Market Report

Building Income:

Week #11 of 2024, Week ‘s report on ideas for positive cash flow

Update on relevant financial information.

March 11-15, 2024

1 Macroeconomic Environment:

Week ending:

The CPI inflation report showed an increase of 0.4% over the previous month and 3.2% for the year completed in February. The market was expecting 0.3% and 3.1% . This was the largest increase since last September. This data turned an orange light on the markets.

Comsumer Price Index (CPI) YoY

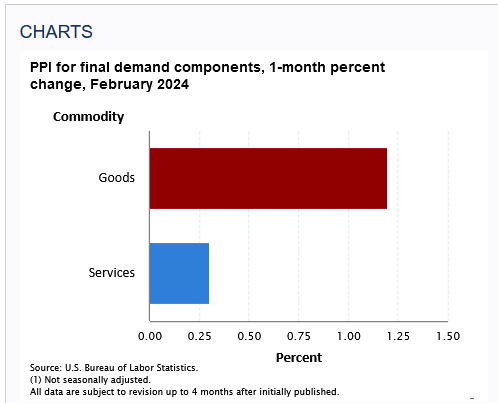

The PPI or wholesale and industrial index also rose, which warmed the Bear’s spirits. They were expecting 0.3% and posted 0.6%.

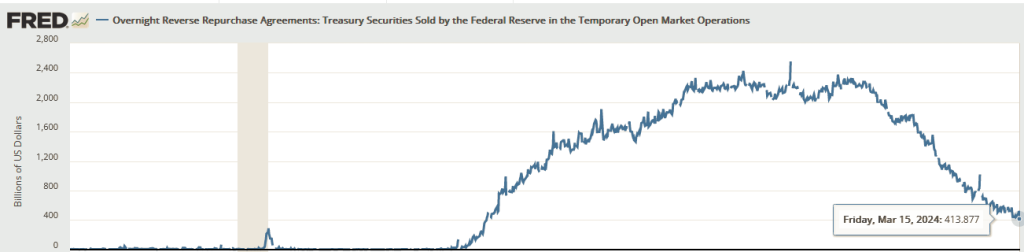

Market liquidity improves due to lower Fed absorption.

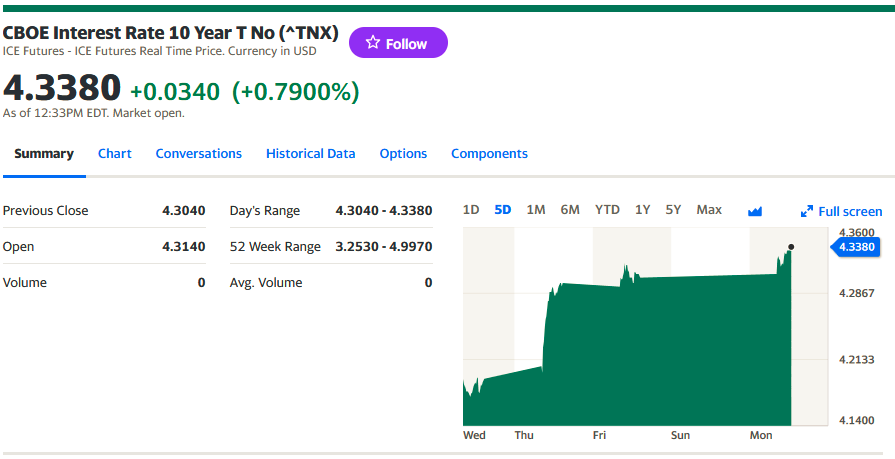

The 10-year bond rises in yield and falls in price, in a bearish signal.

