Market Report

Week #3 of 2024, Report on ideas for positive cash flow.

Update on relevant financial information.

January 15 – 19, 2024

1 Macroeconomic Environment:

Week ending:

Positive economic data continued to add up.

Retail sales and consumption in line with expectations.

In addition, earnings from flagship companies such as Goldman Sachs improved forecasts and released a positive forecast for the rest of the year.

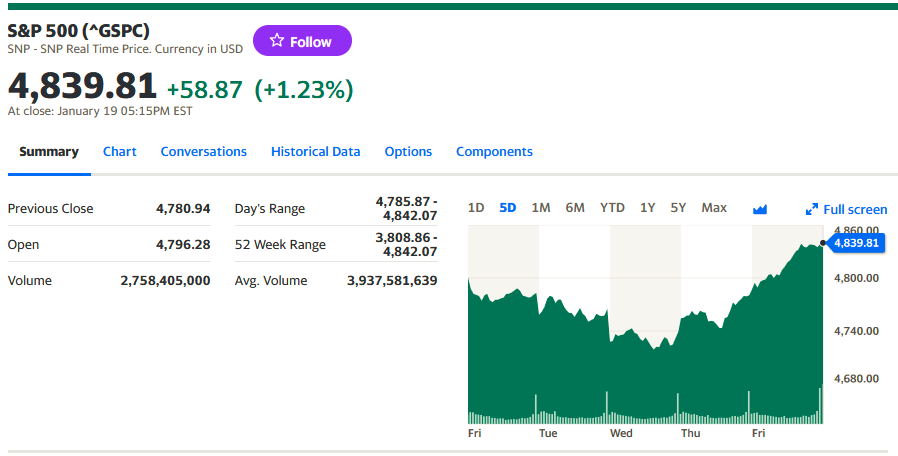

Meanwhile the SP 500 breaking All Time Highs of 4808.

Reverse Repos, with which the Fed injects liquidity into the system, rise to 625,182, taking the pulse of the money market.

The Corporate Bonds ETF, HYG, fell slightly, yielding 5.73%, in line with the downward trend in interest rates.

With today’s options contracts expiring, Gamma is raised and the SP 500 price trend in ranges for the week ahead between 4800 low and 4850 high.

Next Week

The PCE index, Personal Consumption and expenditures, is due for release next week.

What is the difference between CPI and PCE?

The CPI measures the change in the out-of-pocket expenditures of all urban households and the PCE index measures the change in goods and services consumed by all households, and nonprofit institutions serving households.

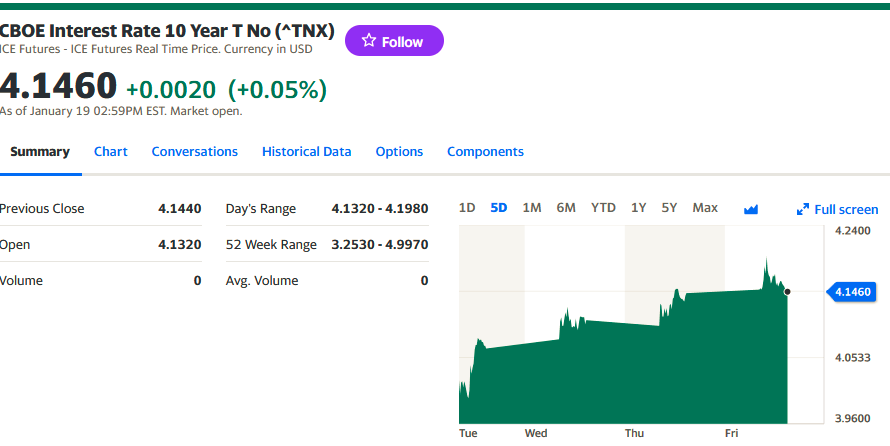

The Fed’s next monetary policy meeting is less than 12 days away, on January 31, 2024.

The chart shows that among economic analysts, 97% believe that expectations will not rise and 3% believe that they will.

