Market Report

Building Income:

Week #7 of 2024, Report on ideas for positive cash flow.

Update on relevant financial information.

February 12-16, 2024

1 Macroeconomic Environment:

Week ending:

The consumer price index, or inflation, was the star performer, posting a 3.1% increase when analysts were expecting 2.9%. On Tuesday’s release, the markets fell more than 2%.

Then today, Friday the Wholesale and Producer Index also came in higher than expected and the markets reacted by moving lower.

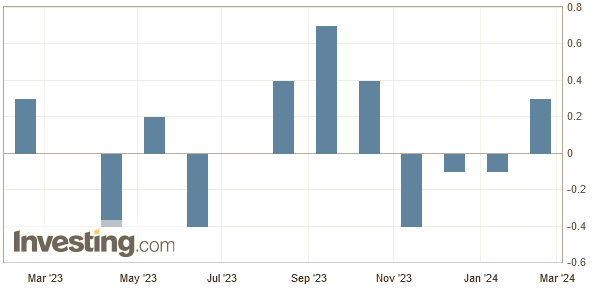

United States – Producer Price Index (PPI) – monthly

Then today, Friday the Wholesale and Producer Index also came in higher than expected and the markets reacted by moving lower.

United States – Producer Price Index (PPI) – monthly

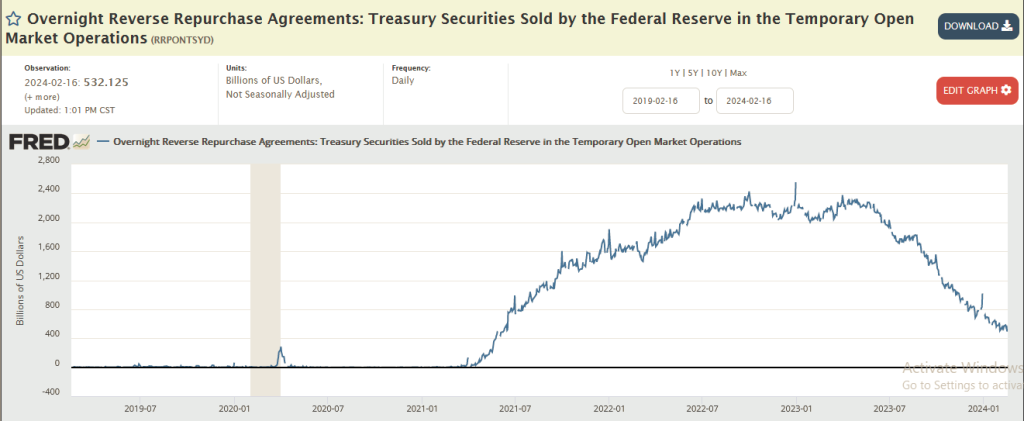

Reverse Repos as seen in the chart, stable, liquidity continues to flow into the system and the Fed drains what appears to be excess.

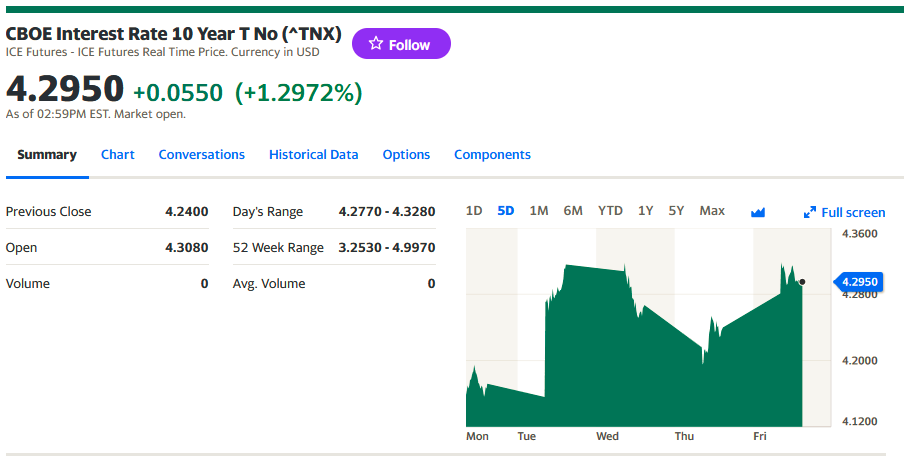

The 10-year bond yield falls and rises as a result of the Data issued by the Secretary of Commerce.