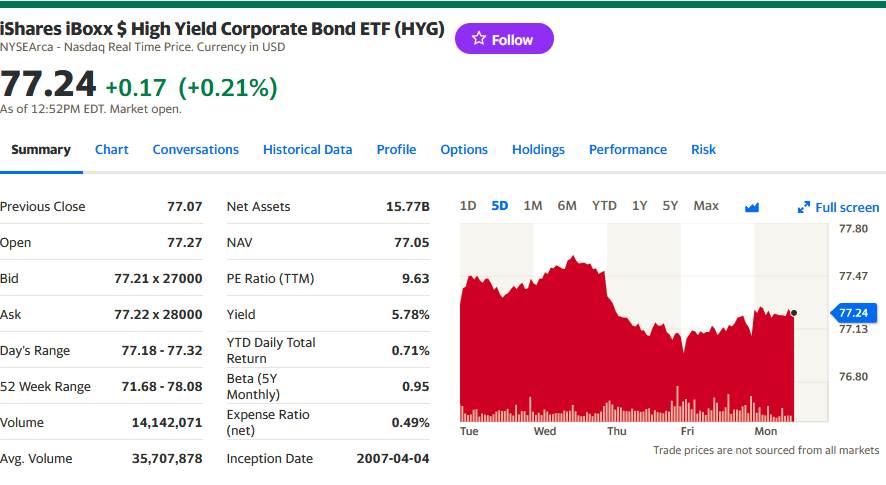

Corporate bonds followed the downward trend

Market highlight

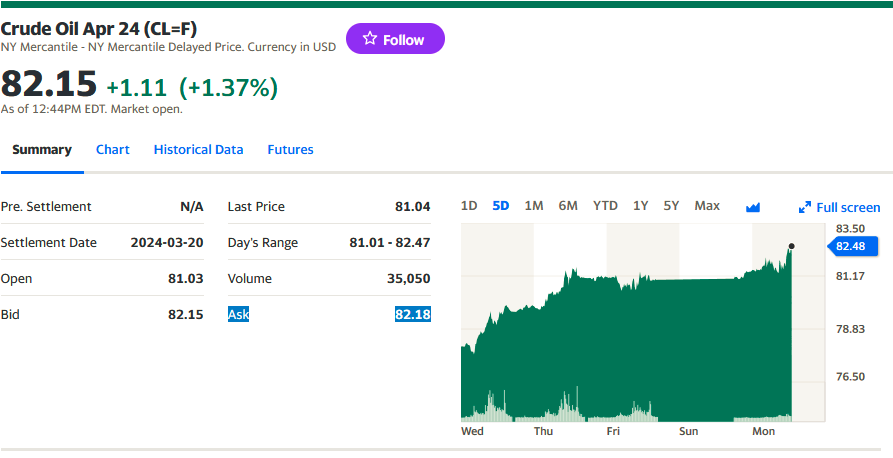

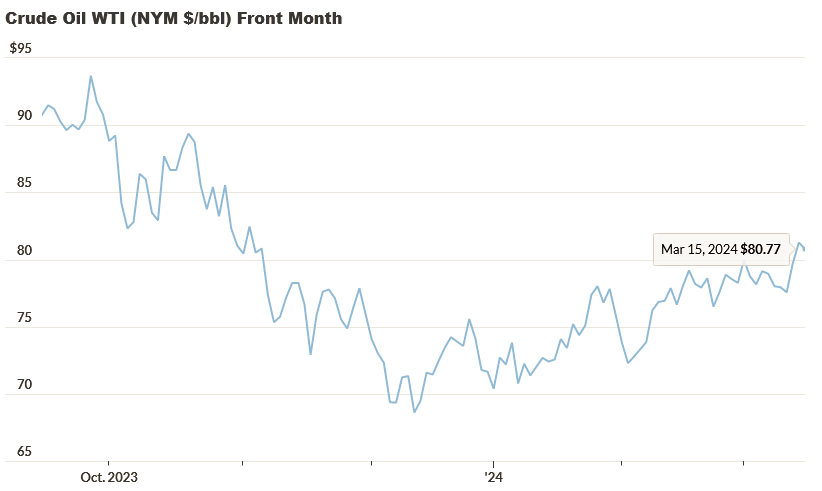

The highlight was the increase in energy prices.

Oil Market Movers

Losses for front-month futures for WTI and Brent crude on Friday followed gains a day earlier that lifted prices for both to their highest settlements since Nov. 2.

“The indicative smooth uptrend suggests that the wildest part of the rally is yet to come,” said Alex Kuptsikevich, senior market analyst at FxPro, in emailed commentary.

“The medium-term uptrend in oil began at the December lows,” he said, adding that at that time, oil was “actively bought in attempts to break below the 200-week moving average.” Touching this mark was also a “turning point in 2023, kicked off a strong rally in 2020, and provided crucial support in 2019.”

It’s important to note, however, that this “isn’t just a technical level,” as the Organization of the Petroleum Exporting Countries and Russia have increased support for the price over the past five years by announcing quota cuts to break through that technical level, Kuptsikevich said.

Among other supportive factors, the Paris-based IEA on Thursday said it now sees growth of 1.3 million barrels a day, or mbd, versus a previous forecast of 1.2 mbd.