CME FedWatch Tool

2 Micro

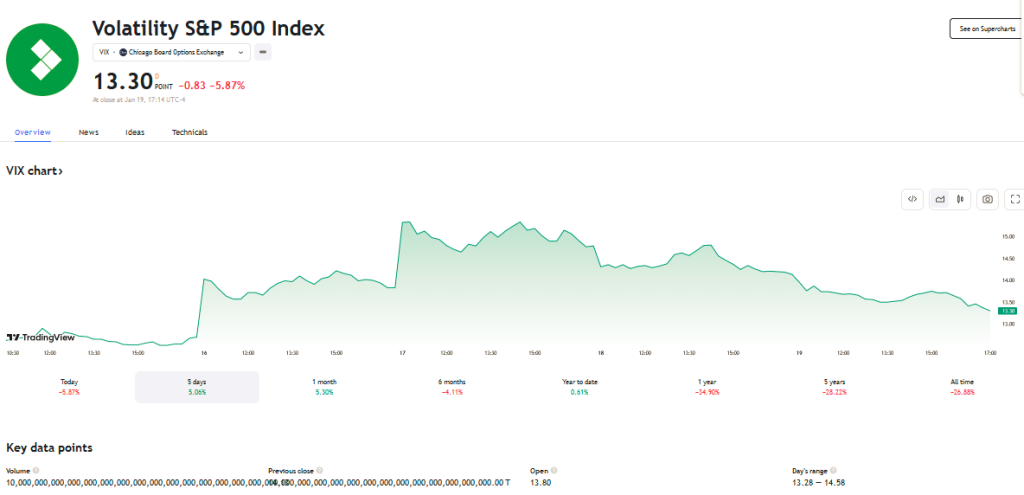

Market price volatility rises 7.9%, making Waves between 12.2 and 15 for this week.

OIL

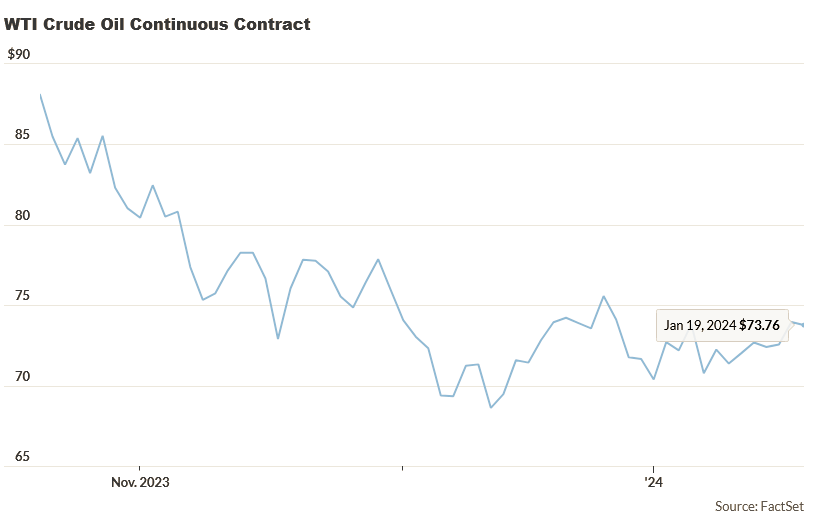

Oil prices in sideways mode are up $1 on the week.

This week’s oil prices gain some on the week in a “violently oscillating” market.

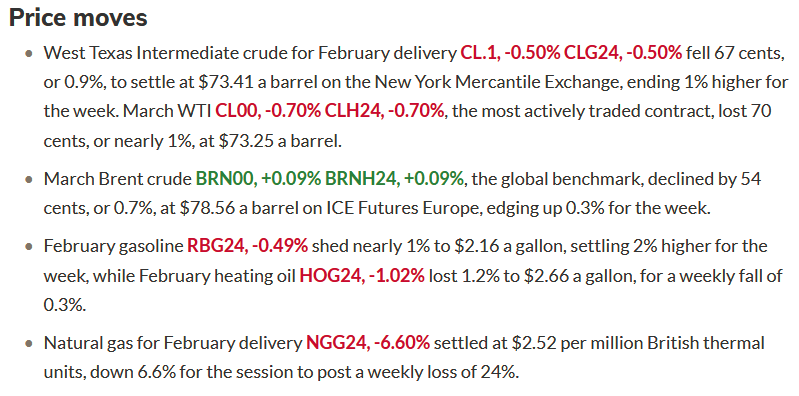

Oil futures ended lower Friday, trimming gains for the week, as traders assessed rising supply, the demand outlook, weather problems in U.S. production and continued tensions in the Middle East.

As Michael Lynch, president of Strategic Energy & Economic Research, told MarketWatch, oil’s weakness is due to “several geopolitical events that have not impacted actual supply and the economic situation looks weaker, including the latest home sales report.”

“Oil prices remain violently rangebound to start the year,” said Michael Tran, commodity analyst at RBC Capital Markets, in a note. “While this sentence sounds like an oxymoron, keen observers of the market have become numb or achieved a degree of analysis paralysis to start the year given the confluence of escalating geopolitical risk enveloped in a market that remains reasonably well supplied.”