Corporate bonds also fell in price, raising their yields, all as a result of rising inflation.

Next Week

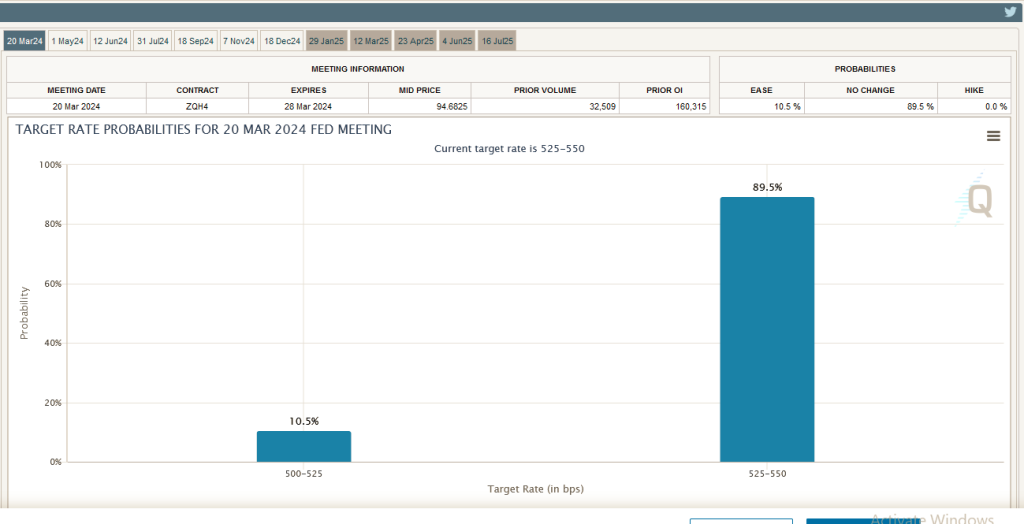

The graph shows that 89% of economic analysts believe that interest rates will not be raised and 11% that they will, the meeting will be held on March 20. It is surprising that despite the inflation results, expectations remain the same.

CME FedWatch Tool

2 Micro

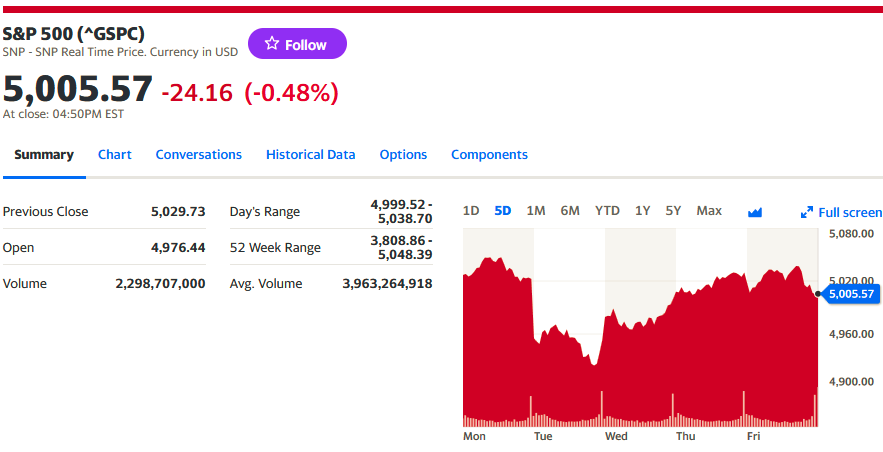

The SP500 has price ranges of 4,925 and 5,050.