Crude prices had climbed sharply Wednesday after data from the Energy Information Administration showed a fall in U.S. crude inventories last week.

Attacks on Russian energy infrastructure and continued uncertainty tied to the Israel-Hamas war also contributed to the rise in oil prices, analysts said.

“Bottom line, an early 2024 rally has emerged in the oil market after months of consolidation in the upper $60s to low $70s, and yesterday’s new closing high above $81/barrel (for WTI), a four-month high, helps to technically reiterate that the path of least resistance is higher right now,” analysts at Sevens Report Research said in a note.

“The slew of bullish fundamental news paired with the bullish demand details in Wednesday’s weekly EIA report all are supportive of a continued move higher in oil,” they wrote.

Source: MarketWatch

Oil Price moves

- West Texas Intermediate crude CL00, 1.63% for April delivery CL.1, 1.72% CLJ24, 1.72% fell 22 cents, or 0.3%, to settle at $81.04 a barrel on the New York Mercantile Exchange, for a 3.9% weekly gain, according to Dow Jones Market Data

. - May Brent crude BRN00, 1.51% BRNK24, 1.50%, the global benchmark, edged down by 8 cents, or about 0.1%, at $85.34 a barrel on ICE Futures Europe, leaving it up 4% for the week.

- April gasoline RBJ24, 1.36% added nearly 0.7% to $2.72 a gallon, for a weekly rise of 7.7%.

- April heating oil HOJ24, 1.81% climbed 0.7% to $2.73 a gallon, gaining 3.3% for the week.

- Natural gas for April delivery NGJ24, 2.60% settled at $1.66 per million British thermal units, down 4.9%, with Friday’s losses contributing to an 8.3% loss on the week.

Source: MarketWatch

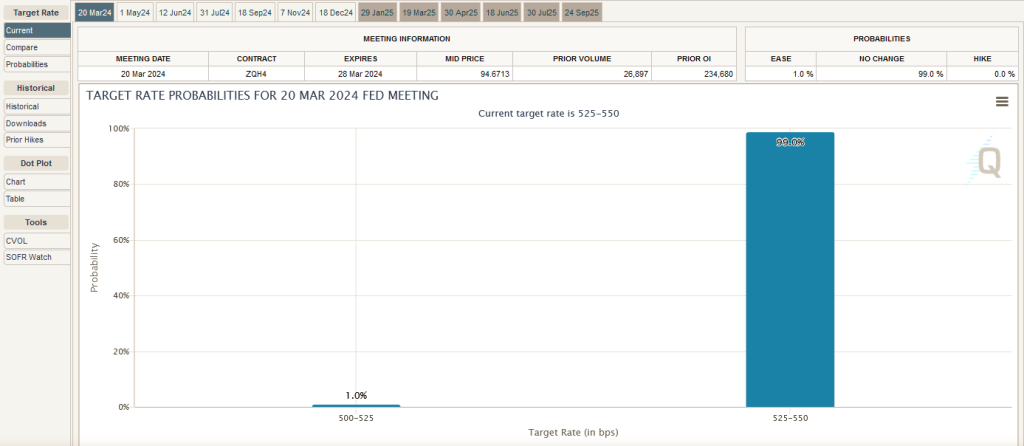

Next Week

Fed meeting next Wednesday, the event of the month. Here are the odds of interest rate moves:

CME FedWatch Tool

2 Micro

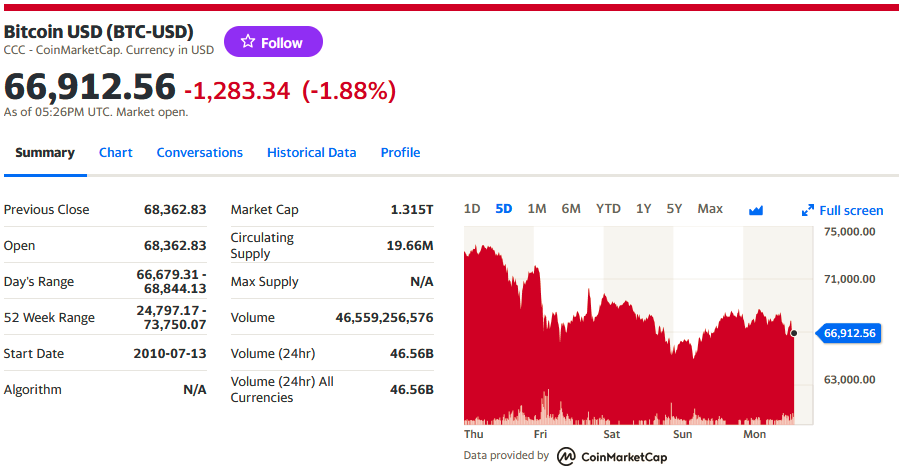

Bitcoin was punished as was the rest of the market, dropping 6% this week.

