the sanctions reprieve will hold, given that the US warned in December that it could reimpose some of the restrictions it waived.

The prospect of more heavy crude supply from Venezuela has already weighed on Colombian crude, with heavy sour Castilla falling to a $10.40/bl discount to Ice Brent in mid-November, a seven-month low, and remaining fairly weak at around $10.10/bl below the marker in early January (see graph).

Castilla values could find support this year from US Gulf coast buyers looking for substitute grades. Higher-gravity crudes such as Castilla and Colombian medium sour Vasconia often make their way to the US Gulf coast. An average of 144,000 b/d of Colombian crude, which could comprise other Colombian sour grades, arrived in January-October, EIA data show.