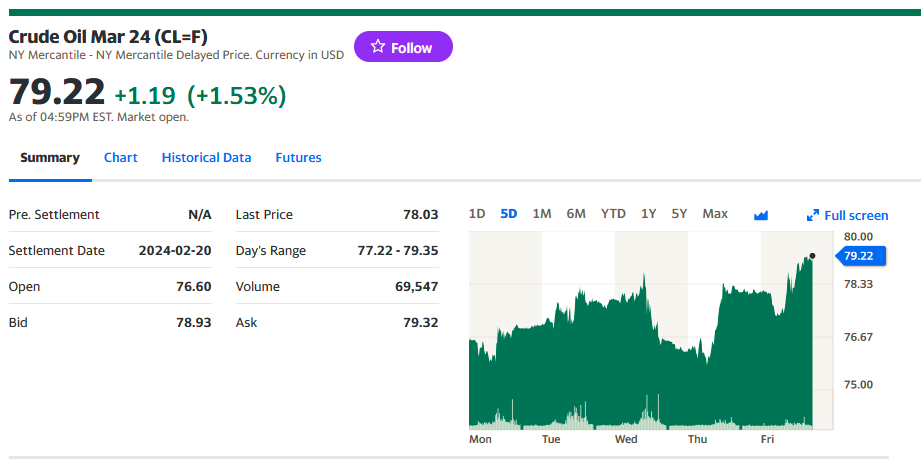

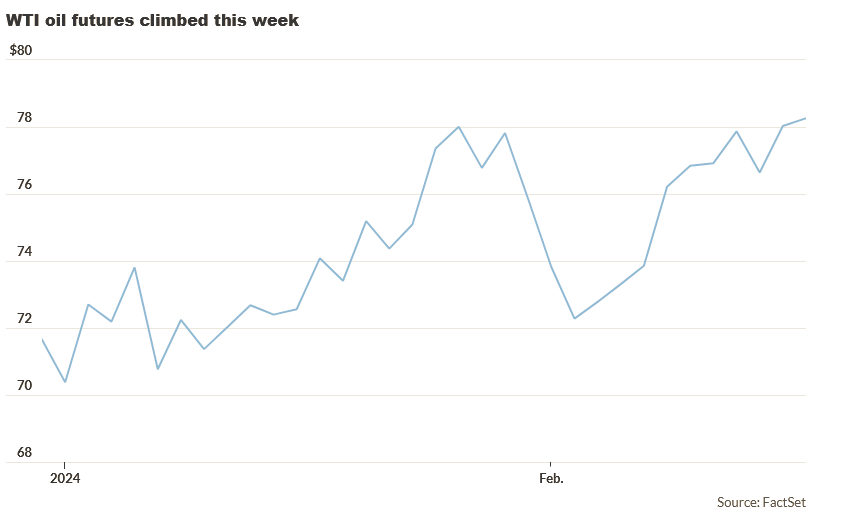

Oil prices

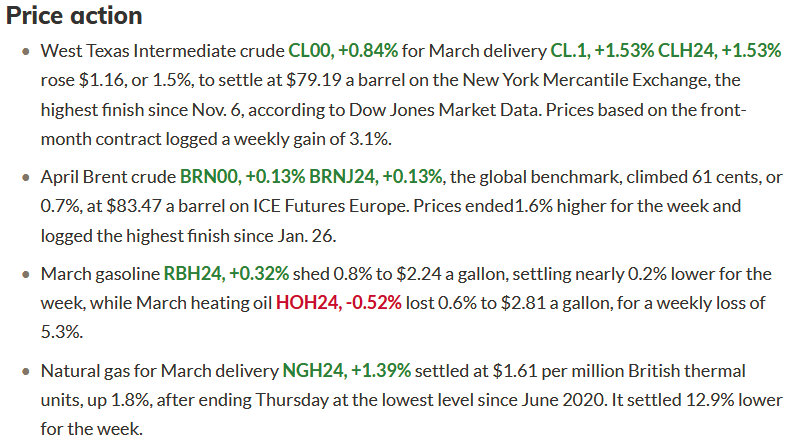

They rose again this week by 3.3%, tensions in the Middle East continue.

Market drivers

“Prices have benefited this week from escalating tensions in the Middle East,” said Stewart Glickman, energy equity analyst at CFRA Research. “The closer you get to pairing Iran and Israel in a battle, the more upward pressure on oil – and the Israeli attacks on Lebanon are a move in that direction,” reports MarketWatch.