3 Building a long-term portfolio

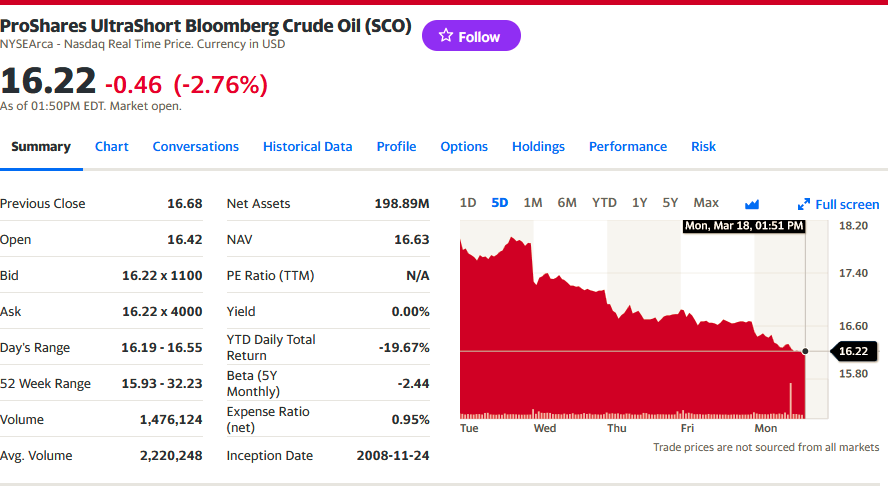

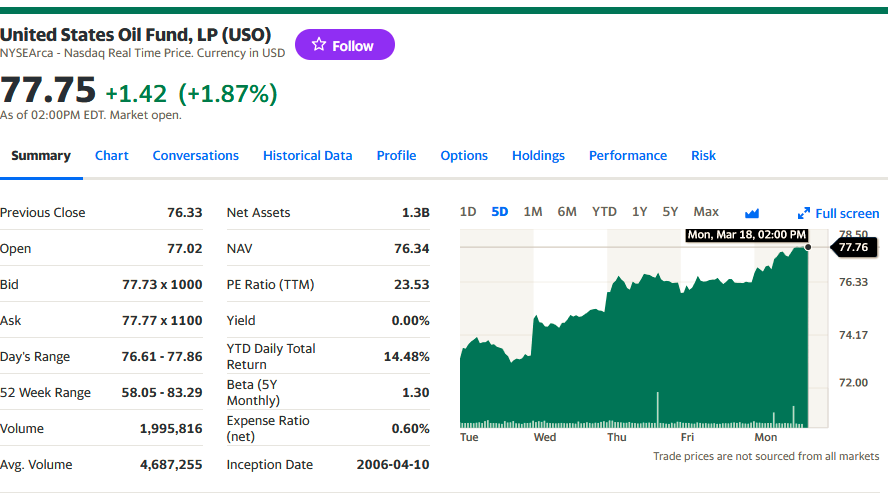

This week the energy ETF markets moved like this:

The ProShares UltraShort Bloomberg Bloomberg Crude Oil, SCO which works with short crude oil futures contracts, lost – 9%,

Meanwhile, the United States Oil Fund USO, which contains not only crude oil futures, but also natural gas, diesel and gasoline futures, with less volatility and lower volatility than the underlying assets, gained +6%.

The arbitrage between the prices of both funds was +3% per week.

4 Execution of an algorithm or method to generate cash flow on a long-term portfolio or with money in the account.

Our procedure involves reviewing volumes, volatility, technical analysis on support charts and short and long term resistances.

It is our favorite strategy.