Pakistan and Iran and the U.S. exchanged missiles and Iranian-backed Houthi militants have continued to attack Red Sea shipping. This has caused disruptions to shipping, including the diversion of tankers, but has not yet reduced the flow of crude oil out of the Middle East.

Tyler Richey, co-editor of Sevens Report Research, told MarketWatch, “oil market fundamentals are “slightly tilted in favor of the bears right now.”

Natural gas futures, meanwhile, lost more than 20% on the week after posting two consecutive weekly gains

Crude Oil Price Closing, Friday, January 19, 2024

See: Oil ends lower, ekes out a gain for the week in a ‘violently rangebound’ market

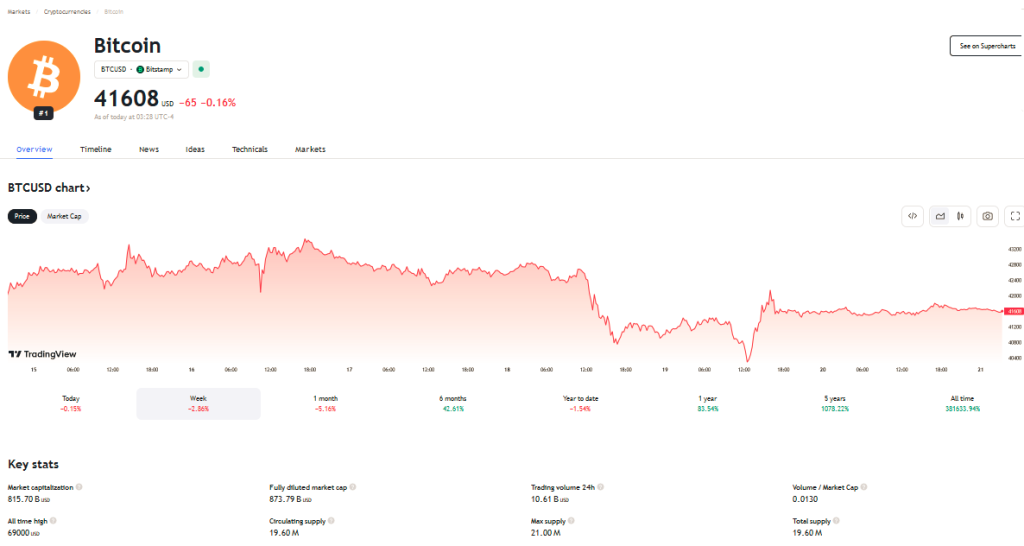

Bitcoin lost more than 9% on the week, sends no signals with new ETFs , better times will come.

3 Build a long-term portfolio

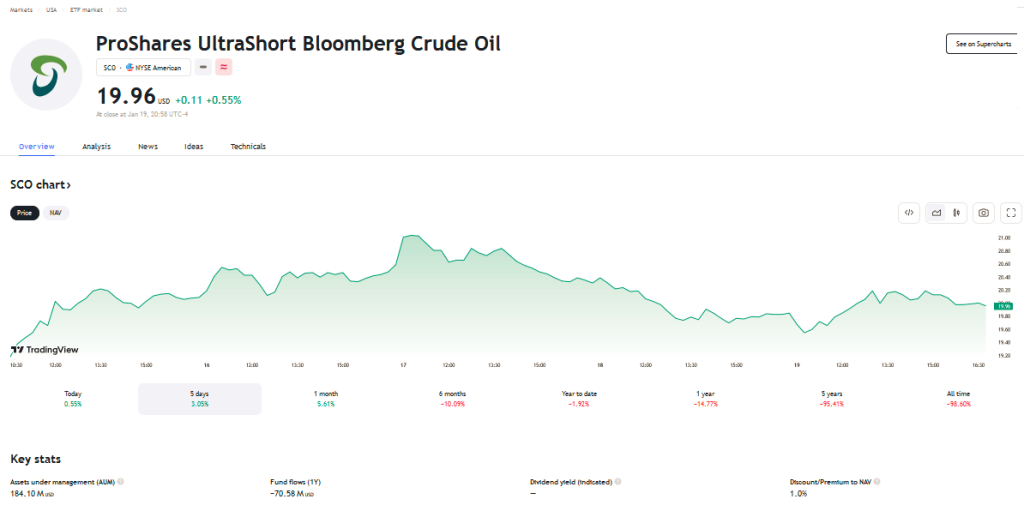

This week the energy ETF markets moved like this:

The ProShares UltraShort Bloomberg Bloomberg Crude Oil, SCO which works with short crude oil futures contracts, gained +3.1% in a week, on lower volume.