Both WTI and Brent crude oil posted a second consecutive weekly gain.

However, oil prices experienced “choppy” trading this week, partly as the strength of the U.S. dollar held them back, Fawad Razaqzada, market analyst at City Index and Forex.com, told MarketWatch.

The dollar’s strength has been “countering supportive measures such as the situation in the Middle East, ongoing OPEC intervention and hopes that economic conditions in China will improve in the coming quarters,” he said. “Overall, I think the risks are skewed to the upside for oil, as there are not many negative influences that could affect prices.”

On Friday, WTI settled above what Razaqzada considers a “key resistance around $78,” where the 200-day average has proven to be a “tough nut to crack.” This could lead to a “strong continuation towards $80 next,” he said.

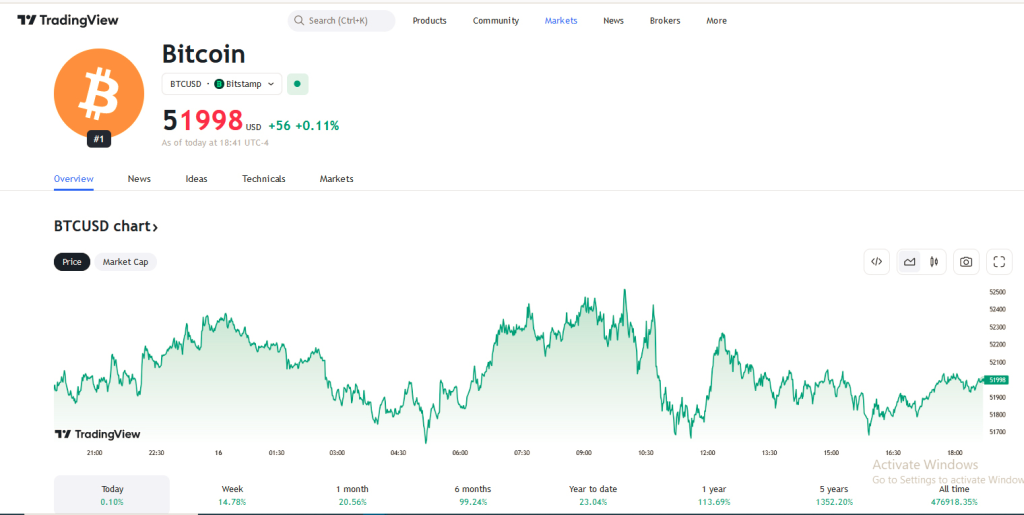

Bitcoin increase the price more than 14% in the week.

3 Building a long-term portfolio

This week the energy ETF markets moved like this:

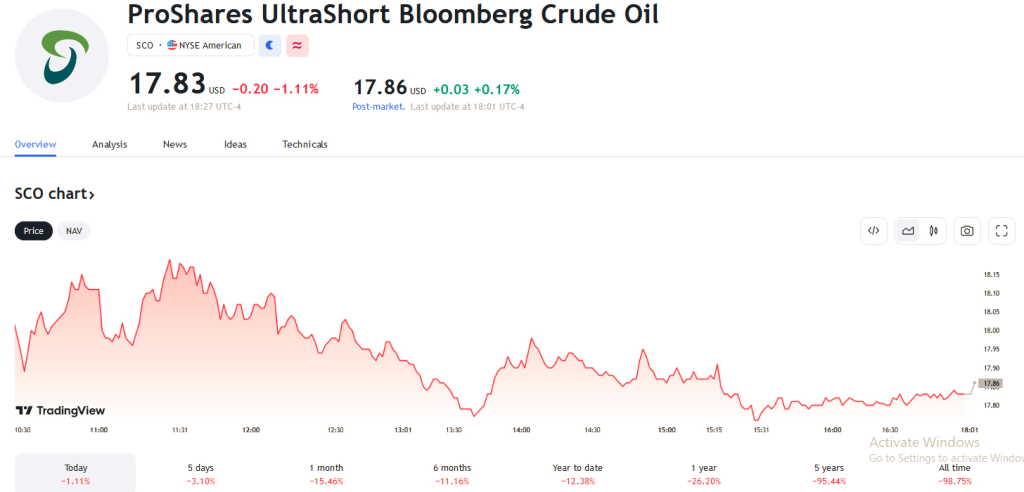

The ProShares UltraShort Bloomberg Bloomberg Crude Oil, SCO which works with short crude oil futures contracts, lost -3.21% for the week,