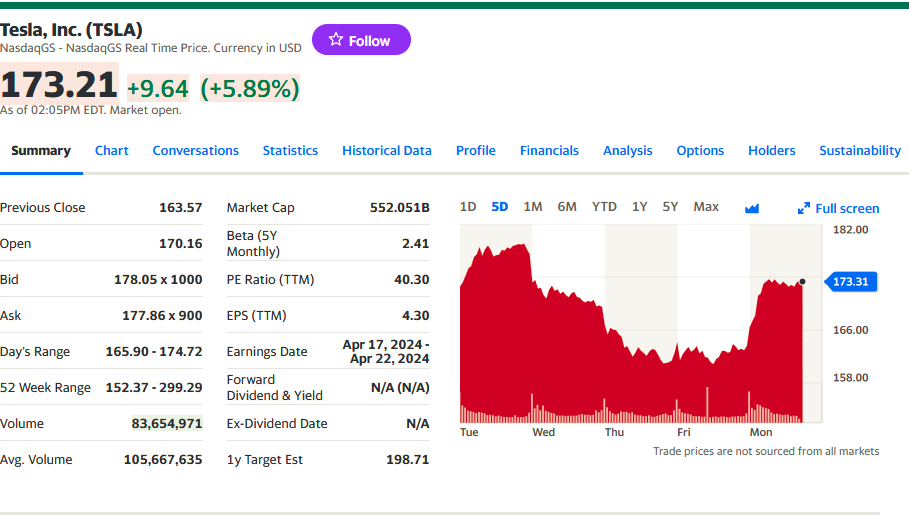

Among the magnificent 7, TESLA was beaten down by investors, falling 10% during the week.

Downgrades from several brokerage firms plus bad news that keeps coming in. Still it is the highest Beta in the market at 2.4 plus great stock market liquidity.

5 Analysis of previous week’s forecast results.

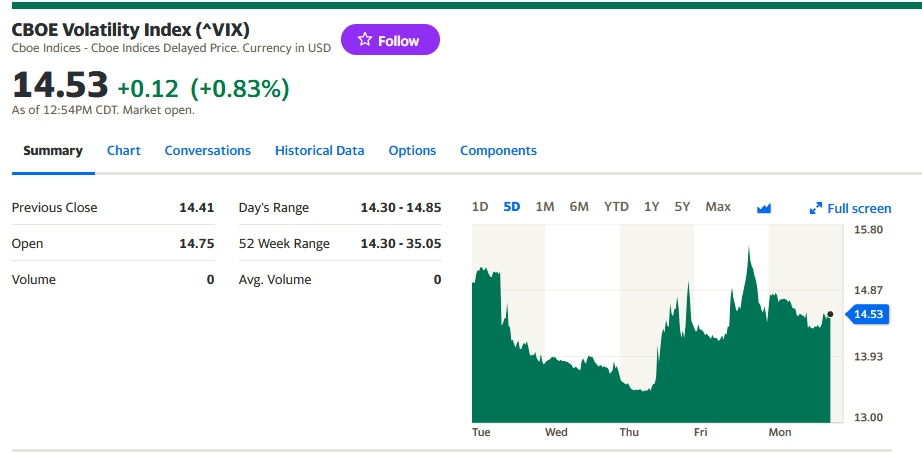

Although there was volatility between peaks and valleys of 15%, it ended the week with less volatility than the previous week.

Our hypothesis of price adjustment after the record highs is once again proven.

6 Forecast for the week ahead:

This week will be less volatile, with price movements peaking on Wednesday ahead of the Fed’s interest rate meeting results.

We will compare and hypothesize with the yields of oil, Gold, SPY, crude oil and the 10 year bond.

We will use our method for stocks and options in SP500 ranges between 5,050 support and 5180 resistance. It will probably touch the 5050 numbers because of volatility. We will wait.

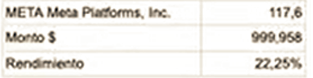

Weekly performance of the US $ 1,000 investment challenge, in 21 weeks:

The portfolio is yielding

Venezuelan market

Price of the dollar vs Bs

BCV : Bs 36.27

Unofficial : Bs 37.88

NOTE: We do not recommend investments, we only give our opinions.

For special courses or investment management, please contact us at : Instagram @coachraultorrealba or email : editor@petroleumworld.com

_________________________________________________________

Raúl Torrealba Ramos, B.A. in Administration and Accounting, Universidad Católica Andrés Bello, Caracas; Lawyer, Universidad Metropolitana, Caracas, is an experienced financial analyst since 1990. The views expressed are not necessarily those of EnergiesNet.

Editor’s note: This article is published as an opinion and is not recommended for investment. All comments submitted and posted on EnergiesNet do not reflect either for or against the opinion expressed and is not an endorsement by EnergiesNet or Petroleumworld.

Energiesnet.com 18 03 2024