Rebecca Conan, Argus Media

MEXICO CITY

EnergiesNet.com 01 05 2024

Mexico’s energy sector could reach a turning point this year as presidential elections in June promise a candidate that could green the country’s energy policy after almost six years of President Andres Manuel Lopez Obrador’s tepid climate change strategy.

Governing party candidate Claudia Sheinbaum and opposition candidate Xochitl Galvez have both pledged to develop more renewable energy to decarbonize the electricity sector, but Sheinbaum’s plan to cap the private sector’s share of power generation 46pc would restrict the scale of new buildout given state power company CFE’s limited resources.

Mexico needs to add 20,000MW of wind and solar capacity by 2030 to reach its emissions reductions targets, according to the Mexican wind energy association Amdee, but CFE has only managed to build 120MW in solar capacity in the last five years.

The slowdown in private-sector renewable investment during Lopez Obrador’s administration is also expected to continue this year as permitting is expected to slow even more as it grinds to a halt ahead of the election and three-month presidential handover period.

Outflows of foreign direct investment into the electricity sector outweighed inflows by $285.6mn during the first half of last year, according to the latest data published by the economy ministry.

Sheinbaum leads the polls with 61pc of the vote, according to a December poll by Mitofsky and, as Lopez Obrador’s continuity candidate, the former Mexico City mayor is expected to press on with prioritization of CFE power generation. That policy saw the share of electricity generation for coal-fired power increase by 1.2 percentage points last year to 3.9pc in November, while combined cycle power’s share in the energy matrix also increased by 3 percentage points to 62pc, latest data from grid operator Cenace show.

Despite Lopez Obrador’s much-trumpeted Sonora Plan designed to boost solar power development, Mexico’s power generation matrix is unlikely to shift much this year. Solar power capacity will see a small bump as the 1GW Puerto Penasco solar plant build out continues but combined-cycle capacity is also expected to expand with the launch of new plants in Merida and Valladolid by year-end.

The impact of Lopez Obrador’s energy sovereignty policy will be evident this year as Mexico is expected to fail in its target to generate 35pc of electricity from renewable sources by end of this year under the Paris Agreement.

To-do list

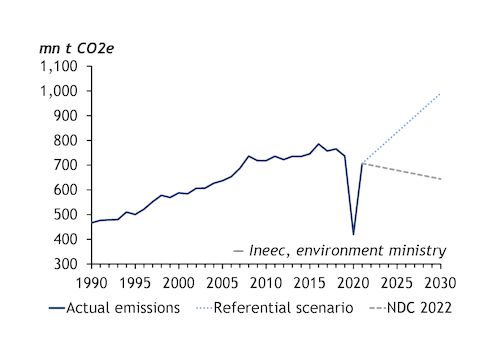

But Mexico does hope to make headway this year on its new target of reducing greenhouse gas emissions by 35pc by 2030 from a 2000 baseline, with much of the effort centered on reducing state-owned Pemex emissions.

Pemex has pledged to reduce gas flaring to 188mn cf/d this year from the average 319mn cf/d reported last year but compliance will depend on the company’s ability to avoid any major accidents, following a string of incidents last year, as well as to build a new gas processing plant to manage high nitrogen levels in associated gas fields.

This year is also expected to bring publication of Pemex’s delayed long-term sustainability program that will provide a clearer vision towards emissions reductions and the potential to decarbonize elements of the operator’s business.

While Lopez Obrador has dragged his feet on climate change strategies, the energy transition is one of the “major unresolved matters,” of the administration that will have to be dealt with by the incoming government, Moody’s Investors Service analyst Roxana Munoz says.

Pemex’s financial situation — with total financial debt of $105.8bn as of 31 September — is unsustainable and will force the incoming president to make structural changes that could include diversification of Pemex’s business portfolio to move towards natural gas and green hydrogen as its Latin American counterparts have done in recent years, Munoz said.

argusmedia.com 01 05 2024