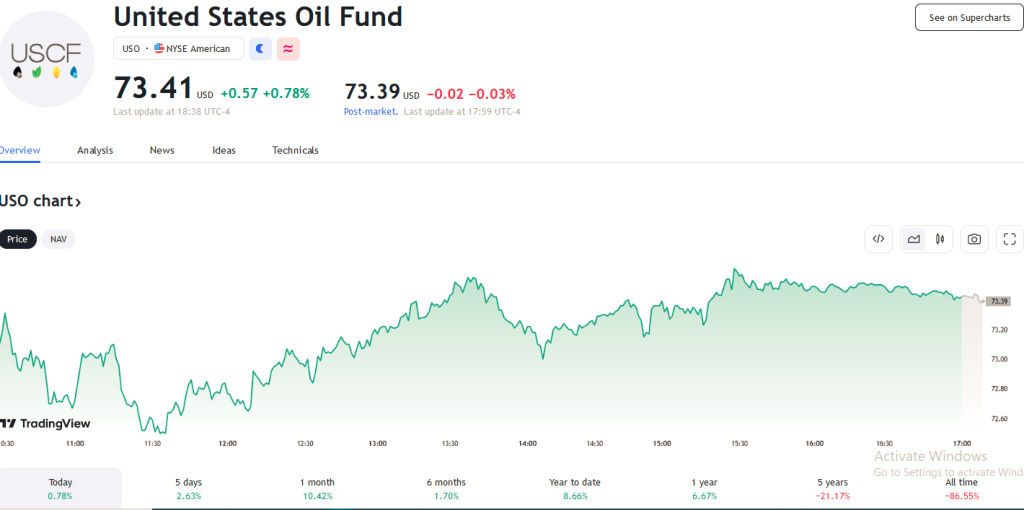

Meanwhile, the United States Oil Fund USO, which contains not only crude oil futures, but also natural gas, diesel and gasoline futures, with less volatility, is down as well as the underlying assets, up +2.73%.

The arbitrage between the prices of the two funds was +1.50% weekly difference.

4 Execution of an algorithm or method to generate cash flow on a long-term portfolio or with money in the account.

Our procedure involves reviewing volumes, volatility, technical analysis on short and long term support and resistance charts.

This is our favorite strategy.

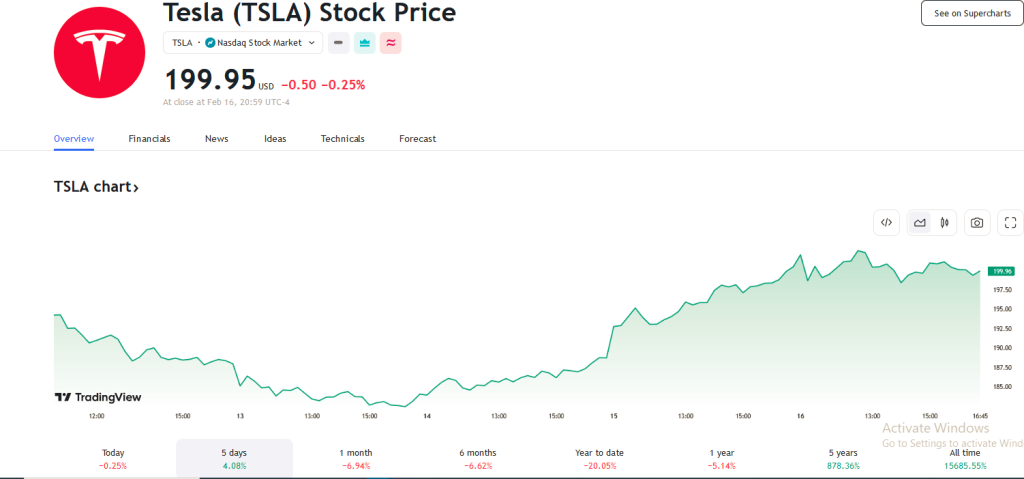

The Magnificent 7, which lead the stock indexes with more than 60% due to their traded volumes, were volatile, with TESLA standing out, which lifted 4% of its price after several days of falling.