Meanwhile the United States Oil Fund USO, which contains in addition to crude oil futures, has futures on Natural Gas, Diesel and gasoline, with less volatility rose as did the underlying assets, up -0.82%.

The arbitrage between the prices of both funds was +2.3% weekly difference.

4 Running an algorithm or method to generate cash flow on a long-term portfolio or with money in the account.

Our procedure involves reviewing volumes, volatility, technical analysis on short and long term support and resistance charts.

This is our favorite strategy.

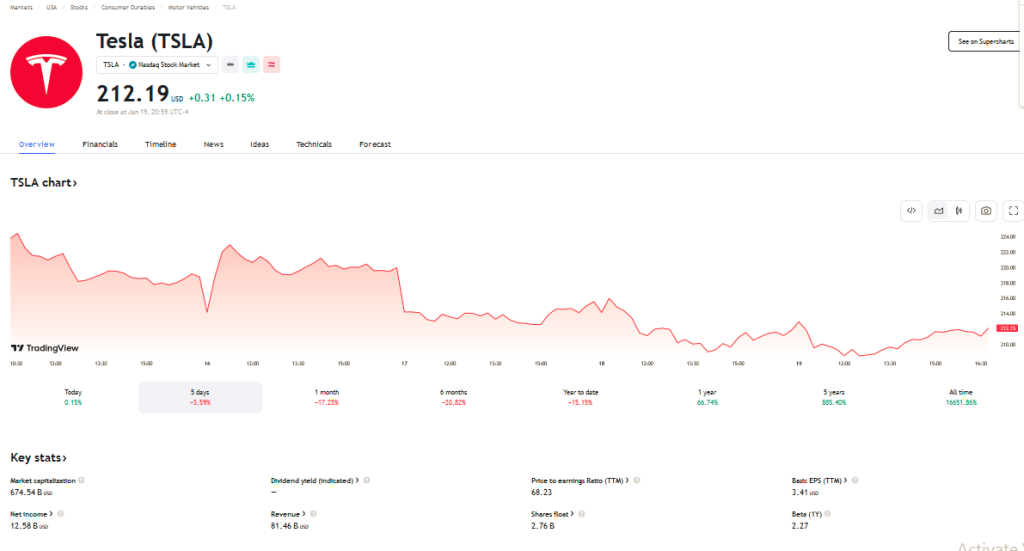

The Magnificent 7, which drive the price indexes due to their traded volumes, were all up with the exception of TSLA. Elon Musk claims to want more control of the company, i.e. he is not happy with certain policies, which led investors to have less interest in the company.

We look at the Fund containing the Listed Funds Trust – Roundhill Magnificent Seven ETF (MAGS) listed on the stock exchange since March 2023.

5 Analysis of the results of the previous week’s forecast.

The forecasts turned out to be correct. SP500 breaking resistance at 4800 (see chart).

Volatility rose

The 10-year bond yield rose from 4.02 to 4.14, in contrast to the rise in stocks.

Gold loses 1% .

6 Forecast for the week ahead:

We will compare and hypothesize with oil , Gold, SPY, crude and 10-year Bond yields.

Incoming liquidity is down again.

We will use our method for stocks in ranges of 4,750 support and 4850 resistance in the SP500 for entries in and exits. Watch for.

Market responding to the sum of good news, earnings, interest rates and energy, despite heating up election year .

Weekly performance of the $1,000 investment challenge in 17 weeks:

The portfolio is yielding 16.15%, on the rise, the news is helping us (excel table No 150).

Venezuelan market

Price of the dollar vs Bs

BCV : Bs 36.13

Unofficial : Bs 38.77

____________________________________

Translated by Elio Ohep, Editor EnergiesNet.

Follow this report on social networks: Instagram You tube linkedin Faceboook

Raúl Torrealba Ramos, B.A. in Administration and Accounting, Universidad Católica Andrés Bello, Caracas; Lawyer, Universidad Metropolitana, Caracas, is an experienced financial analyst since 1990. The views expressed are not necessarily those of EnergiesNet.

Editor’s note: This article is published as an opinion and is not recommended for investment. All comments submitted and posted on EnergiesNet do not reflect either for or against the opinion expressed and is not an endorsement by EnergiesNet or Petroleumworld.EnergiesNet.com 01 14 2024

Energiesnet.com 01 21 2024