5 Analysis of previous week’s forecast results.

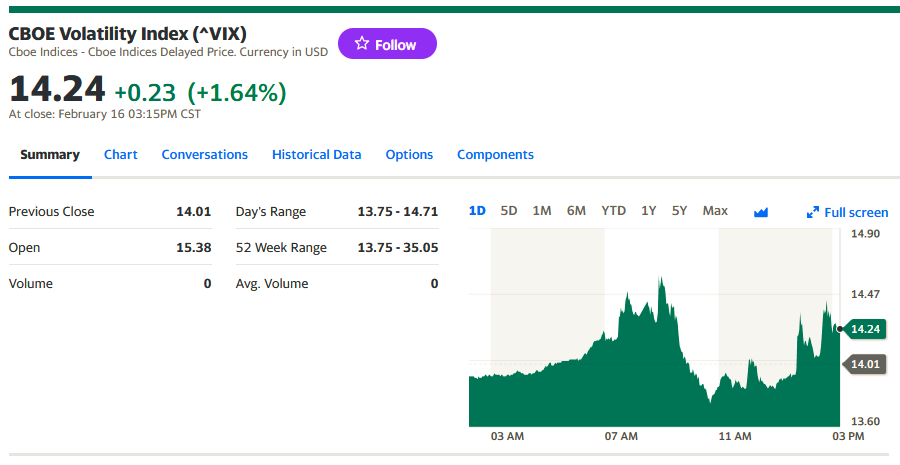

Volatility , VIX contained, with highs of 17 on Tuesday and lows of 13.

SP500 between 4920 support and reached 5047 beating our forecast of 5030 from last week .

6 Forecast for the week ahead:

We will compare and hypothesize on the yields of oil , Gold, SPY, crude oil and the 10-year Bond.

Monday holiday and Wednesday Fed minutes.

4 Fed board members will be giving speeches, at forums and addressing monetary issues to reporters.

We will use our method for stocks and options in ranges of 4,900 support and 5050 resistance . It is possible to break above it at 5075 , however 5000 support has held despite negative news on wholesale and retail inflation.

Weekly performance of the US $ 1,000 investment challenge, in 18 weeks:

BAC Bank of America Corporation

100,188

GLDS PDR Gold Shares

198,55

GS The Goldman Sachs Group, Inc.

104,96

TSLA Tesla, Inc.

100,8

SPY SPDR S&P 500 ETF Trust

269,4

QQQ Invesco QQQ Trust

108,46

META Meta Platforms, Inc.

117,6

Amount $ 999,958

Yield 20.46%.

The portfolio is yielding 20.46%, despite inflation and volatility data.

Venezuelan market

Parallel dollar accumulates a drop of 4.73% and the official dollar has risen only 0.86% so far in 2024.

The spread between the official and parallel dollar prices is less than 3%, while liquidity has accumulated an increase of less than 1%.

The reserve requirement deficit has been maintained due to the liquidity restriction.

Price of the dollar vs Bs

BCV : Bs 36.33

Unofficial : Bs 37.52

Parallel dollar price falls. Official dollar stable.

NOTE: We do not recommend investments, we only give our opinions.

For special courses or investment management, please contact us at : Instagram @coachraultorrealba or email : editor@petroleumworld.com

___________________________________________

Raúl Torrealba Ramos, B.A. in Administration and Accounting, Universidad Católica Andrés Bello, Caracas; Lawyer, Universidad Metropolitana, Caracas, is an experienced financial analyst since 1990. The views expressed are not necessarily those of EnergiesNet.

Editor’s note: This article is published as an opinion and is not recommended for investment. All comments submitted and posted on EnergiesNet do not reflect either for or against the opinion expressed and is not an endorsement by EnergiesNet or Petroleumworld.

Energiesnet.com 02 17 2024